What Are Rate Alerts and Should I Use One?

What Are Rate Alerts?

Rate alerts are email notifications in which you will be informed via e-mail as soon as the rate has hit your desired level. They are developed to enable you to keep track of exchange-rate movements without having to constantly watch the markets. You can set a rate alert through a bank, financial institution, or through companies specializing in currency exchange, like Cambridge Currencies.

How Do Rate Alerts Work?

Actually, setting up a rate alert is quite easy:

- Select a Currency Pair: Choose which two currencies you want to monitor. This could range from anything between the US dollar and the euro, for instance.

- Set Your Target Rate: Set what the actual rate of exchange is that you want to be alerted at. For example, you might be alerted when one US dollar exchanges for 0.90 euros.

- Set up notification preferences: You will be asked to choose how you want to be notified. Some common options are email, SMS, or push notifications via a mobile app.

- Monitor the Market: The service provider will be watching the market on your behalf. Once any of the target rates that you set is reached, you will be alerted.

Benefits of Using Rate Alerts

Rate alerts are highly beneficial both for individuals and businesses. Some of the major benefits include:

- Time and Effort Saved

Searching continuously for an exchange rate update can be very time-consuming and annoying. Rate alerts spare you this hassle by automating the process. Once you set the target rate, you just have to wait for it in the confirmation email.

- Grab the Best Rate

The exchange rate changes drastically within a day. With rate alerts, you will never miss great rates since you will be ready to exchange anytime it is most convenient for you.

- Better investments

Currency risk management is essential for any given business but more so for those involved in international trade. Rate alerts will help the firm in better financial planning by allowing them to lock in great rates for future transactions.

- Less Stress

Knowing exchange rates can be a headache, more so when large sums of money are involved. Rate alerts keep the heart at ease by assuring you that you will be the first to know when your desired rate is live.

Real-Life Applications of Rate Alerts

For Individuals

- Travelers: When thinking of going on a trip oversees, one can set up the rate alert to get the best value one needs for exchanging money into the destination’s currency.

- Expats and International Workers: Those who earn money in one currency but spend in another one can use such rate alerts to maximize their income while transferring money between accounts.

- Investors: The investors in foreign assets, with the aid of the rate alerts, will know when to invest and get better returns.

Businesses

- Importers and Exporters: An account for rate alerts is all that companies engaged in international trade will need to be able to keep track of the optimum schedule for payments and avoid currency risk.

- Large Enterprises: Large companies running business across borders can manage effective currency exposure from these rate alerts.

- Freelancers and Consultants: The professionals dealing with clients from various countries can ensure the best rates for their services against the same in different currencies.

How to Set Up a Rate Alert: Step-by-Step

Setting up a rate alert is relatively straightforward, although it may vary slightly depending on the platform being used. In general, these are steps that can help you get started:

- Step 1: Service Provider

You should settle on a reliable service provider first. For example, Cambridge Currencies has a very user-friendly platform where one can easily set up and manage rate alerts.

- Step 2: Open an Account

In case you don’t have an account with the chosen provider, sign up. This almost always entails providing some basic personal or business information.

- Step 3: Select Currency Pair

Choose the currency pair you are interested in. If you want to monitor the US dollar and the euro, it will be USD/EUR.

- Step 4: Set Your Target Rate

It specify the rate at which you want to be alerted. If needed, you can create various rate alerts for different target rates.

- Step 5: Notification Method

Select how you want to receive your notification. They usually include email, SMS, and in-app push notifications.

- Step 6: Activate the Alert

Just set up your alert, then turn it on, and let the service provider do the rest. Notification will be sent to you when your target rate reaches.

How Rate Alerts Benefit a Business

The case study below elaborately explains the benefits of rate alerts in business. Case example: This would involve a small business operator called Sarah who operates an import/export business.

Challenges

She laid the import from Europe, selling the same products within the United States. Her business profit margins are greatly affected by the EUR/USD currency exchange rate. Whenever the exchange rate changes, it really challenges her costs and profitability.

Solution

Sarah configures rate alerts through Cambridge Currencies. She puts an alert to let her know when the level of the EUR/USD exchange rate reaches her preferred level, where 1 EUR equals 1.15 USD.

The Result

Weeks later, Sarah is contacted to let her know that her target rate has been reached. She promptly transfers funds and locks in the great rate, saving herself a small fortune on her import costs, and now she can offer very competitive prices to her customers while commanding healthy margins.

How to Effectively Use Rate Alerts

- Set Realistic Target Rates: While setting a target rate, keep in mind recent market trends and set up some realistic targets. Outrageous targets are unlikely to be met. If you miss out on an opportunity due to an unrealistic target, there is definitely something that should be avoided.

- Monitor Multiple Pairs: In case you need to deal with multiple currencies, have the rate alerts set for each pair so as to remain updated on all relevant exchange rates.

- Review on a Timely Basis and Make Changes: There are several factors that can move exchange rates. Make a review regularly regarding the rate alerts, following the market conditions and your goals in finance.

- Integrate with Other Tools: Make use of rate alerts along with other tools and strategies of finance, such as forward contracts and options, for effectively managing currency risk.

Possible Disadvantages of Rate Alerts

While rate alerts have several advantages, there are a few disadvantages to be considered:

- Overspending on Alerts: Relying solely on rate alerts can often keep you out of the action if market conditions suddenly change. It is critical that you keep up with broader market trends and developments.

- False Sense of Security: Receiving the rate alert itself doesn’t guarantee that the rate will sustain your favour. Sometimes, exchange rates are changed within a very short span, and the rate you get may not be exactly the one alerted.

- Alert Fatigue: Having too many alerts can put you in notification fatigue, making you overlook other important alerts. Be selective and only set it for those that are really important rates.

Should You Use Rate Alerts?

In brief, the rate alerts are very beneficial for people who deal with currency transactions. They not only save time but also provide convenience for one to make good use of the fluctuations in the exchange rate. Be it an individual traveller, an expat, an investor, or a business owner, rate alerts did a lot to help refine your financial planning and decision-making.

How Cambridge Currencies Can Help with Rate Alerts

If you’re a business owner, an investor, or possibly someone who has to trade frequently in foreign currencies, the management of currency exchange rates may become the most critical factor for your financial transactions today in this global economy.

In this article, we will discuss how Cambridge Currencies can help in regard to rate alerts and give an example of a real situation when this service really made a difference.

What Are Rate Alerts?

Rate alerts are notifications that let you know when an exchange rate has reached your predetermined level. This becomes a significant tool for those looking to optimize their currency exchange because it gives real-time information on how to cash out at the best rates.

How Rate Alerts Work at Cambridge Currencies

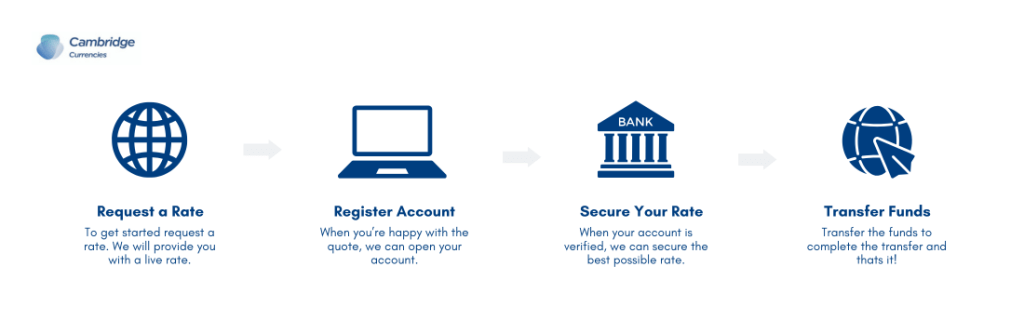

Setting up rate alerts with Cambridge Currencies is very easy:

- Choose the currency pair you need: This would be the selection of the two particular currencies to consider. For example, if you want to track the US dollar-to-euro exchange rate, you would set this as USD/EUR.

- Set your target rate: This will be an exchange rate at which you want to be alerted. For example, this might be when 1 USD = 0.85 EUR.

- Select notification preferences: It involves how you would prefer to receive notifications. Options include email, SMS, or even push notifications via a mobile app.

- Activate Your Alert: Once you set up your target rate, Cambridge Currencies will constantly monitor the markets for you and contact you when we reach your desired rate.

Benefits of Cambridge Currencies’ Rate Alerts

- Time and Effort Savings

Rate alerts automate the constant checking of rates, freeing one to deal with other stuff. You will be contacted instantly once your rate reaches the goal. Therefore, you’ll never miss out on any opportunity.

- Maximize Favourable Rates

Exchange rates fluctuate within a day. Rate alerts will ensure that you make the most of your felicitous rates and can save you a lot on transaction costs.

- Better Reconciliation

Every business that trades globally has to contend with currency risk. Alerts on favourable rates for future transactions improve financial planning and budgeting.

- Reduced Stress

It can be stressful keeping track of these exchange rates, especially if you deal with a huge sum of money. With rate alerts, it puts your mind at rest because you will be alerted instantly if and when your preferred rate becomes live.

A Real-World Situation: How Rate Alerts Changed Everything

The case study below of a real situation about a small business owner named Sarah will give readers a better idea of how the rate alerts provided by Cambridge Currencies can make a real difference in their business.

The Challenge

Sarah operates an import/export business. She purchases merchandise at a cost in Europe and resells it in the United States. Her profit margins are highly correlated with the EUR/USD exchange rate. Lately, she noticed the EUR/USD was volatile, so she would like to sell on a good rate to maximize her profit margin on an upcoming large purchase.

The Solution

Sarah utilized Cambridge Currencies’ free rate alert service. She set an alert whereby she would be contacted the instant that the EUR/USD exchange rate achieved 1 EUR = 1.10 USD for an extremely competitive rate for her business.

The Result

A few weeks later, Cambridge Currencies sent her an email stating that her target rate had been reached. She could then very quickly execute her currency exchange at this favourable rate of exchange, hence saving her so much on the minus side. This timely information saved her thousands of dollars, which she could reinvest in her business.

Not only did it save her some money, but the rate alert gave her a strategic advantage, allowing her to competitively price her goods sold into the US market while maintaining healthy margins.

Setting Up Rate Alerts with Cambridge Currencies

This procedure enables one to set up rate alerts through Cambridge Currencies.

- Create an account: If you have not already registered with Cambridge Currencies, then log on to their website and provide the requisite details. Verify your account.

- Now login into your account: You would find a range of currency pairs to choose from. Select the one that you want to track. For example, USD/EUR.

- Set Your Target Rate: Set the rate at which you want to be notified. Be sure that the target rate is realizable with the changing market trends.

- Notification Preferences: Select how you want to be notified. Cambridge Currencies offers several notification choices, such as email and SMS, in addition to notifications on mobile applications.

- Activate the Alert: Activate your rate alert once everything is set up and allow Cambridge Currencies to monitor the market on your behalf.

Why Cambridge Currencies for Rate Alerts?

- Experience and Reliability

Cambridge Currencies has built a credible record in the provision of reliable, accurate currency exchange services. Its team of experts watches the markets constantly to provide timely and accurate alerts.

- User-Friendly Platform

The platform is very user-friendly for you to set up and control your rate alerts. The interface is user-friendly enough to make the experience silky-smooth, even for those who are not tech-savvy.

- Round-the-Clock Support

On the support side, Cambridge Currencies has establishing extensive customer support that would help you in deriving the best from its services. Be it setting up an alert or explanation of the market trend; their customer service is on its feet all the time.

- Customisation Options

The rate alert service is very flexible: one can set many alerts for a number of currency pairs and target rates. All this confirms you’re able to personalize the service to your needs.

Bring your currency transactions under your control.

These very rate alerts are just one of the great tools in anyone’s dealings with currency transactions. They provide timely information that may bring quite substantial savings and better financial planning. At Cambridge Currencies, they offer a pretty robust rate alert service that is easy to use and very effective for staying at the forefront of the market and really making informed decisions.

Let Cambridge Currencies’ rate alerts work to your advantage in minimizing your currency risk and maximizing your transactions for better financial outcomes. Be it as a businesswoman like Sarah, an investor, or a person dealing with international currencies, these rate alerts can give you an edge over others in the dynamic financial landscape of today.

Get control of your currency transactions today. Set up rate alerts with Cambridge Currencies for these advantages that come with knowing timely and accurate exchange rate information. Your financial future will thank you!

Share Your Experiences with Rate Alerts

Have you ever run rate alerts? Share your experiences in the comments below. What worked well for you, and what have been some of the challenges that you came across? If you’ve got a helpful tip or trick about rate alerts, we’d love to hear more!

Further Reading

For more information on managing currency risk and optimizing your financial transactions, check out these articles:

How to Hedge Against Currency Risk

Top Strategies for International Trade

Maximizing Profits with Forward Contracts

Stay informed and stay ahead with Cambridge Currencies. Happy transfers!