Understanding SWIFT Message MT103: Everything You Need to Know

When it comes to international money transfers, the SWIFT system plays a critical role. If you’ve ever sent or received money across borders, you may have heard terms like SWIFT message and MT103. But what do they actually mean?

In this blog, we’ll explain how the SWIFT system works. We’ll also discuss SWIFT codes and MT103 messages. These are important for smooth international payments.

What is the SWIFT System?

The SWIFT system (Society for Worldwide Interbank Financial Telecommunication) is a network that banks and financial institutions use worldwide. It securely sends and receives information about money transfers. Established in 1973, SWIFT connects over 11,000 institutions in more than 200 countries, making it the backbone of global banking.

Although SWIFT doesn’t move money directly, it helps banks send payment instructions safely. This includes important details like the SWIFT code and bank code, ensuring the money reaches the right place.

What is a SWIFT Code?

A SWIFT code is a unique identifier that helps identify banks during international transfers. Also known as a BIC(Bank Identifier Code), the SWIFT code works like a postal address for banks. You’ll need this code whenever you send money internationally to make sure the funds go to the correct bank.

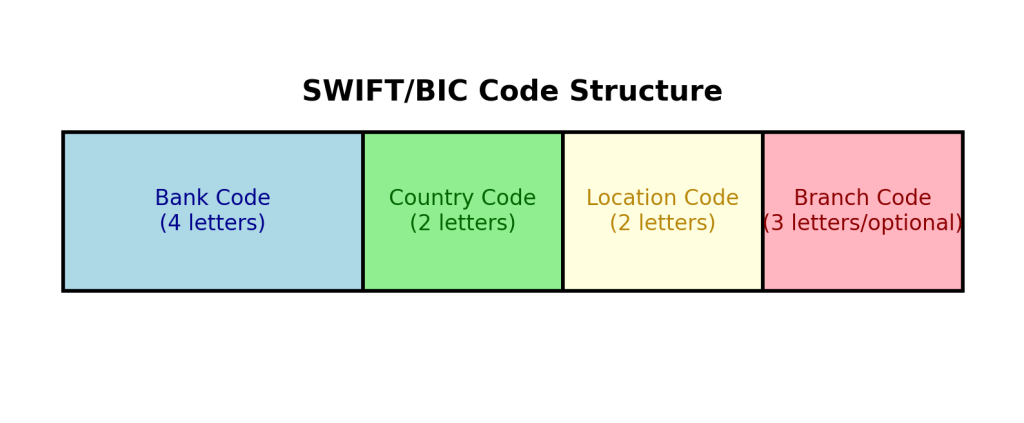

Here’s how a typical SWIFT code is structured:

- The first 4 characters: Identify the bank.

- The next 2 characters: Indicate the country.

- The following 2 characters: Specify the bank’s location.

- The last 3 characters (optional): Point to a specific branch.

For example, HSBC Bank in the UK uses the SWIFT code MIDLGB22.

What is a SWIFT Message MT103?

A SWIFT message MT103 is a standardized message used for international wire transfers, especially for customer payments. It provides detailed information about the transaction, including:

- Amount and currency

- Sender and receiver details

- SWIFT and bank codes

- Reference numbers

An MT103 is like an official receipt for international transfers. It is useful for tracking payments. It also confirms proof of payment.

How Does SWIFT Message MT103 Work?

Here’s a simple breakdown of how an MT103 message works:

- Initiation: The sender’s bank creates an MT103 message. This message contains all the needed information, like the SWIFT code, payment amount, currency, and the recipient’s details.

- Transmission: The SWIFT system securely sends the message to the recipient’s bank.

- Processing: The receiving bank checks the details and credits the recipient’s account. The MT103 provides a record of the transaction and can be used to solve any issues.

Why is the SWIFT Message MT103 Important?

The MT103 is helpful for several reasons:

- Proof of Payment: It acts as formal proof that funds have been transferred.

- Transparency: It includes all necessary information, making it easier to track and fix any issues.

- Accuracy: The standardized format ensures that both banks and customers have a clear record of the transaction.

How Long Does an MT103 Transfer Take?

An MT103 transfer usually takes 1-3 business days. The duration depends on the banks involved. It also varies with the countries sending and receiving the money.

Common FAQs About SWIFT Message MT103

1. What is an MT103?

An MT103 is a standard message in the SWIFT system used to record and track international money transfers.

2. Can I track an international payment using MT103?

Yes, you can. The MT103 includes a unique reference number that lets banks trace the transaction and track its progress.

3. Is an MT103 proof of payment?

Yes, the MT103 acts as an official record of the transaction. It is often used as proof that the money has been sent.

4. How do I get a copy of an MT103?

You can ask your bank for a copy of the MT103. Request it if you need proof of payment. You can also request it to track a delayed transaction.

5. Can an MT103 be reversed?

Once an MT103 has been processed, reversing the transaction can be difficult. You would need to talk to your bank, and the outcome would depend on the recipient bank’s policies.

6. What’s the difference between MT103 and MT202?

While an MT103 is used for customer payments, an MT202 is used for bank-to-bank transfers. They serve different purposes within the SWIFT network.

7. What does an MT103 message include?

An MT103 message includes the payment amount, sender and recipient details, SWIFT code, bank codes, and reference numbers.

8. How do I avoid errors when sending an MT103?

Double-check all details before sending the SWIFT message, like the correct SWIFT code, account numbers, and payment amounts. It’s always a good idea to check with your bank if you’re unsure.

9. Why is the SWIFT system important for international transfers?

The SWIFT system allows banks worldwide to communicate securely. It ensures that money transfers across borders happen smoothly and efficiently.

10. What happens if there is a delay with my MT103 payment?

If there’s a delay, you can use the MT103‘s reference number to trace the payment. You can work with both banks to solve any issues.

Avoiding Common Mistakes When Using SWIFT Codes

To make sure your international payment goes smoothly, always:

- Double-check the recipient’s SWIFT code and bank details.

- Confirm the correct currency and amount.

- Contact your bank to review the transaction if you are unsure about any details.