Understanding Clearance Codes in Banking

Need to send money abroad? Whether it’s a local payment or an international transfer, clearance codes ensure your funds land in the right account. In this guide, we explain what clearance codes are, why they matter, how to use them correctly, and clear up common confusion around terms like “clearance cipher.”

What Are Clearance Codes?

Clearance codes (or clearing codes) are identifiers used by banks to route payments accurately. These codes help direct funds to the correct financial institution and specific account.

They vary depending on the country and the type of transaction. Clearance codes are fundamental to the global financial system, supporting secure and efficient processing.

What Is a Clearance Cipher?

“Clearance cipher” isn’t an official banking term. It’s often a mistaken variation of “clearance code.”

While clearance codes identify banks and branches for transaction routing, a cipher usually refers to encryption used in securing data. If you’re sending or receiving money, you’re most likely looking for a clearance code like a SWIFT, IBAN, or routing number.

Common Types of Clearance Codes

Here’s a breakdown of the most used clearance codes around the world:

1. Sort Code (UK)

Used in the UK for domestic transfers. It’s a six-digit number that identifies a specific bank and branch.

How to find your UK sort code here

2. Routing Number (USA)

Used for domestic U.S. transfers like direct deposits or ACH payments. It’s a nine-digit code identifying the bank handling the transaction.

How to find your routing number

3. SWIFT Code (International)

SWIFT codes (8–11 characters) are used for international transfers. They identify the bank and its global location.

Check this list of SWIFT codes

4. IBAN (Europe/Middle East)

The International Bank Account Number includes country, bank, and account information. It’s used in many international transfers, especially in Europe.

5. BIC Code

Often used interchangeably with SWIFT codes. BICs help identify a specific bank during international transactions.

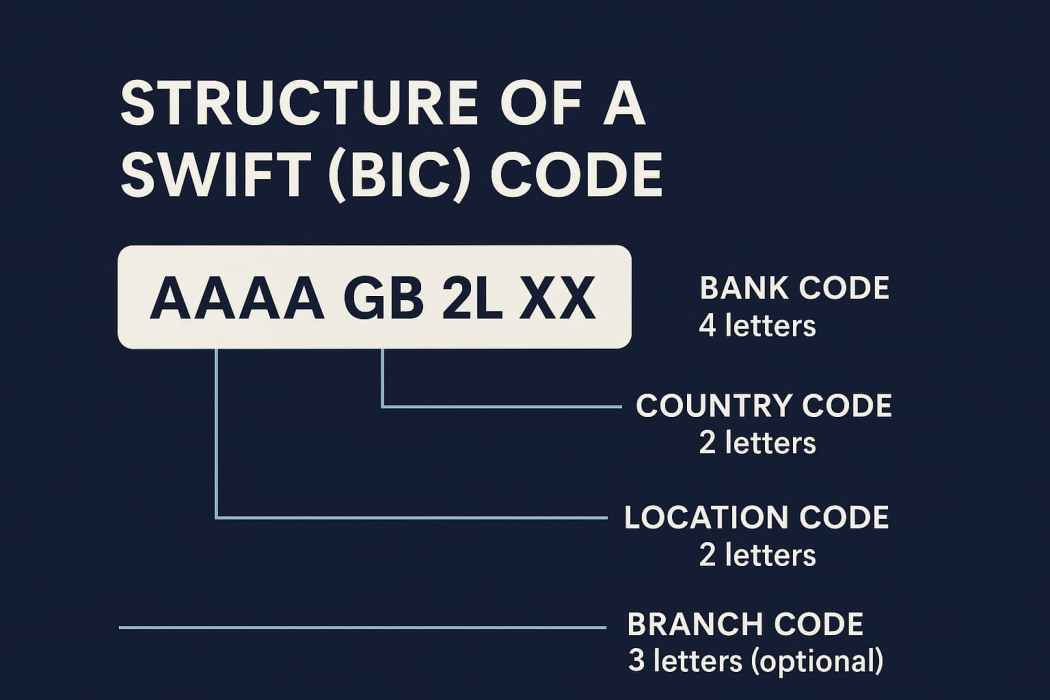

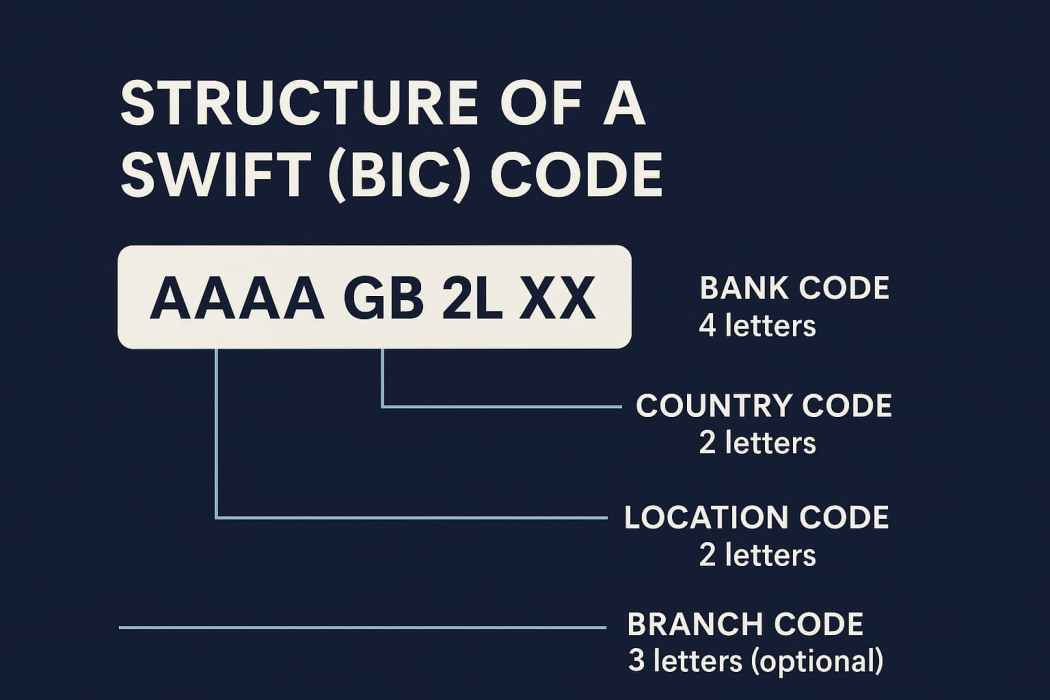

SWIFT/BIC Code Structure

Here’s how a SWIFT/BIC code is structured:

- Bank Code: 4 letters identifying the bank

- Country Code: 2 letters identifying the country

- Location Code: 2 letters or numbers for the bank’s location

- Branch Code (optional): 3 letters or numbers for a specific branch

Why Are Clearance Codes Important?

Clearance codes are essential for:

- Accuracy: Prevents errors and misdirected funds

- Speed: Automates processing, reducing delays

- Security: Verifies institutions to reduce fraud

For example, using the correct SWIFT code for international transfers ensures funds go to the right bank without holdups.

How to Use Clearance Codes Correctly

- Verify the Code: Always double-check the code with your bank or recipient.

- Include Full Details: Add account number, bank name, and any required reference.

- Follow Format Rules: Ensure codes match the required format (especially for SWIFT or IBAN).

How to Find the Right Clearance Code

- Bank Website: Most publish their SWIFT, IBAN, and sort codes.

- Bank Statements: Codes often appear in your online or paper statements.

- Online Directories: Sites like IBAN.com or Bank Codes directories.

- Customer Support: When in doubt, call or message your bank directly.

Common Questions

Can I reuse the same clearance code?

Yes. Codes like SWIFT, routing numbers, or sort codes remain stable unless the bank changes them.

What if I enter the wrong code?

It may cause the payment to fail or be misdirected. Contact your bank immediately if it happens.

Do clearance codes ever change?

Occasionally—especially during mergers or rebrands. Always verify before sending large or international payments.

Final Thoughts

Clearance codes make financial transactions smoother and more secure. Using the right one prevents delays, errors, or losses. Always double-check your recipient’s information and confirm details with your bank if unsure.

Whether you’re sending money across town or across continents, a clearance code is the small detail that keeps your payment on track.

Clearance Code Meaning

Clearance Code Meaning