How to Send Money to Mexico Online: A Complete Guide

4th September 2024 – Send Money Internationally, Wise Transfer Options, Send Money to Mexico

Sending money abroad, especially to Mexico, is an essential service for many individuals—whether you’re supporting family members, making payments for business, or managing international transactions. In today’s digital age, sending money to Mexico online is easier than ever, thanks to various services that offer security, affordability, and speed.

In this guide, we’ll walk you through the best ways to send money to Mexico online, compare different options, and answer questions like, “How can I send money to Mexico quickly and securely?” By understanding the pros and cons of each service, you’ll be able to make informed decisions and save on fees.

How to Send Money to Mexico Online

Sending money to Mexico has never been more convenient, thanks to the multitude of online money transfer services available today. Many people send money for different reasons: paying for services, helping family, buying property, or investing in a business. The following are some of the most popular and reliable methods to send money to Mexico.

1. Online Money Transfer Services (Wise, Remitly, Cambridge Currencies)

Online money transfer services are often the first choice for sending funds internationally. These platforms allow you to send money directly to a recipient’s bank account or offer cash pickup options, depending on the service. Some of the most popular services are Wise, Remitly, and Cambridge Currencies, which are known for their affordability, speed, and ease of use.

Advantages of Online Money Transfer Services

- Low Fees: These services typically charge lower fees compared to traditional banks or services like Western Union.

- Competitive Exchange Rates: They offer better exchange rates than many banks or other alternatives.

- Speed: Transfers can be completed within minutes or a few business days, depending on the service and payment method.

- Convenience: You can send money directly from your smartphone or computer, eliminating the need for physical visits to an office or location.

Disadvantages

- Bank Account or Platform Access Required: Both the sender and recipient need access to a bank account or an account on the transfer platform.

- Not Always Available Everywhere: While online money transfer services are widely accessible, some remote areas may not have service coverage for cash pickup.

How to Use Online Money Transfer Services

- Create an Account: Sign up for an account with the service provider (e.g., Cambridge Currencies, Remitly, or Wise).

- Enter the Recipient’s Details: Provide the recipient’s name, bank account number, or choose a cash pickup location.

- Choose the Amount: Select the amount you wish to send and confirm the exchange rate (e.g., from USD to MXN).

- Review and Confirm: Double-check the transfer details, including fees and exchange rates, before hitting “send”. The recipient will receive the money in their account, or they can pick it up from a partner location.

2. PayPal

For those who already use PayPal, sending money to Mexico is another straightforward method. PayPal allows you to send funds directly from your PayPal account to another PayPal account or bank account, and the money is usually transferred almost instantly.

Advantages

- Ease of Use: If you already have a PayPal account, sending money to Mexico is as simple as a few clicks.

- Instant Transfers: For PayPal-to-PayPal transactions, funds are transferred almost instantly.

- Global Reach: PayPal operates in more than 200 countries, making it a great option for international transfers.

Disadvantages

- High Fees: PayPal typically charges high fees for international transfers, especially if you fund the transfer using a credit card.

- Currency Conversion Fees: PayPal has a currency conversion fee that can significantly reduce the amount your recipient gets after conversion to Mexican Pesos (MXN).

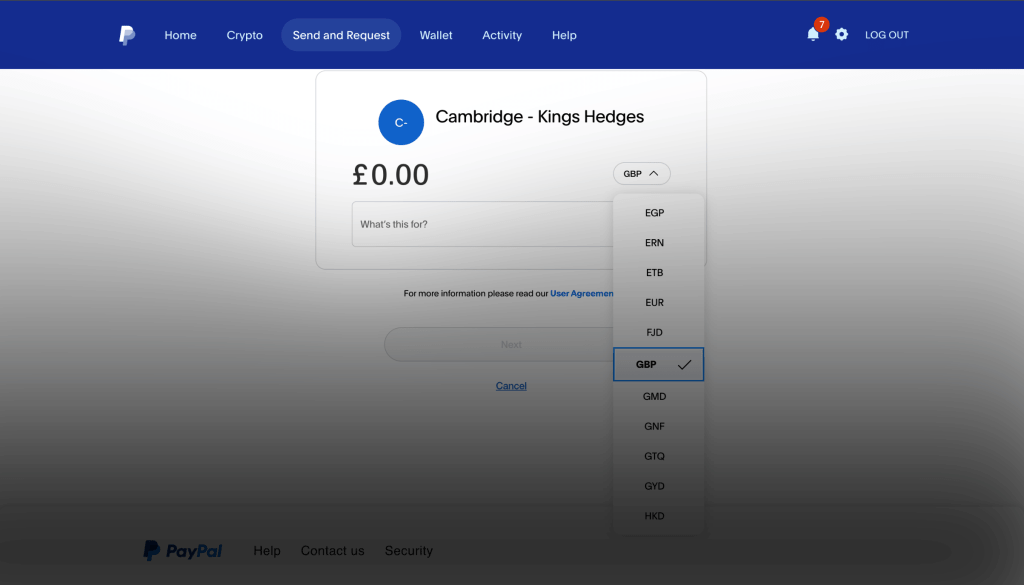

How to Send Money with PayPal

- Log In to Your PayPal Account: Access your PayPal account via the website or app.

- Select ‘Send Money’: Enter the recipient’s email address or mobile phone number linked to their PayPal account.

- Choose the Amount and Currency: Select MXN (Mexican Peso) as the destination currency and enter the amount.

- Confirm the Transfer: PayPal will show you the fees associated with the transfer, and once you approve, the money will be sent to the recipient’s PayPal account instantly.

3. Western Union or MoneyGram

For those who need to send cash quickly or who may not have access to bank accounts, Western Union and MoneyGram are two excellent alternatives. These services are known for their extensive network of agents and locations around the world, allowing recipients in Mexico to pick up funds in cash from a local branch.

Advantages

- Fast Cash Delivery: Your recipient can pick up cash from thousands of agent locations in Mexico almost immediately.

- No Bank Account Required: Cash pickups make these services ideal for recipients who do not have a bank account.

- Wide Coverage: Both Western Union and MoneyGram have agents in urban and rural areas throughout Mexico.

Disadvantages

- Higher Fees: Both Western Union and MoneyGram often have higher transfer fees compared to other online services.

- Inconvenient for Large Transfers: If you are transferring a large sum, paying high fees could eat into your total amount sent.

How to Use Western Union or MoneyGram

- Go Online or Visit a Location: You can initiate the transfer either online or by visiting a physical agent location.

- Enter the Recipient’s Details: Provide the recipient’s name and select a pickup location in Mexico.

- Choose the Amount: Select the amount you want to send and confirm that the recipient can pick up the money from the selected location.

- Confirm the Transfer: Review the fees, exchange rate, and transfer speed, and confirm the transaction. The recipient can collect the funds shortly thereafter.

4. Sending Money via Credit Card

Sending money using a credit card is possible through many online platforms like Wise, Remitly, and PayPal. This can be particularly useful if you don’t have enough funds in your bank account but still need to send money.

Advantages

- Flexibility: Use your credit card to fund the transfer if your bank account balance isn’t sufficient.

- Convenient: Many people already have credit cards, making this a straightforward method.

Disadvantages

- High Fees: Credit card transfers typically incur higher fees than transfers funded by a bank account.

- Interest Charges: If you don’t pay your credit card balance in full immediately, you may incur interest charges on the amount sent.

Steps to Send Money Using a Credit Card

- Choose a Service: Make sure the platform you choose supports credit card payments (such as PayPal or Wise).

- Provide Recipient Information: Enter the recipient’s details, including their bank account information or cash pickup location.

- Select Credit Card as Payment Method: When prompted, input your credit card details.

- Review Fees: Carefully review the fees for using your credit card to fund the transfer.

- Send the Money: Once all details are correct, confirm the transfer. The recipient will receive the funds based on the selected transfer method.

How to Send Money from Mexico to the US Online

If you need to send money from Mexico to the United States, many of the same services that allow you to send money to Mexico also facilitate transfers in the opposite direction. Here’s how you can send money from Mexico to the US.

1. Use Online Transfer Platforms

Services like Wise, Remitly, and PayPal make it easy to send funds from Mexico to the US. Simply create an account, enter the recipient’s details, and select the conversion from MXN to USD.

2. PayPal for International Transfers

If both you and the recipient have PayPal accounts, this is an easy and fast method to transfer funds internationally. You can log into PayPal, select ‘Send Money’, enter the recipient’s details, and specify USD as the destination currency.

Best Practices When Sending Money to Mexico Online

To ensure you get the best deal and avoid surprises when sending money to Mexico, here are a few best practices to keep in mind:

1. Compare Fees and Exchange Rates

Fees and exchange rates vary between platforms. Be sure to check both before you send money to ensure you’re getting the best deal. A small difference in exchange rates can make a big impact on how much your recipient gets in Mexican Pesos.

2. Consider Transfer Speed

Depending on your chosen service, transfers can range from instant to a few days. If you need funds sent urgently, opt for faster options like Western Union or Remitly.

3. Track Your Transfers

Most platforms allow you to track your transfer once it has been sent. This ensures transparency and peace of mind, especially for large sums.

Are You Thinking of Making a Move to Mexico?

If you’re planning to move to Mexico—whether for work, retirement, or any other reason—managing your finances and making international transfers efficiently is essential. Why not speak with one of our currency experts? With years of experience in helping people just like you, we can guide you on securing the best exchange rates and minimizing transfer fees when making the move.

Contact us today to find out how we can help you get the best deal on international transfers. Whether you’re sending money to family, paying for services, or managing your finances from abroad, we’ll make sure your money goes further with expert advice and competitive rates.