How to send and receive IBAN Transactions

What exactly is an IBAN? How does it work? And how can you use it to send and receive money internationally?

This guide will answer these questions and more. It covers IBAN transactions, explaining their structure and how SWIFT and SEPA payments work.

What Is an IBAN?

An IBAN (International Bank Account Number) is a standardized format used for international payments. It includes your country code, bank identifier, and account number, ensuring accurate and efficient transfers. IBANs are essential for sending and receiving money between banks across borders.

An IBAN typically comprises several parts:

- Country code

- Check digits

- Bank code

- Account number

How Does an IBAN Work?

An IBAN ensures international payments are routed correctly by providing a standardized account format. It includes a country code, check digits, bank identifier, and account number. When you send or receive money, the IBAN helps banks verify account details, reducing errors and delays in cross-border transfers.

How Much Do International Payments Cost?

The cost of international payments depends on factors like provider fees, exchange rate markups, and transfer methods. Banks often charge high fees and markups, but Cambridge Currencies keeps costs low, especially for large transfers.

Fees depend on the currency and destination, but we always provide a clear breakdown of costs. For affordable and efficient transfers, always choose a trusted provider that offers transparency and value.

Step-by-Step Guide: How to Send an IBAN Payment

Sending an IBAN payment is straightforward if you have the right details. Start by collecting the recipient’s IBAN and their bank’s BIC/SWIFT code. Log in to your online banking or contact your bank to initiate the transfer. Enter the recipient’s name, IBAN, and BIC/SWIFT code carefully to avoid errors.

Specify the amount, currency, and purpose of the payment. Double-check all details before confirming the transaction.

Here’s a quick checklist to guide you:

- Verify the recipient’s IBAN for accuracy

- Enter recipient’s personal information (name, address)

- Input the desired transfer amount and currency

- Choose the transfer type (standard, express)

- Review all entered details before submission

Receiving Money: How to Provide Your IBAN for International Payments

Sharing your IBAN (International Bank Account Number) is essential for receiving international payments smoothly. First, locate your IBAN by checking your bank statement, online banking, or by contacting your bank directly. Ensure the number is correct; it includes your country code, bank identifier, and account number. Share it securely, such as via email or over the phone with trusted senders only.

What Details Are Needed To Make An International Payment?

1. Recipient’s Full Name

- Ensure the name matches the account holder’s name at their bank.

2. IBAN (International Bank Account Number)

- Used in many countries to identify the specific bank account.

- Includes the recipient’s country code, bank code, and account number.

3. BIC/SWIFT Code

- Identifies the recipient’s bank for international transactions.

- Usually 8-11 characters long.

4. Recipient’s Bank Name and Address

- Sometimes needed to verify the transaction.

5. Payment Amount and Currency

- Specify the exact amount and currency to be sent.

6. Purpose of Payment

- Some countries require a reason for the transfer (e.g., invoice payment, gift).

7. Sender and Recipient Contact Information

- Email or phone numbers may be requested for confirmation or updates.

Check Your IBAN / SWIFT Code

Easily check, verify and be sure next time you use an IBAN or SWIFT code.

SWIFT vs. SEPA Payments: What’s the Difference?

What Is a SWIFT Payment?

A SWIFT payment is an international bank transfer made via the SWIFT network. It securely connects banks worldwide, enabling cross-border payments. You’ll need the recipient’s BIC/SWIFT code, IBAN, and account details.

Transfers usually take 1-5 business days, depending on the destination.

What Is a SEPA Payment?

A SEPA payment is a transfer made within the Single Euro Payments Area, covering 36 European countries. It allows fast, secure euro transfers between participating banks.

You’ll need the recipient’s IBAN and, sometimes, their BIC. SEPA payments are usually completed within one business day and often have lower or no fees. They’re ideal for businesses and individuals making euro transfers across Europe.

Key Differences Between SWIFT and SEPA:

- Region: SWIFT is global; SEPA is Europe-specific.

- Currency: SWIFT supports multiple currencies; SEPA focuses on Euros.

- Speed: SEPA transactions are usually faster.

Knowing these differences can help you choose the right method for your needs. For European transfers, SEPA offers efficiency and lower costs. For other regions, SWIFT is the way to go.

What Is The Exchange Rate For International Money Transfers?

Exchange rates for international money transfers vary based on the currencies involved and the service provider. These rates fluctuate constantly due to market conditions. For example, as of January 13, 2025, the pound was valued at $1.21, its lowest since November 2023.

Banks and money transfer services often add a margin to the mid-market exchange rate, typically ranging from 1% to 5%. This means the rate you receive is less favorable than the actual market rate. Some providers, like Wise, use the mid-market rate and charge a transparent fee, which can be more cost-effective.

Key Points to Remember:

- Exchange Rates: Rates can fluctuate; keep track for the best deal.

- Transfer Limits: Know the maximum amounts you can send daily or monthly.

- Provider Differences: Some services offer better rates or higher limits.

Choosing the right time to transfer can save money. During favorable exchange rate periods, your recipient receives more. Planning your transfers strategically can maximise your funds’ impact.

The Cost of Sending Money Internationally: Fees and Charges Explained

Sending money abroad can incur various fees. Understanding these charges helps you manage costs effectively. Banks and transfer services often have different fee structures.

Typical fees you may encounter include:

- Transfer Fees: Flat fees charged by banks or transfer services.

- Exchange Rate Markup: The difference between the actual exchange rate and what you receive.

- Sending/ Receiving Fees: Charged by banks that process the transaction along the route.

- Receiving Bank Fees: Some banks charge fees for incoming international payments.

Before starting a transfer, check the total cost with your provider. Using comparison tools can help find the most cost-effective service. Be aware of any hidden fees that could increase the overall cost. Understanding the complete fee structure ensures transparency and better budgeting for your transactions.

How Long Does an International IBAN Transfer Take?

The speed of an international IBAN transfer can vary. On average, transfers may take one to five business days. Different factors influence the timeline.

Bank holidays can delay processing times. Also, the countries involved may affect the transfer speed. Transfers between countries with advanced banking systems are typically quicker.

Opting for services with expedited options can reduce waiting times. However, faster transfers might come with higher costs. It’s crucial to weigh the urgency against the potential charges when planning an international payment. Timing your transfers carefully can help in managing expectations and minimizing delays.

How to Send an International Payment

Sending an international payment is easy when you follow these steps:

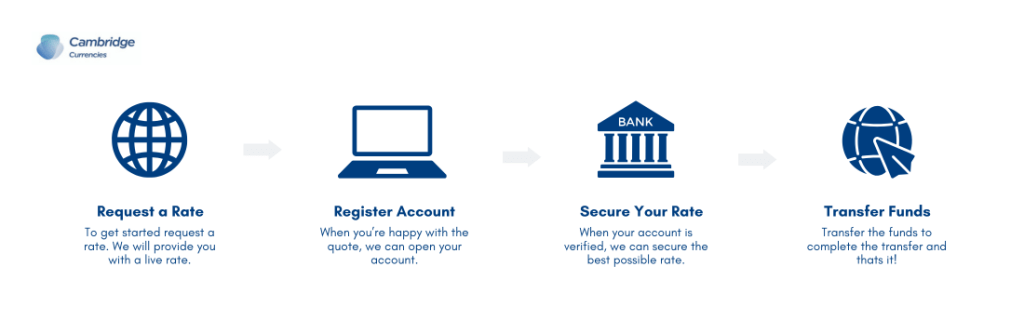

Request a Free Rate

Speak with a financial expert about sending your hard earned money abroad.