How Cambridge Currencies Works: A Complete Guide

In today’s global economy, managing foreign exchange transactions efficiently is more important than ever. If you’re a business owner, you deal with international suppliers. You need a reliable and cost-effective solution for your foreign currency needs. An individual making personal overseas transfers also needs this. Cambridge Currencies is a trusted platform. It simplifies the process of exchanging currencies. The service is transparent, efficient, and user-friendly for businesses and individuals alike.

This blog will explain how Cambridge Currencies works. It covers the benefits it offers. It also discusses the steps involved in using the platform for your foreign exchange transactions.

Common Areas We Will Address

- Introduction to Cambridge Currencies

- Key Benefits of Using Cambridge Currencies

- How to Get Started with Cambridge Currencies

- Understanding the Exchange Process

- Services Offered by Cambridge Currencies

- How Cambridge Currencies Helps Businesses

- Safety and Compliance: Is Cambridge Currencies Secure?

- Frequently Asked Questions

1. Introduction to Cambridge Currencies

Cambridge Currencies is a leading foreign exchange platform. It specializes in helping businesses and individuals with international payments. It also handles currency transfers. Cambridge Currencies offers competitive rates and low fees. It also has a strong focus on customer satisfaction. The service is designed to make international money transfers smooth and easy.

Cambridge Currencies was founded by experts in the foreign exchange industry. Clients trust the company due to its transparency and efficiency in transactions. The platform allows users to exchange currencies for various purposes. They can pay international suppliers, transfer money to overseas accounts, or invest abroad.

2. Key Benefits of Using Cambridge Currencies

There are many reasons why clients choose Cambridge Currencies over traditional banks and other foreign exchange platforms. Here are some of the key benefits:

- Competitive Exchange Rates: Cambridge Currencies offers some of the best rates in the market. Clients save money on every transaction compared to using traditional banks.

- Low Fees: Unlike many other currency exchange platforms, Cambridge Currencies has minimal fees. This makes it an affordable solution for individuals and businesses.

- Personalized Support: Cambridge Currencies provides dedicated account managers. They assist clients with their foreign exchange needs. The managers offer tailored advice and support.

- Fast and Efficient Transfers: The platform processes transactions quickly. This ensures that your money reaches its destination on time, whether it’s a business payment or a personal transfer.

- Hedging Options: For businesses, Cambridge Currencies offers FX hedging strategies to manage risk and protect against currency volatility.

3. How to Get Started with Cambridge Currencies

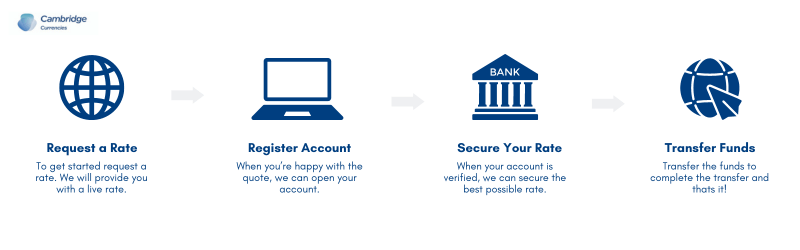

Getting started with Cambridge Currencies is simple. Whether you’re a business looking for large international transfers or an individual making a one-time payment, the process is straightforward. Here’s how it works:

Step 1: Create an Account

Sign up for a Cambridge Currencies account by visiting the website. The process involves filling out a simple form with your personal or business details. For businesses, you may need to provide additional documentation for verification.

Step 2: Verify Your Identity

Once your account is created, you will need to complete the verification process by providing the necessary identification documents. This step ensures that all transactions are secure and compliant with regulations.

Step 3: Choose Your Currency and Amount

Your account verification is necessary. Once completed, you can log in to the platform. After logging in, select the currency you wish to buy or sell. Simply input the amount you want to exchange, and you’ll receive a real-time quote based on the current exchange rate.

Step 4: Confirm the Transaction

Review the exchange rate and the fees (if any), then confirm your transaction. Cambridge Currencies will handle the rest, ensuring that your funds are converted and transferred securely and quickly.

4. Understanding the Exchange Process

The exchange process with Cambridge Currencies is fast and efficient. Here’s a breakdown of how it works:

- Real-Time Rates: The platform provides real-time exchange rates, allowing you to lock in the best possible rate for your transaction.

- Fund Transfer: After confirming your exchange, Cambridge Currencies will deduct the necessary funds from your account. They will then convert them to your desired currency.

- Delivery: Once the funds are converted, they are transferred directly to the recipient’s account. Alternatively, they are sent to you for further use. This process is completed quickly, typically within 1-2 business days, depending on the destination country.

5. Services Offered by Cambridge Currencies

Cambridge Currencies offers a variety of services to cater to different types of clients. Here’s a look at some of the services available:

1. International Payments

Cambridge Currencies simplifies payments. It is easy to pay international suppliers. You can also send money to family members abroad. They handle payments in multiple currencies across the globe.

2. Spot Transfers

Spot transfers allow you to make immediate currency exchanges at the current market rate. This service is perfect for individuals or businesses that need to make quick transfers.

3. FX Hedging for Businesses

For businesses dealing with foreign currencies regularly, FX hedging strategies help protect against the risk of currency fluctuations. This service is particularly useful for companies that want to lock in favorable exchange rates for future transactions.

4. Multi-Currency Accounts

Cambridge Currencies also offers multi-currency accounts, allowing you to hold and manage different currencies in one place. This service is ideal for businesses with international operations or individuals with foreign investments.

6. How Cambridge Currencies Helps Businesses

Cambridge Currencies is a valuable tool for businesses that deal with international suppliers or clients. Here’s how the platform helps businesses:

- Cost Savings: By offering competitive rates and low fees, businesses can save on every transaction, improving their bottom line.

- Risk Management: Cambridge Currencies provides businesses with FX hedging solutions to manage currency risk and protect against exchange rate fluctuations.

- Dedicated Account Managers: Each business client is assigned an account manager. This manager can offer personalized support and advice. They help businesses navigate complex foreign exchange transactions.

- Faster Payments: The platform processes payments quickly, ensuring that businesses can pay suppliers or receive payments from clients without delays.

7. Safety and Compliance: Is Cambridge Currencies Secure?

Security is a top priority at Cambridge Currencies. The platform complies with all international regulations and employs advanced encryption technology to protect your personal and financial information.

- Regulated by Financial Authorities: Cambridge Currencies is fully regulated and adheres to strict compliance standards set by financial authorities.

- AML and KYC Compliance: The platform follows Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. This ensures that all transactions are legitimate. It also ensures they are secure.

- Secure Transactions: Every transaction is encrypted using the latest technology, ensuring that your money and personal information are safe.

8. Frequently Asked Questions

How long does a currency transfer take with Cambridge Currencies?

Most transfers are completed within 1-2 business days, depending on the destination country and the currency being exchanged.

What fees does Cambridge Currencies charge?

Cambridge Currencies charges low fees compared to traditional banks. The exact fee depends on the type of transaction and the currency being exchanged.

Can I use Cambridge Currencies as an individual?

Yes, Cambridge Currencies is available for both individuals and businesses. Whether you’re sending money for personal or business reasons, the platform can cater to your needs.

Is Cambridge Currencies safe to use?

Yes, Cambridge Currencies is fully regulated. It complies with all necessary financial and security standards to ensure safe and secure transactions.

How do I get started with Cambridge Currencies?

To get started, visit the Cambridge Currencies website, create an account, and complete the verification process. Once your account is set up, you can begin exchanging currencies.

Cambridge Currencies simplifies the process of exchanging money internationally, providing competitive rates, personalized support, and fast, secure transfers. Whether you’re a business seeking to manage international payments, or an individual who needs to transfer money abroad, Cambridge Currencies can assist you. With its comprehensive services and commitment to customer satisfaction, it’s the ideal platform for all your foreign exchange needs.

If you’re ready to start saving on your foreign currency exchanges, sign up today and experience the convenience and efficiency of Cambridge Currencies.