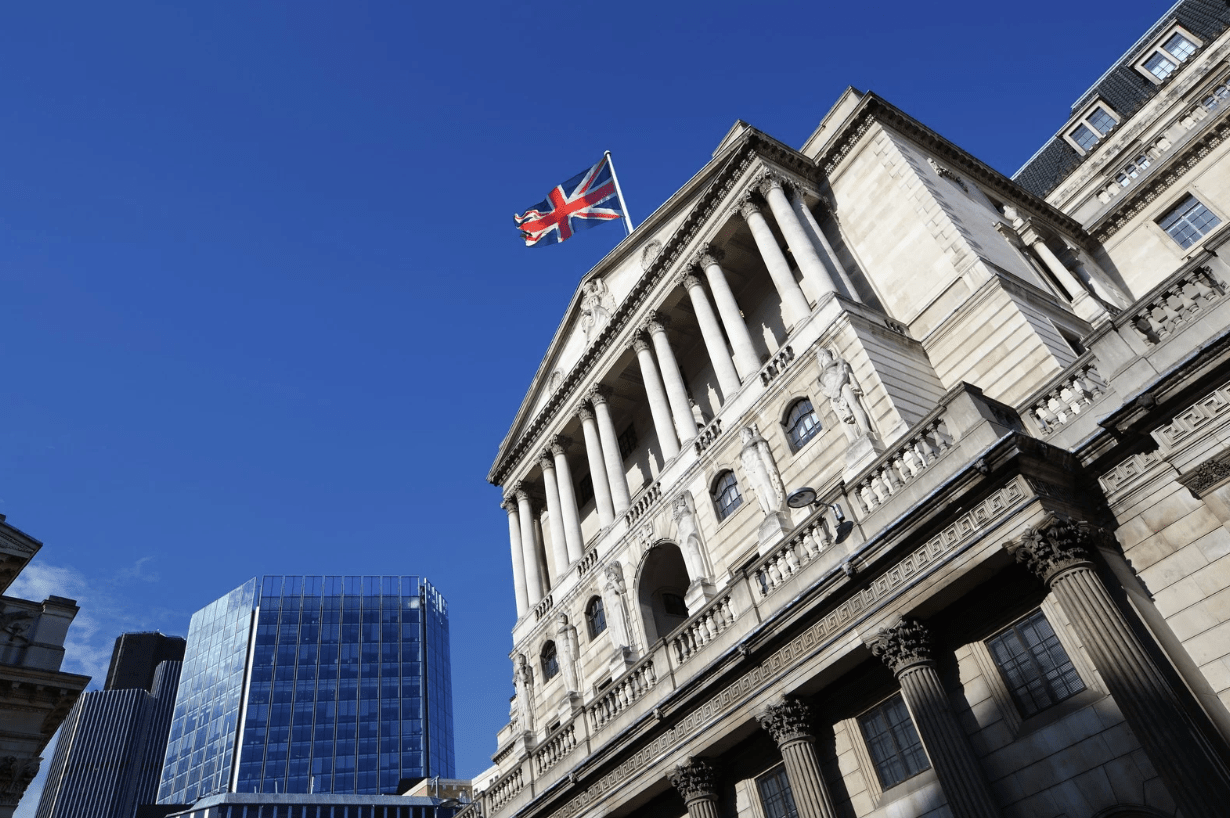

Bank of England Interest Rate Decision: What to Expect

With the Bank of England (BoE) set to announce its policy decision, market participants are watching closely to see how the vote split plays out. While expectations are for the BoE to keep rates steady at 4.5%, the breakdown of votes could spark some volatility. Last month’s meeting saw a surprise when two members backed a 50bp cut, while the majority leaned toward a 25bp cut. Any shifts in voting patterns could influence market sentiment around the BoE’s next move.

Key Data Out Today

- BoE Interest Rate Decision: The central bank is expected to hold at 4.5%, but the vote split will be the real focus. A wider shift toward cuts could fuel expectations of policy easing in the coming months.

- BoE MPC Minutes & Monetary Policy Report: Markets will be looking for any signs of changing views within the committee.

- ECB’s Lane Speech: Any fresh insight on the eurozone’s inflation outlook could move the EUR.

- US Initial Jobless Claims: A reading near the expected 224K could reinforce the Fed’s patient stance.

- Philadelphia Fed Manufacturing Survey & Existing Home Sales: Key data points for gauging US economic strength.

Commodities

- Oil: Brent crude is holding steady at $70.85 (+0.09%), while WTI is up 0.15% at $67.01. Prices are finding support from expectations that central banks will remain cautious in tightening policy.

- Gold: Edging down 0.36% to $3,039.02, as investors take a wait-and-see approach ahead of key central bank decisions.

- Silver: Dropping 1.23% to $33.48, as the broader metals market remains under pressure.

Currency Movements

EUR/USD (1.0851, ↓0.47%)

The euro is under pressure as markets await signals from central banks.

GBP/USD (1.2955, ↓0.37%)

The pound is lower as traders position ahead of the BoE’s decision and vote split.

AUD/USD (0.6294, ↓1.00%)

The Aussie is sliding, tracking risk-off sentiment.

NZD/USD (0.5746, ↓0.67%)

The Kiwi is weaker as markets stay defensive.

USD/JPY (148.702, ↑0.01%)

The yen remained stable against the dollar, reflecting balanced market sentiments.

USD/CNY (7.24483, ↑0.19%)

The Chinese yuan depreciated marginally against the dollar amid ongoing trade tensions.

USD/CHF (0.88182, ↑0.45%)

The Swiss franc weakened against the U.S. dollar, influenced by global economic uncertainties.

USD/CAD (1.43712, ↑0.31%)

The Canadian dollar weakened slightly, influenced by declining oil prices and investor caution.

USD/MXN (20.1361, ↑0.31%)

The Mexican peso depreciated against the dollar amid broader market risk aversion.

USD/INR (86.3470, ↑0.04%)

The Indian rupee remained relatively stable with a slight depreciation against the U.S. dollar.

Market Outlook

Investors are advised to monitor central bank communications and geopolitical developments closely. The interplay between trade policies and monetary decisions will be pivotal in shaping the economic landscape in the coming months.

Central Banks Hold Rates Amid Economic Uncertainty

AP News

Bank of England set to keep main UK rate unchanged at 4.50% despite gloomy economic news

Today

Reuters

Trump says Fed would be better off cutting rates as tariffs ‘transition’ into economy

Today

The Guardian

Bank of England expected to leave interest rates on hold today, as wage growth slows and redundancies rise – business live

Today