Ultimate Money Guide

The Rise Of Fintech 2024

The Rise of Fintech: Revolutionizing the Financial Landscape

In recent years, financial technology, commonly referred to as “fintech,” has become a buzzword in the financial industry. It encapsulates the integration of technology with financial services to enhance or automate banking and financial operations. The advent of fintech has disrupted traditional financial services, offering innovative solutions and transforming the way consumers interact with their money. This article explores the rise of fintech, its impact on the financial sector, and its future prospects.

The Rise Of Fintech

What is Fintech?

Fintech is an umbrella term that describes the use of technology to deliver financial services in new and innovative ways. This includes everything from mobile banking apps and digital wallets to blockchain and cryptocurrency. Fintech companies leverage cutting-edge technologies like artificial intelligence (AI), big data, and blockchain to create efficient, user-friendly financial solutions.

The Rise Of Fintech

Historical Context of Fintech

The roots of fintech can be traced back to the late 20th century with the advent of the internet and electronic banking. However, the fintech revolution truly gained momentum post-2008 financial crisis. The crisis exposed significant flaws in traditional banking systems, leading to a surge in demand for more transparent, efficient, and user-centric financial services. Entrepreneurs and tech-savvy innovators seized this opportunity, leading to the birth of numerous fintech startups.

The Rise Of Fintech

Key Areas of Fintech

- Digital Payments and Transfers:

- Mobile payment apps like PayPal, Venmo, and Apple Pay have revolutionized how people transfer money.

- Blockchain technology and cryptocurrencies such as Bitcoin and Ethereum offer decentralized and secure methods for transactions.

- Lending and Credit:

- Peer-to-peer lending platforms like LendingClub and Prosper connect borrowers directly with lenders, bypassing traditional banks.

- Online lenders use AI and machine learning to assess creditworthiness, offering quicker and often more accessible loan options.

- Personal Finance Management:

- Apps like Mint and YNAB help users manage their budgets, track spending, and set financial goals.

- Robo-advisors like Betterment and Wealthfront provide automated, algorithm-driven financial planning services with lower fees than traditional advisors.

- Insurtech:

- Companies like Lemonade and Oscar are leveraging technology to offer more personalized and efficient insurance services.

- Insurtech solutions utilize AI to assess risk more accurately and automate claims processing.

- Regtech:

- Regtech solutions help financial institutions comply with regulatory requirements more efficiently.

- Technologies like AI and big data analytics assist in monitoring transactions and ensuring compliance.

The Rise Of Fintech

Impact of Fintech on Traditional Financial Institutions

The rise of fintech has significantly impacted traditional financial institutions, pushing them towards digital transformation. Banks and other financial entities are increasingly adopting fintech solutions to stay competitive. This symbiotic relationship has led to a more integrated and innovative financial ecosystem.

The Rise Of Fintech

- Increased Competition:

- Fintech startups have introduced competitive pressure, forcing traditional banks to innovate and improve their services.

- Lower fees, better user experience, and innovative products have become essential to retain customers.

- Collaborative Ecosystem:

- Many banks are collaborating with fintech firms to enhance their offerings.

- These partnerships often lead to the development of hybrid solutions that combine the reliability of traditional banking with the innovation of fintech.

- Enhanced Customer Experience:

- Fintech solutions prioritize user experience, offering intuitive interfaces and faster services.

- AI and big data are used to personalize financial products, meeting individual customer needs more effectively.

The Rise Of Fintech

The Rise Of Fintech

The Role of Blockchain and Cryptocurrency in Fintech

Blockchain technology and cryptocurrencies have emerged as pivotal components of the fintech landscape. Blockchain offers a decentralized, secure ledger system that enhances transparency and reduces fraud. Cryptocurrencies, on the other hand, offer an alternative to traditional currencies, with potential benefits like lower transaction fees and faster cross-border transfers.

- Security and Transparency:

- Blockchain’s decentralized nature makes it highly secure and less susceptible to hacking.

- Each transaction is recorded on a public ledger, promoting transparency.

- Smart Contracts:

- Smart contracts are self-executing contracts with the terms of the agreement directly written into code.

- They automatically execute transactions when predefined conditions are met, reducing the need for intermediaries.

- Tokenization:

- Tokenization involves converting physical or digital assets into blockchain tokens.

- This process can democratize investment, allowing fractional ownership of assets like real estate and art.

The Rise Of Fintech

The Rise Of Fintech

Regulatory Challenges and Opportunities

The rapid growth of fintech has outpaced the development of regulatory frameworks, posing challenges and opportunities for regulators and industry players alike. Balancing innovation with consumer protection is crucial for sustainable fintech growth.

- Regulatory Uncertainty:

- Different countries have varied approaches to fintech regulation, leading to a fragmented global landscape.

- Clear and consistent regulations are needed to foster innovation while ensuring consumer protection.

- Sandbox Environments:

- Regulatory sandboxes allow fintech companies to test innovative products in a controlled environment under the supervision of regulators.

- This approach encourages innovation while managing risks.

- Data Privacy and Security:

- With the increasing reliance on digital solutions, data privacy and cybersecurity have become paramount.

- Regulations like the GDPR in Europe set standards for data protection that fintech companies must adhere to.

The Rise Of Fintech

The Rise Of Fintech

The Future of Fintech

The future of fintech looks promising, with continued advancements in technology and growing consumer acceptance. Key trends shaping the future include:

- Artificial Intelligence and Machine Learning:

- AI will play a crucial role in personalizing financial services, improving fraud detection, and optimizing investment strategies.

- Machine learning algorithms can analyze vast amounts of data to identify patterns and make more accurate predictions.

- Open Banking:

- Open banking initiatives encourage banks to share customer data with third-party providers (with consent), fostering innovation.

- This can lead to more personalized financial products and services.

- Sustainable Finance:

- Fintech can promote sustainability by enabling green finance initiatives and offering tools for sustainable investing.

- Blockchain can be used to track and verify environmental impact, ensuring transparency in sustainable finance.

- Financial Inclusion:

- Fintech has the potential to bring financial services to underserved populations, promoting financial inclusion.

- Mobile banking and digital wallets can reach remote areas where traditional banking infrastructure is lacking.

- Quantum Computing:

- Though still in its infancy, quantum computing could revolutionize fintech by solving complex problems much faster than classical computers.

- This could lead to breakthroughs in cryptography, risk management, and financial modeling.

The Rise Of Fintech

Conclusion

Fintech is undoubtedly revolutionizing the financial landscape, offering innovative solutions that enhance efficiency, security, and user experience. While it presents significant opportunities, it also poses challenges that require careful navigation. The collaboration between fintech companies, traditional financial institutions, and regulators will be crucial in shaping a sustainable and inclusive financial future.

As we move forward, embracing technological advancements while prioritizing consumer protection and regulatory compliance will be key. The fintech revolution is not just a passing trend but a fundamental shift in how we perceive and interact with financial services. Its impact will continue to resonate, driving the evolution of the financial sector for years to come.

References

- Arner, D. W., Barberis, J. N., & Buckley, R. P. (2015). The Evolution of Fintech: A New Post-Crisis Paradigm? Georgetown Journal of International Law, 47(4), 1271-1319.

- Gai, K., Qiu, M., & Sun, X. (2018). A Survey on FinTech. Journal of Network and Computer Applications, 103, 262-273.

- Schueffel, P. (2016). Taming the Beast: A Scientific Definition of Fintech. Journal of Innovation Management, 4(4), 32-54.

- Zalan, T., & Toufaily, E. (2017). The Promise of Fintech in Emerging Markets: Not as Disruptive. Contemporary Economics, 11(4), 415-430.

- Puschmann, T. (2017). Fintech. Business & Information Systems Engineering, 59, 69-76.

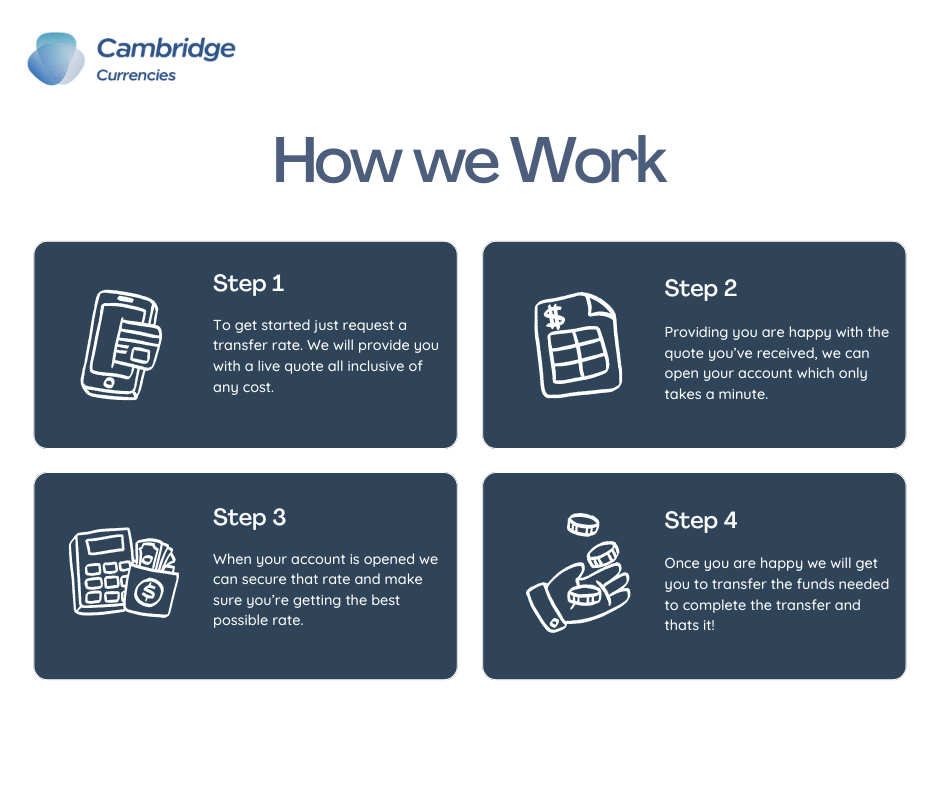

Need Help?

Request for one of our trusted brokers to give you a call back.

+44 (0) 1223 608-232