MT202 vs MT202 COV: What’s the Difference?

When people search for “MT202,” they’re often referring to the MT202 COV — a specific type of SWIFT message used in international bank transfers. Understanding the distinction matters:

| Message Type | Purpose | Contains Customer Info? | Commonly Paired With |

|---|---|---|---|

| MT202 | Bank-to-bank payments | No | Standalone for simple transfers |

| MT202 COV | Cover message for MT103 | No | Used with MT103 for customer transfers |

| MT103 | Customer payment instructions | Yes | Paired with MT202 COV |

This guide focuses on the MT202 COV, often referred to as the MT202 cover message.

What Is the MT202 Cover Message?

The MT202 COV is a SWIFT message used by banks to move funds between financial institutions while keeping customer-specific information hidden from intermediary banks. It acts as a “cover” for the MT103 message, which carries full customer transaction details.

Why it matters:

- Separates sensitive customer data from intermediary banks

- Meets regulatory standards (AML, KYC)

- Speeds up and secures cross-border payments

Key Roles of the MT202 COV Message

The MT202 COV plays several important roles in global finance:

- Acts as a communication tool between banks

- Separates payment details for privacy

- Supports correspondent banking relationships

- Facilitates smooth, timely cross-border fund transfers

- Ensures regulatory compliance (AML/CFT/KYC)

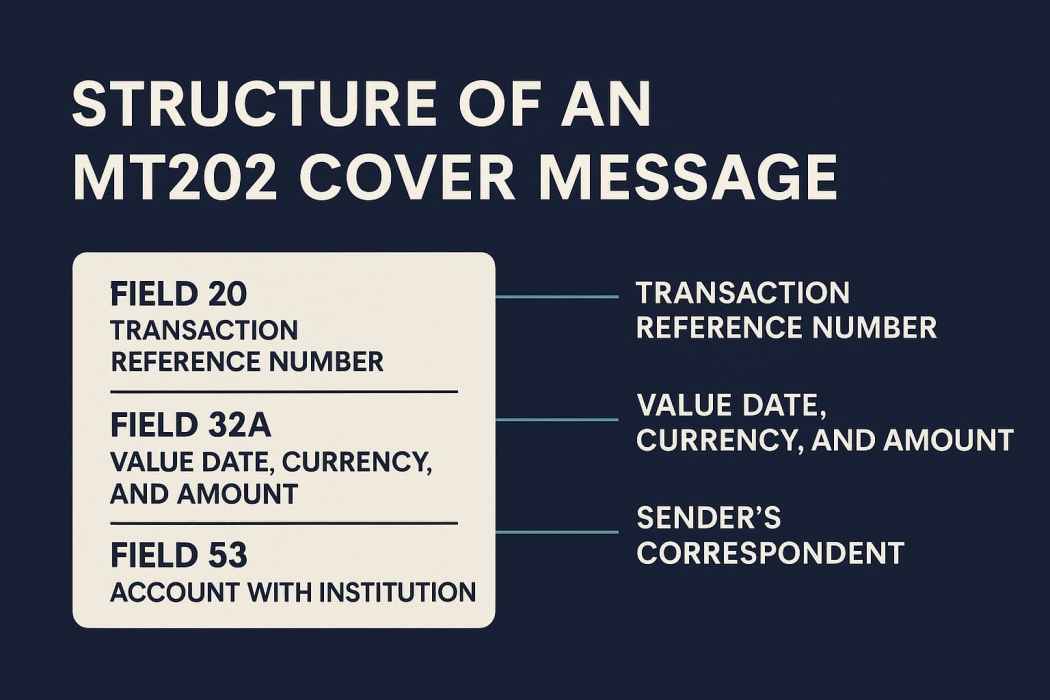

Structure of an MT202 COV Message

Each MT202 COV message follows a standardized field structure to ensure clarity and accuracy.

Essential fields include:

- Field 20: Transaction Reference Number

- Field 21: Related Reference

- Field 32A: Value Date, Currency, and Amount

- Field 52: Ordering Institution

- Field 53: Sender’s Correspondent

- Field 56: Intermediary

- Field 57: Account with Institution

- Field 58: Beneficiary Institution

Each field must be accurate to avoid delays, rejections, or regulatory issues.

MT202 Cover vs MT103

These two messages work together:

- MT103 includes customer information and payment instructions.

- MT202 COV transfers the funds without exposing sensitive data to intermediary banks.

This dual-message setup boosts privacy and efficiency in international payments.

Why MT202 COV Matters in Correspondent Banking

In cross-border payments, correspondent banks act as middlemen when direct bank-to-bank relationships don’t exist. The MT202 COV:

- Routes funds without exposing customer details

- Reduces compliance risks

- Helps banks manage privacy and speed

This message ensures transactions flow smoothly across currencies, countries, and compliance environments.

Compliance and Regulation

The MT202 COV is built to support global regulatory standards:

- AML (Anti-Money Laundering): Helps shield data and track funds

- KYC (Know Your Customer): Supports risk profiling and transaction monitoring

- CFT (Countering the Financing of Terrorism): Ensures information is properly segmented

Its structure helps institutions meet compliance obligations without compromising customer privacy.

Treasury Operations & Risk Management

- Reduces errors in high-value transfers

- Enables traceability for audits

- Supports liquidity management

For treasury teams, MT202 COV messages ensure fund flows are timely, traceable, and reliable.

Case Studies: MT202 COV in Action

- A global bank used MT202 COV to streamline treasury operations across 12 countries.

- A mid-sized Asian bank reduced settlement risk by using MT202 COV to tighten correspondent controls.

- A European corporate used MT202 COV to optimize multi-currency flows and minimize exposure.

The Future of MT202 Cover Messages

As payment systems evolve and real-time processing expands, the MT202 COV remains essential for:

- Connecting traditional finance with new digital rails

- Meeting rising compliance demands

- Supporting faster, smarter global payments

Emerging tech like blockchain may integrate with SWIFT messaging, but MT202 COV will likely remain a key bridge between legacy and modern systems.

Frequently Asked Questions

What’s the difference between MT202 and MT202 COV?

MT202 is for simple bank-to-bank transfers without customer data. MT202 COV is used with MT103 to transfer funds while hiding customer details from intermediary banks.

Is MT202 COV mandatory with MT103?

Yes. If MT103 is used as a cover payment, MT202 COV is required to route the funds securely.

Which SWIFT fields are in an MT202 cover message?

Field 20, Field 21, Field 32A, Field 52, Field 53, Field 56, Field 57, and Field 58

Conclusion

The MT202 COV is more than a message — it’s a critical part of global banking infrastructure. It ensures security, speed, and compliance in international transactions.

Whether you’re a finance professional or just curious about how global money moves, understanding the MT202 COV gives you valuable insight into how modern banking works.

Need help with SWIFT message formats or compliance?

Contact Cambridge Currencies for expert guidance on international payments.