Wise Money Transfers: Smarter Options for Moving Your Money

Transferring money internationally has become an essential part of life for many, whether you’re supporting family overseas or managing global business deals. However, not all money transfer services are equal, and the wrong choice could end up costing you more in fees and poor exchange rates. Making a wise money transfer means finding an option that saves you money, offers transparency, and provides efficiency.

In this blog, we’ll explore how traditional banks and some transfer services can end up being expensive, and how Cambridge Currencies provides a smart, cost-effective alternative. Whether you’re sending money for personal reasons or business needs, making an informed decision is important. Let’s dive in.

Wise Money Transfers: What are Not?

1. True Cost of Using Traditional Banks for Money Transfers

Using your bank to send money abroad might seem like the most obvious choice. After all, your bank is likely where you handle most of your transfers, so it naturally feels right. However, when it comes to international money transfers, banks are not always the best choice. If ever.

It’s very easy to overlook the extra costs that banks impose on these types of transactions. Here’s a closer look at what you’re really paying for:

a. Transfer Fees

Banks usually charge flat fees for international money transfers, which can range from £10 to £30 or even higher, depending on the destination and the amount you’re transferring. These fees can be substantial, especially if you make frequent or large transfers.

b. Exchange Rate Markups

The exchange rate your bank offers is almost never the mid-market rate—the rate you see on currency converter tools like XE or Google. Instead, banks typically add a markup on top of the rate, which effectively means you’re losing money during the conversion process. This markup is often not disclosed, and many people don’t realize how much extra they’re paying.

c. Hidden Fees

In addition to transfer fees and poor exchange rates, there are often other hidden costs when sending money via banks. For example, intermediary banks may be involved in the transaction, particularly if the transfer passes through multiple countries. These banks often take a cut, adding even more to your total costs.

d. Slow Processing Times

Another downside to using traditional banks is the processing time. International bank transfers can take anywhere from 3 to 5 business days, which can be frustrating if you need the funds to arrive quickly.

Despite the familiarity and convenience of using your bank, it’s clear that it’s not the most wise money transfer option. But banks aren’t the only culprits—there are other services that can also lead to higher costs and longer delays.

What are the Expensive service options?

2. Expensive Transfer Services: Hidden Costs You Should Be Aware Of

Aside from banks, Popular money transfer companies also offer convenient solutions. These services can be very cost effective, especially for larger amounts. But while they might market themselves as fast and easy to use, the costs can still pile up.

a. High Service Fees

Many transfer services charge fees based on a percentage of the total amount being transferred. If you’re sending small sums, this might not seem like a big deal. But if you’re transferring large amounts, this can become very expensive very quickly. For example, a 2% fee on a £10,000 transfer amounts to £200.

b. Unfavorable Exchange Rates

Similar to banks, many of these services also make money by offering exchange rates that are less favorable than the mid-market rate. While this difference might seem small at first, it can have a significant impact when you’re transferring large sums.

c. Lack of Transparency

Some services don’t provide clear upfront information about how much you’ll be charged, which can lead to unpleasant surprises. You might think you’re getting a good deal based on the advertised fee, only to find out that you’ve lost money due to poor exchange rates or hidden fees.

By now, you might be wondering if there’s a better solution. Luckily, there is— Cambridge Currencies offers a much more transparent, affordable, and efficient way to make international money transfers.

3. Why Cambridge Currencies is the Smart Choice for Wise Money Transfers

If you’re looking for a wise money transfer solution that saves you both time and money, look no further than Cambridge Currencies. Our platform offers all the benefits you need for stress-free international transfers. Let’s explore the reasons why Cambridge Currencies is the better option.

a. Competitive Exchange Rates

Unlike banks and some transfer services, Cambridge Currencies offers real-time exchange rates based on the mid-market rate. We don’t add hidden markups, meaning you get the best value for your money.

b. Low, Transparent Fees

We believe in keeping things simple and transparent. You won’t encounter any hidden fees or unexpected costs when using Cambridge Currencies. We offer low, fixed fees that are clearly displayed upfront, so you always know what you’re paying for.

c. Fast Transfers

Timing matters, especially in business transactions. Cambridge Currencies processes transfers quickly, often within the same day. This ensures that your money arrives when you need it, without the unnecessary delays common with banks and other services.

d. Security and Compliance

With Cambridge Currencies, you can rest assured that your money is safe. We work with fully regulated partner banks and adhere to international standards for money transfers. All transactions are secure and compliant with local laws.

e. Tailored Solutions for Large Transfers

Are you transferring large sums of money, such as for property purchases or business investments? Cambridge Currencies provides tailored solutions to meet your specific needs, helping you manage currency risk and maximize savings.

By choosing Cambridge Currencies, you’re making a wise money transfer that saves you both time and money, while providing peace of mind.

4. Cambridge Currencies vs. Traditional Banks and Transfer Services

To illustrate just how much better Cambridge Currencies is for wise money transfers, let’s compare it to banks and other expensive services:

As you can see, Cambridge Currencies consistently outperforms traditional banks and expensive transfer services in the areas that matter most—fees, exchange rates, and transparency.

| Feature | Traditional Banks | Expensive Transfer Services | Cambridge Currencies |

|---|---|---|---|

| Transfer Fees | £10–£30 per transfer | High percentage-based fees | Low, transparent fees |

| Exchange Rates | Markups on rates | Markups on rates | Competitive, no markups |

| Transfer Speed | 3–5 business days | 1–2 days | Often same-day transfers |

| Transparency | Hidden costs | Lack of clarity | Clear, upfront pricing |

| Tailored Solutions | Rarely available | Limited | Available for large transfers |

5. The Benefits of Wise Money Transfers for Businesses

For businesses that regularly deal with international transactions, making wise money transfers is essential. Whether you’re paying overseas suppliers or receiving payments from global clients, a poor money transfer solution can eat into your profits and disrupt cash flow.

a. Save on Costs

By choosing Cambridge Currencies, businesses can save significantly on transfer fees and exchange rate markups. These savings are even more noticeable when dealing with large sums of money, as even small differences in fees and rates can add up quickly.

b. Improved Cash Flow

Speedy transfers mean that payments are processed faster, helping businesses maintain healthy cash flow. This is especially important for companies that rely on regular, timely payments to keep operations running smoothly.

c. Manage Currency Risk

For businesses exposed to currency fluctuations, Cambridge Currencies offers solutions to hedge against exchange rate volatility. This allows businesses to lock in favorable rates and minimize the risk associated with currency movements.

6. Wise Money Transfers for Personal Use: Property Purchases and More

It’s not just businesses that benefit from making wise money transfers. Individuals, too, can save a lot by using the right service. Whether you’re buying property abroad, sending money to family, or paying for education or healthcare, using Cambridge Currencies can make a significant difference.

a. Property Purchases

Buying a house or apartment in another country often involves transferring large sums of money. Using a bank for this process could result in substantial losses due to high fees and poor exchange rates. Cambridge Currencies offers better rates and lower fees, helping you save more of your money.

b. Sending Money to Family

Many people need to send money abroad to support family members, whether for daily expenses, healthcare, or education. Cambridge Currencies makes this process more affordable by reducing fees and providing better exchange rates.

No matter the reason for your transfer, using Cambridge Currencies ensures you’re making a wise money transfer that protects your financial interests.

7. How to Make a Wise Money Transfer with Cambridge Currencies

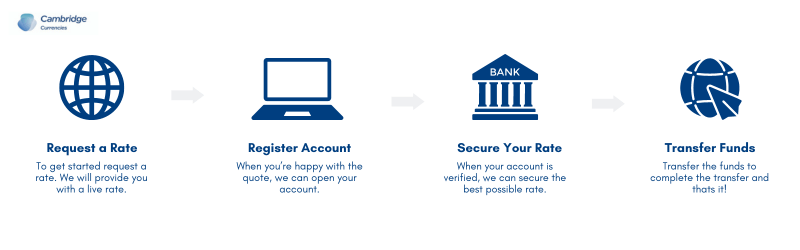

Getting started with Cambridge Currencies is easy and straightforward:

- Sign Up: Create an account and complete a quick verification process.

- Choose Your Currency and Amount: Select the currency you want to send and the amount. Our platform will show you the exact cost and fees upfront.

- Enter Recipient Details: Fill in the necessary details to complete your transfer.

- Send and Track Your Transfer: Once your transfer is initiated, you’ll be able to track it to see when it arrives.

With Cambridge Currencies, every step is designed

to be simple, transparent, and efficient.

8. External Resources for Further Reading

For more information on how to make smart financial decisions when transferring money abroad, check out these helpful resources:

These resources offer additional insights and tips on how to make the best decisions when sending money internationally.

Frequently Asked Questions: How to Make Every Transfer a Wise One

A wise money transfer involves choosing the best service to send money abroad, focusing on low fees, competitive exchange rates, and fast transfer times. It helps ensure that your funds arrive quickly and affordably.

Banks often add hidden markups to exchange rates and charge high transfer fees. Additionally, intermediary banks might take a cut, making the total cost higher than other options.

Cambridge Currencies offers a simple, easy-to-use platform with low fees, competitive rates, and fast transfers. You can sign up, choose your currency, and send your funds within minutes.

Yes, Cambridge Currencies offers tailored solutions for businesses, helping them manage currency risk and improve cash flow. Whether you’re paying suppliers or receiving payments, Cambridge Currencies has you covered.

Yes, Cambridge Currencies is fully regulated and works with secure partner banks, ensuring your funds are protected throughout the transfer process.

Transfers are often completed on the same day, depending on the currency and destination. This is faster than the 3–5 days that traditional banks usually require.