Pound to INR Forecast: What the Next Six Months Hold for the Pound to Rupee Exchange Rate

The GBP to INR exchange rate is used for businesses, expats, and individuals. It is important for those involved in currency transfers between the UK and India. If you are transferring money, you should understand the Pound to INR forecast. This is also true if you are making investments or just tracking the markets. Knowing the forecast for the next six months will help save money.

In this expanded guide, we will explore the factors driving the GBP to INR exchange rate. We will also review its historical performance and predict what the future holds. We’ll provide actionable tips on how to get the best rates. We will also answer commonly asked questions that people have about this important currency pair.

Questions We Will Cover:

- What Is the GBP to INR Exchange Rate?

- Key Factors Influencing the Pound to INR Exchange Rate

- Historical Performance of GBP to INR

- Current Market Trends for GBP to INR

- GBP to INR Forecast for the Next Six Months

- Is the Pound to INR Expected to Rise?

- How to Get the Best GBP to INR Exchange Rate

- GBP to INR: Important Considerations for Businesses

- Pound to INR Rate for Personal Transfers and Expats

- Why Is the GBP to INR Rate Falling?

- Frequently Asked Questions (FAQs)

1. What Is the GBP to INR Exchange Rate?

For the most current GBP to INR exchange rate, check the live widget below.

How Exchange Rates Work

Exchange rates reflect the value of one currency relative to another. They fluctuate based on factors such as supply and demand, interest rates, inflation, and economic performance. When the demand for the British Pound increases, its value rises compared to other currencies like the Indian Rupee. Conversely, if the demand for the Rupee increases, the value of the Rupee will rise. As a result, the value of the Pound will fall in comparison.

Spot Rate vs. Forward Rate

There are two key types of exchange rates you should be aware of: spot rates and forward rates.

- Spot Rate: This is the current exchange rate for immediate currency transactions. It’s the most commonly referenced rate.

- Forward Rate: This allows businesses to lock in a rate today. It lets individuals secure a rate today for a currency exchange that will happen in the future. Forward rates are used to hedge against potential unfavourable fluctuations in the market.

Why the GBP to INR Rate Matters

For individuals and businesses transferring money internationally, even small fluctuations in the exchange rate can have a major impact. They can significantly affect the value of their transactions. A slight shift in the exchange rate could result in either losses or savings when transferring large amounts. This is why understanding the GBP to INR rate is crucial. Whether you’re sending remittances, investing, or making cross-border business payments, tracking this rate is important.

2. Key Factors Influencing the Pound to INR Exchange Rate

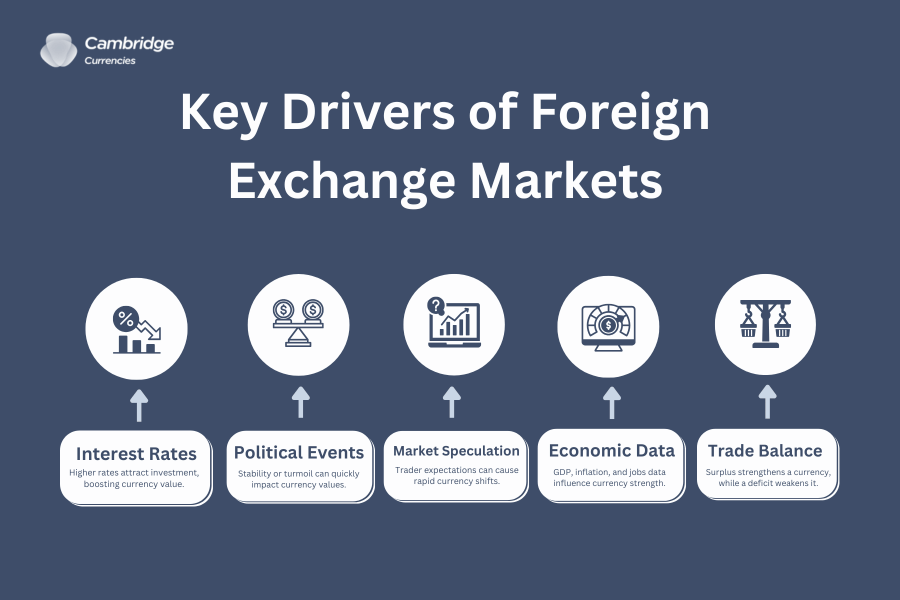

Multiple factors contribute to the fluctuations in the GBP to INR exchange rate. Below, we outline the key drivers that affect the exchange rate between the Pound and the Rupee.

1. UK Economic Performance

The UK’s economic health plays a significant role in determining the strength of the British Pound. Economic indicators such as Gross Domestic Product (GDP), inflation, and unemployment rates influence the pound’s value. Economic growth forecasts also play a role in shaping its value.

- GDP Growth: A strong, growing economy boosts investor confidence. This increase in confidence leads to higher demand for the Pound. Consequently, this demand raises its value.

- Inflation: High inflation can devalue the pound by reducing its purchasing power, which can cause the exchange rate to drop.

- Unemployment Rates: Lower unemployment signals a strong economy. It supports a stronger Pound, which can positively impact the GBP to INR exchange rate.

2. India’s Economic Growth

India’s economy is one of the fastest-growing in the world, and its performance directly impacts the value of the Rupee. Here are the main factors that strengthen or weaken the Rupee:

- Export Growth: India’s robust IT, manufacturing, and export sectors help increase demand for the Rupee, thereby supporting its value.

- Foreign Direct Investment (FDI): Inflows of foreign capital create demand for the Rupee, pushing up its value. High levels of FDI typically indicate a strong economic outlook.

- Inflation in India: Persistent inflation in India reduces the Rupee’s purchasing power. It weakens the Rupee relative to stronger currencies like the British Pound.

3. Interest Rates

Interest rates are one of the most important tools that central banks use to control inflation and stabilize the economy. The Bank of England and the Reserve Bank of India (RBI) regularly adjust interest rates. These adjustments can directly impact the value of their respective currencies.

- Bank of England Interest Rate Hikes: If the BoE raises interest rates to combat inflation, it can attract foreign investors. These investors look for higher returns. This interest can boost the Pound.

- Reserve Bank of India’s Interest Rates: The RBI may raise interest rates to control inflation in India. Higher rates can attract foreign capital. This influx boosts the demand for Rupees. It can also support the Rupee’s value relative to the Pound.

4. Inflation Rates in the UK and India

Inflation rates are key drivers of currency fluctuations. High inflation reduces a currency’s purchasing power, leading to lower demand and a drop in value. Both the UK and India are currently grappling with inflationary pressures, and central bank policies are aimed at controlling inflation.

- UK Inflation: The UK is facing high inflation due to rising energy prices and supply chain disruptions. The Bank of England’s monetary policy includes interest rate hikes. It aims to stabilize prices. However, inflation continues to challenge the economy.

- India’s Inflation: India has managed to keep inflation at moderate levels compared to other emerging markets. However, rising fuel prices and global inflationary trends pose a risk to the Indian economy.

5. Political Stability and Government Policies

Political stability in the UK and India also impacts the GBP to INR exchange rate. Uncertainty can cause investors to lose confidence in a currency. This loss of confidence can lead to capital flight. Such capital flight can result in a drop in the currency’s value.

- Brexit’s Long-Term Impact: Brexit continues to weigh on the UK economy. Uncertainties regarding trade agreements, labor markets, and regulation may weaken the Pound.

- Indian Government Reforms: India has been actively pursuing economic reforms. These reforms focus on sectors like agriculture, manufacturing, and labor laws. They can attract foreign investment and support the Rupee.

6. Global Market Trends and Commodity Prices

Global economic conditions also play a crucial role in the value of the Pound and Rupee. Events such as trade tensions, geopolitical risks, or changes in commodity prices, especially oil, can affect both currencies.

- Oil Prices: India is a major oil importer. Rising oil prices typically hurt the Rupee. They increase the country’s import costs.

- Global Trade and Supply Chain Issues: Any disruptions in global trade can cause volatility in the currency markets. This volatility affects the GBP to INR rate.

3. Historical Performance of GBP to INR

Looking at the historical performance of the GBP to INR exchange rate provides valuable insights. It shows how the pair has fluctuated over time. It also illustrates what factors have driven those changes.

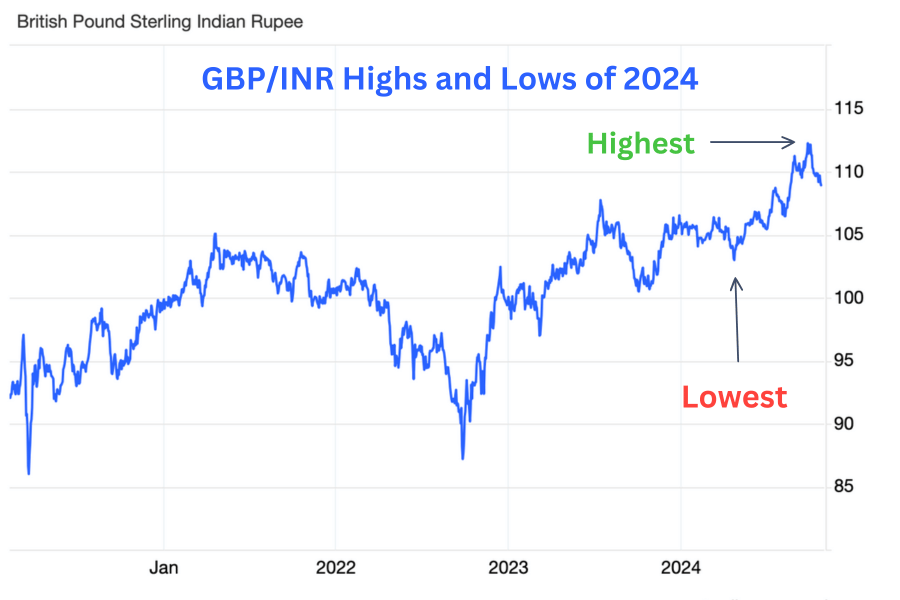

GBP/INR Highs and Lows of 2024

The GBP to INR rate has experienced significant highs and lows throughout its history.

- Highest GBP to INR Rate: The highest British pound sterling to Indian rupees rate occurred on September 25, 2024. On that day, 1 British pound sterling was worth 112.2310 Indian rupee.

- Lowest GBP to INR Rate: The lowest British pound sterling to Indian rupees rate was recorded on April 23, 2024. On this date, 1 British pound sterling was worth 102.9930 Indian rupee.

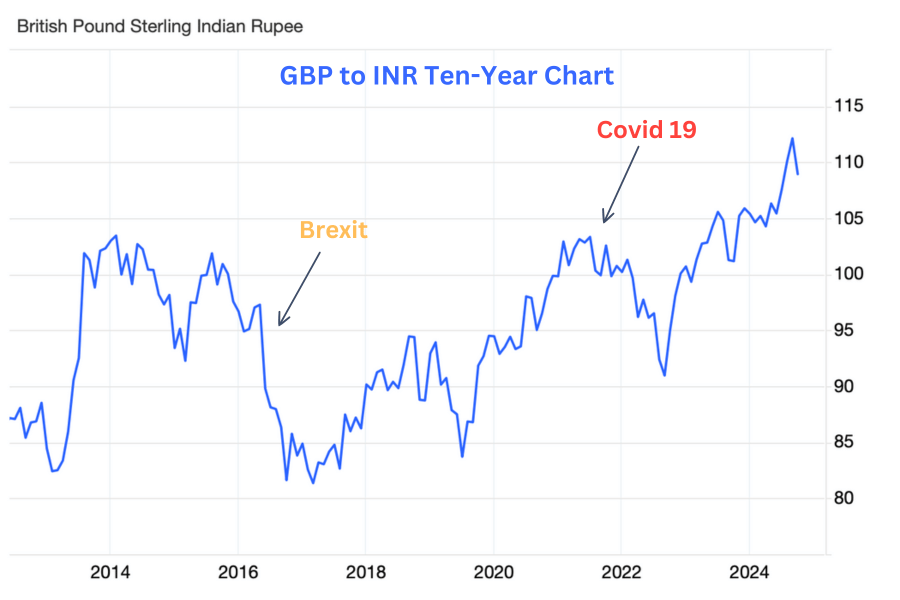

GBP/INR Ten-Year Trend Analysis

Over the past decade, the GBP to INR exchange rate has shown significant variation. It has fluctuated within a range of ₹80 to ₹106. This reflects the economic and political dynamics in both the UK and India.

- Brexit and Post-Brexit Volatility: The 2016 Brexit referendum led to a sharp decline in the value of the Pound. Uncertainty about the UK’s future trading relationships with the EU weighed on investor confidence. The exchange rate dropped from ₹100 to around ₹83 in the months following the vote.

- COVID-19 Pandemic Impact: The global pandemic led to a massive economic contraction in both the UK and India. The UK’s rapid vaccination rollout played a key role in its recovery. This helped the Pound recover against the Rupee, reaching the all-time high of ₹106.63 in early 2021.

Factors Behind Historical Fluctuations

The GBP to INR rate has been influenced by several key factors over the years:

- Central Bank Policies: The Bank of England has changed interest rates. The Reserve Bank of India has done the same. These changes have been major drivers of currency fluctuations.

- Commodity Prices: Global oil prices have been volatile. This volatility has had a notable impact on the Rupee. This is due to India’s reliance on imported oil.

- Political Events: Major political events like Brexit have created uncertainty in the currency markets. General elections in India have also contributed to this uncertainty. These factors lead to volatility in the GBP to INR rate.

The Role of Central Banks

Central banks play a crucial role in managing inflation, stabilizing currencies, and controlling interest rates. The BoE has deployed various monetary policies over the years. The RBI has also implemented different strategies. These policies have directly impacted the value of their respective currencies.

4. Current Market Trends for GBP to INR

The GBP to INR exchange rate is currently influenced by several global trends. It is also affected by domestic trends in both the UK and India. Understanding these trends is essential to predict where the exchange rate might head in the coming months.

1. Inflationary Pressures in the UK and India

Inflation continues to be a major concern in both countries. The UK is grappling with higher-than-expected inflation. This situation is largely driven by rising energy costs. Supply chain issues caused by the COVID-19 pandemic and ongoing geopolitical tensions in Europe also contribute to the problem.

- UK’s Response to Inflation: The Bank of England has raised interest rates in an attempt to control inflation. Higher interest rates are typically good for a currency as they attract more investment, increasing demand for the Pound.

- India’s Inflation Management: India has kept inflation relatively under control, but rising global commodity prices, particularly oil, present a risk. Any sharp increases in inflation could hurt the Rupee by reducing its purchasing power.

2. Post-Pandemic Economic Recovery

Both the UK and India are still recovering from the economic fallout of the COVID-19 pandemic. The UK has seen a stronger recovery in sectors like financial services and retail. Meanwhile, India’s economy thrives due to strong performance in manufacturing and IT exports.

- UK’s Strong Recovery: The UK’s rapid vaccination rollout and subsequent easing of restrictions have helped the economy rebound. This has supported the Pound.

- India’s Resilient Economy: India’s exports, particularly in technology and pharmaceuticals, have supported its recovery, boosting the Rupee. However, challenges such as rising inflation and fuel costs could hamper future growth.

3. Political Developments and Their Impact

Politics continues to play a significant role in shaping the GBP to INR exchange rate. Both countries face upcoming elections and political decisions that could impact the markets.

- UK Political Climate: There are ongoing concerns about the UK’s trade relationships with the EU and other nations post-Brexit. These concerns continue to create uncertainty in the market. Any changes in trade policies or political leadership could affect the value of the Pound.

- India’s Government Reforms: India focuses on infrastructure development, agriculture reforms, and labor market changes. These could have long-term positive effects on the Rupee. This focus may attract more foreign investment.

4. Geopolitical Tensions and Global Economic Conditions

Geopolitical events, like the war in Ukraine and trade tensions between major economies, have affected the global economy. They create ripple effects worldwide. These events contribute to market uncertainty and currency volatility.

- Global Commodity Prices: Rising prices for commodities, particularly oil, are putting pressure on both the UK and India. As a major importer of oil, India is more vulnerable to rising oil prices, which can weaken the Rupee.

- Safe-Haven Status of the Pound: In times of global uncertainty, investors tend to move their money into safer assets like the Pound. This movement can strengthen its value compared to emerging market currencies like the Rupee.

5. GBP to INR Forecast for the Next Six Months

The GBP to INR exchange rate is expected to fluctuate within a range. This range is ₹100 to ₹105 per pound. Current trends and economic data suggest this will occur over the next six months. However, there are several key factors that could influence the rate in either direction.

Short-Term Outlook (1-3 Months)

In the short term, interest rate decisions from the Bank of England will primarily influence the GBP to INR rate. The Reserve Bank of India will also play a significant role in this influence.

- Bank of England Interest Rate Hikes: The BoE may continue to raise interest rates to combat inflation. If this happens, the Pound could strengthen. This action might push the exchange rate toward the upper end of the ₹105 range.

- India’s Strong Economic Performance: India’s continued growth in exports and foreign investment may offset some of the Pound’s gains. This could keep the exchange rate stable.

Medium-Term Outlook (4-6 Months)

Looking further ahead, the exchange rate is expected to stabilize as both economies adjust to post-pandemic realities. The ₹100 to ₹105 range is likely to hold, but several factors could cause fluctuations.

- UK Economic Recovery: If the UK economy continues its strong recovery, the Pound may continue to strengthen. This is particularly true in the retail and financial sectors. However, inflation remains a concern, and any signs of economic slowdown could weaken the Pound.

- India’s Inflation and Import Costs: Rising global energy prices could hurt the Rupee, especially if inflation increases significantly. The RBI could raise interest rates to combat inflation. This action might support the Rupee. However, its effectiveness would depend on other economic factors.

Global Influences on the Forecast

The global economic environment will play a key role in shaping the GBP to INR forecast. Here are some of the major global factors to watch:

- Geopolitical Risks: Any escalation in global tensions, particularly in Europe and Asia, could drive investors toward safe-haven currencies. This shift could include the Pound, which would strengthen its value.

- Commodity Prices: Rising prices for oil and other commodities could increase costs for India, weakening the Rupee.

- Supply Chain Disruptions: Ongoing supply chain issues are prevalent, particularly those affecting the UK and India’s trade relationships. These issues could create volatility in the currency markets.

6. Is the Pound to INR Expected to Rise?

The future direction of the GBP to INR exchange rate depends on a variety of economic and political factors. While some indicators suggest that the Pound may rise against the Rupee, other factors could limit or reverse these gains.

Factors Supporting a Rise in GBP to INR

Several factors point to the possibility of the Pound strengthening against the Rupee in the coming months.

- Bank of England Interest Rate Increases: Higher interest rates in the UK are likely to attract more foreign investment. This increase will drive demand for the Pound. It will push the exchange rate higher.

- UK Economic Recovery: The UK’s ongoing recovery from the COVID-19 pandemic is significant. Sectors like financial services and retail show improvement. This recovery is expected to boost investor confidence in the Pound.

Factors Limiting GBP Gains

Despite these positive indicators, there are several factors that could limit the Pound’s rise. Some factors might even cause it to fall against the Rupee.

- India’s Strong Economic Growth: India’s economy has shown resilience. It is expected to continue growing, particularly in the IT and manufacturing sectors. This could strengthen the Rupee, offsetting gains made by the Pound.

- Global Uncertainty: Geopolitical tensions and global economic challenges could reduce demand for riskier currencies. This situation limits the Pound’s gains against the Rupee.

What to Watch for in the Coming Months

Here are some key events and trends to watch that could influence whether the Pound rises against the Rupee:

- Bank of England Meetings: Keep an eye on BoE policy announcements, particularly regarding interest rates. Any indication of future rate hikes could push the Pound higher.

- India’s Economic Data: Watch for indicators of inflation and export growth in India. Strong economic performance in India could strengthen the Rupee and limit the Pound’s gains.

7. How to Get the Best GBP to INR Exchange Rate

Securing the best GBP to INR exchange rate requires a combination of timing and strategy. It also involves choosing the right financial service provider. Here are some tips to help you get the best rate for your currency exchanges.

1. Compare Rates from Multiple Providers

Not all currency exchange providers offer the same rates, and even small differences can add up when exchanging large sums. Compare rates from banks, online platforms, and currency brokers to ensure you’re getting the most competitive rate. Compare rates (here)

- Online Currency Platforms: Websites like Cambridge Currencies offer real-time exchange rates and competitive fees, often better than traditional banks.

- Banks: While banks are convenient, they often offer less competitive rates and charge higher fees than specialized currency brokers.

2. Monitor the Market for Optimal Timing

Exchange rates fluctuate throughout the day. It’s important to keep an eye on the market. Make your exchange when the rate favors you.

- Set Up Rate Alerts: Many currency platforms allow you to set up alerts. They notify you when the exchange rate reaches a certain level. This can help you make your exchange at the most favorable time.

- Use Currency Conversion Tools: Online tools can help you monitor the market. They also track historical exchange rates. This gives you a better sense of when to make your exchange.

3. Use Forward Contracts for Large Transfers

You may need to make a large transfer. If you worry about potential fluctuations in the exchange rate, consider using a forward contract. This allows you to lock in today’s exchange rate for a future transfer, protecting you from potential market volatility.

- Benefits of Forward Contracts: By locking in a favorable rate, you can ensure that your future transfer won’t be affected. This protects it from any negative market changes.

4. Avoid Hidden Fees and Charges

Always check for hidden fees or additional charges when exchanging currencies. Some providers may offer a competitive exchange rate but add high transaction fees, which can eat into your savings.

- Look for Transparent Pricing: Choose a provider that offers transparent pricing with no hidden fees. Currency brokers like Cambridge Currencies are known for offering competitive rates without any surprise charges.

8. GBP to INR: Important Considerations for Businesses

(Word count: 1000)

For businesses involved in cross-border trade, managing currency risk is crucial. It is an important part of financial planning for those regularly making payments in different currencies. The GBP to INR exchange rate can significantly affect transaction profitability between the UK and India.

1. Hedging Strategies for Managing Currency Risk

Hedging is one of the most effective ways for businesses to protect themselves from unfavorable currency movements. There are several types of hedging strategies that businesses can use:

- Forward Contracts: Lock in today’s exchange rate for a future transaction to protect against unfavorable market fluctuations.

- Currency Options: Options give the right, but not the obligation, to exchange currencies at a predetermined rate. This can be done on or before a certain date.

- Natural Hedging: Businesses with operations in both the UK and India can create natural hedges. They do this by matching revenues and expenses in the same currency. This practice reduces the need for currency exchanges.

2. Working with Currency Brokers for Business Payments

Many businesses turn to currency brokers for large payments instead of relying on traditional banks. Currency brokers often provide more competitive exchange rates, lower fees, and tailored services that meet the unique needs of businesses.

- Benefits of Using a Currency Broker: Brokers like Cambridge Currencies specialize in international payments. They offer dedicated account managers. These managers can help you navigate the complexities of currency exchange.

3. Monitoring the Exchange Rate for Business Planning

It’s essential for businesses to monitor the GBP to INR exchange rate regularly, especially if they make frequent international payments. Keeping track of market trends can help you time your transactions to secure the best possible rate.

- Rate Alerts and Market Analysis: Many currency platforms offer rate alerts and market analysis. They provide businesses with the information they need to make informed decisions about currency exchanges.

4. Impact of Exchange Rate Fluctuations on Business Profitability

Even small fluctuations in the GBP to INR exchange rate can have a significant impact on a business’s bottom line. A weaker Pound implies a UK-based business will encounter higher costs. This is true when they have to pay Indian suppliers in GBP terms. This can reduce profit margins.

9. Pound to INR Rate for Personal Transfers and Expats

For expats and individuals regularly sending money between the UK and India, the GBP to INR exchange rate is crucial. It can affect the amount of money received or sent. Exchange rate fluctuations can lead to significant savings. They can also cause unexpected losses. Therefore, it is essential to understand how to get the best rate for personal transfers.

1. Choosing the Right Service for Personal Transfers

There are several options available for transferring money between the UK and India. However, they do not all offer the same exchange rates or fees. It’s important to compare the different options and choose the service that offers the best value for your needs.

- Currency Brokers: Currency brokers often provide more favorable exchange rates and lower fees compared to banks and other financial institutions. For large transfers, they can also offer personalized service and guidance on how to time your exchange.

- Online Remittance Services: Online services like Wise and PayPal can be convenient for smaller, regular transfers. However, they may not offer the best rates for larger transfers.

2. Timing Your Transfers to Get the Best Rate

Timing your transfers to coincide with favorable exchange rates can help you save money. Keep an eye on the market and make your transfer when the exchange rate is in your favor.

- Set Up Rate Alerts: Many online remittance services and currency platforms offer this feature. You can set up alerts to notify you when the exchange rate reaches a certain level. This can help you make your transfer when the rate is at its best.

- Track Historical Exchange Rates: Look at historical exchange rates. This can give you a better idea of when the GBP to INR rate is likely to improve. This can help you time your transfers more effectively.

10. Why Is the GBP to INR Rate Falling?

The GBP to INR exchange rate has seen some recent declines, and several factors are contributing to this trend. Below, we explore the reasons why the Pound has been losing ground against the Rupee.

1. Inflationary Pressures in the UK

Inflation in the UK has been rising faster than expected, driven by higher energy prices and supply chain disruptions. High inflation erodes the purchasing power of the Pound, making it less valuable relative to other currencies like the Rupee.

- Impact of Energy Prices: The UK is particularly vulnerable to rising energy prices. These increases have pushed inflation higher. They have also weakened the Pound. As energy prices remain high, this could continue to put downward pressure on the GBP to INR rate.

2. India’s Strong Economic Performance

India’s economy has shown remarkable resilience despite global challenges. Strong growth in IT and pharmaceutical sectors supports the Rupee. Foreign investment inflows also make it more competitive against the Pound.

- Export Growth: India’s exports, particularly in technology and pharmaceuticals, have continued to grow, supporting the Rupee’s value against the Pound.

- Foreign Direct Investment: High levels of foreign investment in India have increased demand for the Rupee. This demand helps to boost its value relative to the Pound.

3. Global Economic Uncertainty

Global economic uncertainty, including geopolitical risks and trade tensions, has contributed to volatility in the currency markets. Investors have been moving their money into safer assets, which has weakened the Pound relative to the Rupee.

11. Frequently Asked Questions (FAQs)

The GBP to INR exchange rate is a complex topic. Many people have questions about how it works. They wonder about what affects it and how to get the best rates. Below, we answer some of the most commonly asked questions related to the GBP to INRrate.

1. Is Pound to INR Expected to Increase?

The Pound to INR rate may increase if the UK economy stabilizes and inflation is brought under control. However, India’s strong economic performance could offset gains made by the Pound, leading to a more balanced exchange rate.

- Interest Rate Hikes in the UK: If the Bank of England continues to raise interest rates, the Pound might strengthen. This potential increase is expected against the Rupee.

- India’s Economic Growth: India’s robust economic growth is particularly evident in sectors like IT and manufacturing. This growth could support the Rupee and limit the Pound’s gains.

2. Is GBP Expected to Rise or Fall?

The Pound could rise if the UK’s economic data improves and the Bank of England continues to raise interest rates. However, if inflation remains high without corresponding growth, the Pound could weaken, causing the exchange rate to fall.

- Impact of Inflation: Rising inflation in the UK could weaken the Pound. Lower inflation in India could support the Rupee.

3. What Is the Highest Ever GBP to INR?

The highest recorded GBP to INR exchange rate was ₹106.63 per pound in February 2021. This peak was due to strong demand for the Pound and economic challenges in India at the time.

- Factors Behind the High: The UK experienced rapid economic recovery following the COVID-19 pandemic. Inflationary pressures in India further influenced the situation. These factors drove the Pound to its highest-ever exchange rate against the Rupee.

4. Why Is GBP to INR Falling?

The GBP to INR rate has been falling. This is due to high inflation in the UK. Another reason is the stronger economic performance in India. The Rupee has remained relatively stable, while the Pound has faced downward pressure.

- UK Inflation: Rising inflation in the UK has weakened the Pound. This has reduced its value relative to other currencies like the Rupee.

5. How Does the Bank of England’s Interest Rate Impact GBP to INR?

Interest rates set by the Bank of England directly affect the value of the Pound. Higher interest rates attract foreign investment, strengthening the Pound, while lower rates can weaken the currency. Changes in interest rates can lead to fluctuations in the GBP to INR exchange rate.

6. What Is the Best Way to Monitor the GBP to INR Exchange Rate?

There are several tools available for monitoring the GBP to INR exchange rate. Many online platforms, such as currency brokers and financial news websites, offer real-time exchange rate information. Additionally, you can set up alerts to notify you when the rate hits a specific level.

- Use Online Tools: Websites like Cambridge Currencies offer real-time rate updates and historical data to help you track the market.

7. Can I Use a Forward Contract to Lock in the Current GBP to INR Rate?

Yes, forward contracts are a popular tool for locking in today’s exchange rate for a future transaction. This can protect you from unfavorable currency fluctuations and give you more certainty in your financial planning.

8. How Does India’s Economic Performance Affect the GBP to INR Rate?

India’s economic performance plays a significant role in determining the strength of the Rupee. Strong growth in sectors like IT, manufacturing, and exports strengthens the Rupee. Conversely, inflation and economic instability can weaken it.

- Growth in Exports: India’s strong export growth has supported the Rupee. This growth is particularly evident in the IT and pharmaceutical sectors. As a result, the Rupee has remained competitive against the Pound.

9. How Can I Get the Best GBP to INR Exchange Rate for Personal Transfers?

To get the best exchange rate for personal transfers, it’s important to compare rates across different providers. Online platforms and currency brokers often offer better rates and lower fees than traditional banks. Timing your transfer when the exchange rate is more favorable can also help you save money.

10. What Impact Does Brexit Have on the GBP to INR Exchange Rate?

Brexit has had a lasting impact on the British economy and the value of the Pound. Uncertainty surrounding trade agreements and the UK’s relationship with the EU has caused fluctuations in the exchange rate. As the UK continues to navigate its post-Brexit future, the GBP to INR rate may remain volatile.

11. Is Now a Good Time to Exchange GBP to INR?

Timing your currency exchange depends on the current rate and market conditions. If the Pound is strong, it could be a good time to exchange GBP to INR. The Rupee is weak. Consider these conditions carefully before making a decision. However, if you expect the Pound to strengthen further, it may be worth waiting for a better rate.

12. How Can Businesses Manage Currency Risk in GBP to INR Transactions?

Businesses can use hedging strategies to manage currency risk. They can employ forward contracts or options to lock in favorable rates. This helps reduce exposure to exchange rate fluctuations. Working with a currency broker can also provide businesses with more competitive rates and personalized service.

13. What Is the Best Way to Send Money from the UK to India?

The best way to send money from the UK to India depends on your needs. For small, regular transfers, online remittance services may offer the best rates and low fees. For larger transfers, working with a currency broker like Cambridge Currencies can provide more favorable exchange rates and personalized service.

14. How Does Inflation in India Impact the GBP to INR Rate?

Inflation in India can reduce the value of the Rupee, making it less competitive against stronger currencies like the Pound. If inflation remains high in India, the GBP to INR exchange rate could rise as the Rupee weakens.

15. Can I Use a Currency Exchange Platform for Business Transactions?

Yes, many currency exchange platforms offer services tailored to businesses. These platforms often provide better exchange rates than traditional banks. They offer tools like forward contracts and rate alerts. These tools help businesses manage currency risk.

What Do We Know About The GBP to INR Forecast?

The GBP to INR forecast indicates changes in the exchange rate. It is expected to fluctuate within a range of ₹100 to ₹105 per pound over the next six months. For businesses and individuals making large currency transfers, it’s important to stay informed. Use tools like rate alerts and forward contracts to get the best possible rate.

For competitive rates and tailored currency solutions, consider working with Cambridge Currencies, a trusted provider for international payments.