A Comprehensive Guide

Interest Rates and Their Impact on Currency Exchange

Understanding Interest Rates and Their Impact on Currency Exchange Rates

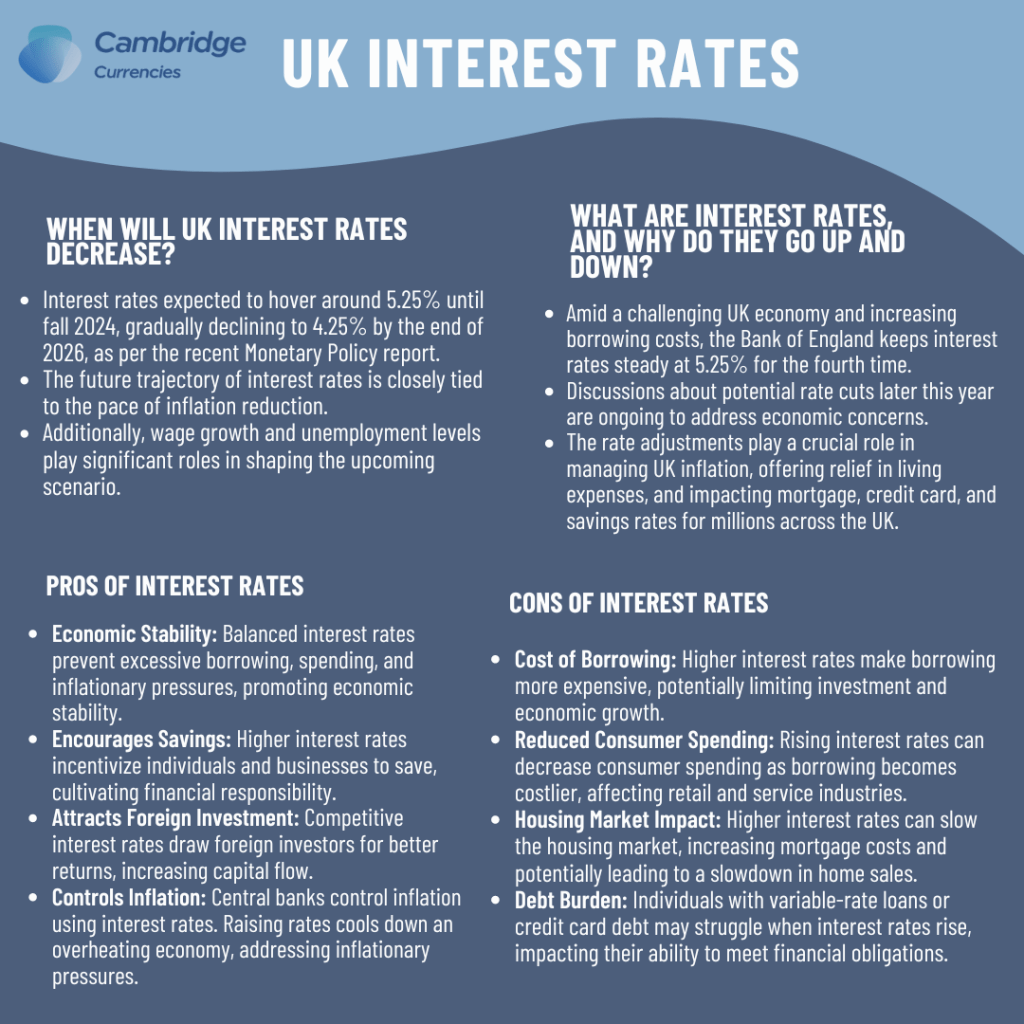

Interest rates play a crucial role in shaping the dynamics of global financial markets, influencing investment decisions, economic growth, and currency exchange rates. In this comprehensive guide, we’ll explore the intricate relationship between interest rates and currency exchange rates, shedding light on how changes in interest rates can affect the value of currencies and impact international trade and investment.

Interest Rates and Their Impact on Currency Exchange

1. Interest Rate Differentials

Interest rate differentials between countries are a key determinant of currency exchange rates. Higher interest rates typically attract foreign investment, leading to increased demand for the currency of the country offering higher yields. As a result, the value of the currency appreciates relative to other currencies with lower interest rates.

2. Capital Flows

Changes in interest rates can influence capital flows between countries, affecting currency supply and demand. When interest rates rise in a particular country, foreign investors may flock to invest in assets denominated in that currency to capitalize on higher returns. This influx of capital strengthens the currency, driving up its exchange rate.

3. Inflation Expectations

Central banks often adjust interest rates in response to inflationary pressures. Higher interest rates are typically used to combat inflation by reducing consumer spending and curbing price growth. Consequently, currencies of countries with higher interest rates may appreciate as investors anticipate lower inflation and higher purchasing power.

Factors Influencing Exchange Rate Fluctuations

1. Economic Indicators

Economic indicators such as GDP growth, unemployment rates, and trade balances can influence interest rate expectations and currency values. Positive economic data may prompt central banks to raise interest rates to cool down an overheating economy, leading to currency appreciation.

2. Central Bank Policies

Monetary policies implemented by central banks, including interest rate decisions and quantitative easing measures, can directly impact currency exchange rates. Hawkish policies, characterized by interest rate hikes, tend to strengthen a currency, while dovish policies, marked by interest rate cuts, may weaken it.

3. Political Stability

Political stability and geopolitical events can also affect currency exchange rates. Uncertainty and geopolitical tensions may lead to capital flight from a country, weakening its currency. Conversely, stability and positive political developments can bolster investor confidence and support currency appreciation.

Interest Rates and Their Impact on Currency Exchange:

1. Stay Informed

Keep abreast of economic news, central bank announcements, and geopolitical developments that may impact interest rates and currency exchange rates. Stay informed to anticipate potential market movements and adjust your trading strategies accordingly.

2. Diversify Your Portfolio

Diversification is key to mitigating risk in currency trading. Spread your investments across different currencies and asset classes to minimize exposure to currency fluctuations and reduce overall portfolio volatility.

3. Utilize Hedging Strategies

Consider using hedging strategies such as forward contracts, options, and futures to protect against adverse currency movements. Hedging allows you to lock in exchange rates and safeguard your profits against unexpected currency fluctuations.

How Cambridge Currencies Can Help

Cambridge Currencies offers a range of tools and resources to help traders and investors navigate currency markets effectively. With access to real-time market data, advanced trading platforms, and expert market analysis, Cambridge Currencies provides valuable insights and support to help clients time their trades strategically. Whether you’re looking to capitalize on short-term fluctuations or execute long-term currency strategies, our experienced team can provide personalised guidance and assistance to help you make informed trading decisions. Trust Cambridge Currencies to be your partner in when navigating Interest Rates and Their Impact on Currency Exchange.

Conclusion

Interest Rates and Their Impact on Currency Exchange from understanding the relationship between interest rates and currency values is essential for investors, traders, and businesses seeking to navigate currency fluctuations effectively. By staying informed, diversifying portfolios, and utilizing hedging strategies, individuals and organizations can mitigate risk and capitalize on opportunities in the dynamic world of currency trading.