How to Find Your NatWest IBAN Number (And What You’ll Need It For)

Need your NatWest IBAN to send or receive money internationally? This quick guide explains how to find your IBAN, what it looks like, and how to use it securely.

What Is a NatWest IBAN Number?

Your IBAN (International Bank Account Number) is what makes international payments possible. It ensures your money reaches the correct bank and account—no matter where it’s coming from or going.

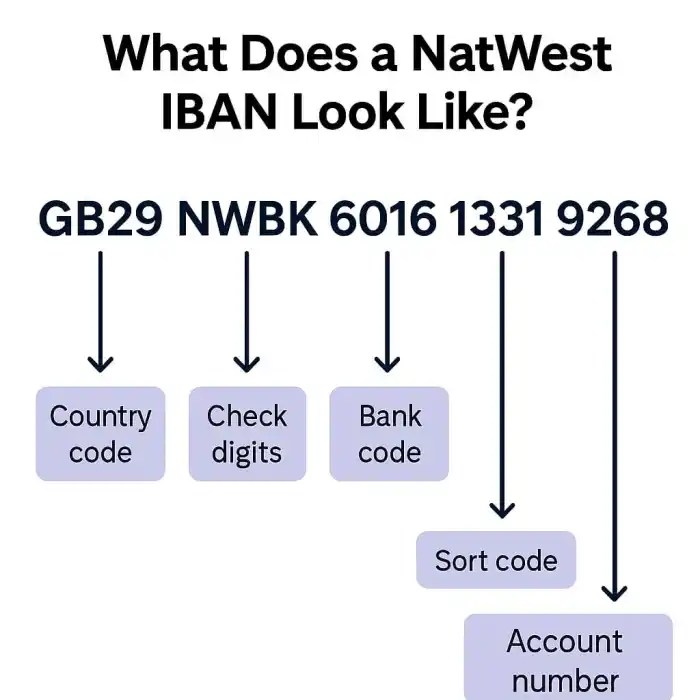

Think of it like a banking passport. It includes:

- The country code (GB for the UK)

- A check number (2 digits to verify accuracy)

- A bank code (NWBK for NatWest)

- Your sort code and account number

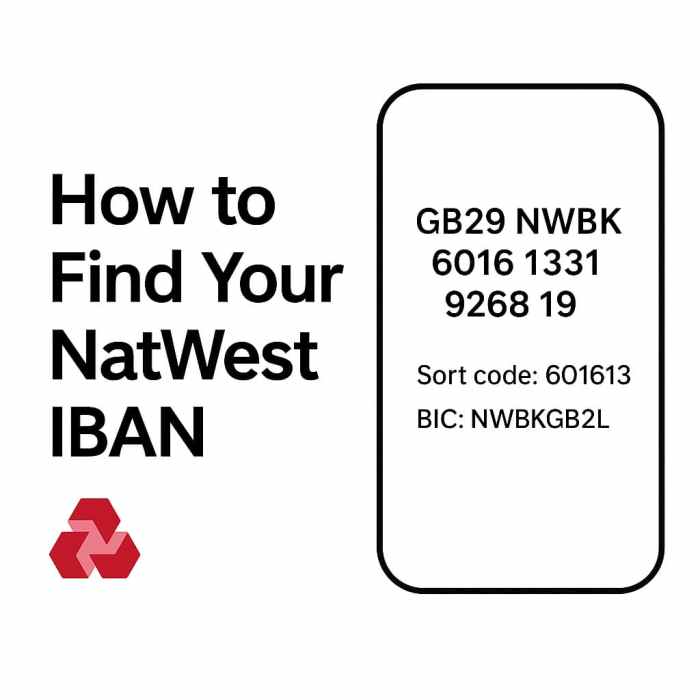

Example NatWest IBAN format: GB29 NWBK 6016 1331 9268 19

How to Find Your NatWest IBAN

Finding your IBAN is quick and easy—especially if you use the NatWest app.

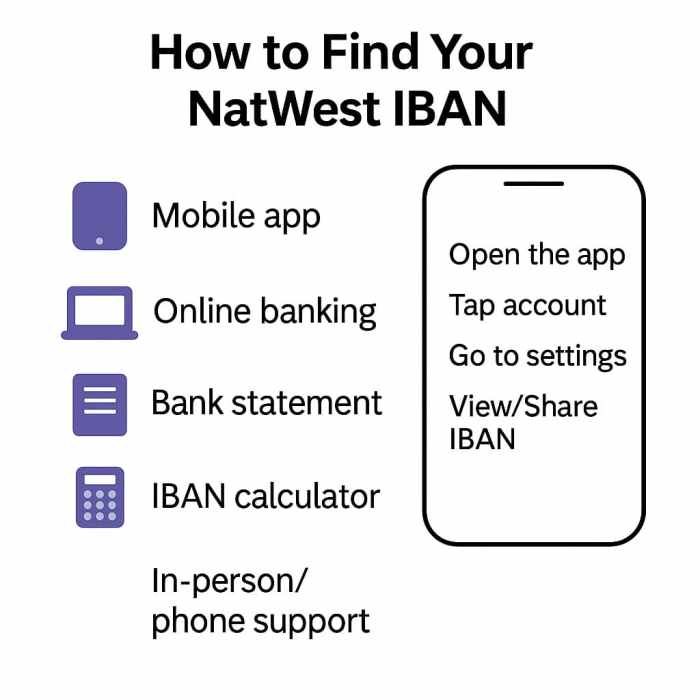

On the NatWest Mobile App:

- Open the app and log in – Download the NatWest app here

- Tap the account you want the IBAN for

- Go to ‘Account Settings’ or ‘View/Share Account Details’

- Your IBAN and SWIFT/BIC will be displayed

You can copy or share this directly from the app via email or messaging apps.

Need to verify your NatWest IBAN?

Use Cambridge Currencies Free IBAN Validator to check if your IBAN is correct before making a transfer.

Other Ways to Find It:

- Online Banking: Log in at natwest.com, select your account, and view details

- Bank Statement: The IBAN is printed near the top

- Branch or Phone: Visit or call customer service

- IBAN Calculator: Use our free IBAN tool to check your NatWest IBAN instantly using your sort code and account number.

Pro Tip: Screenshot or save your IBAN—you may need to verify it when sending money.

Why You Need an IBAN

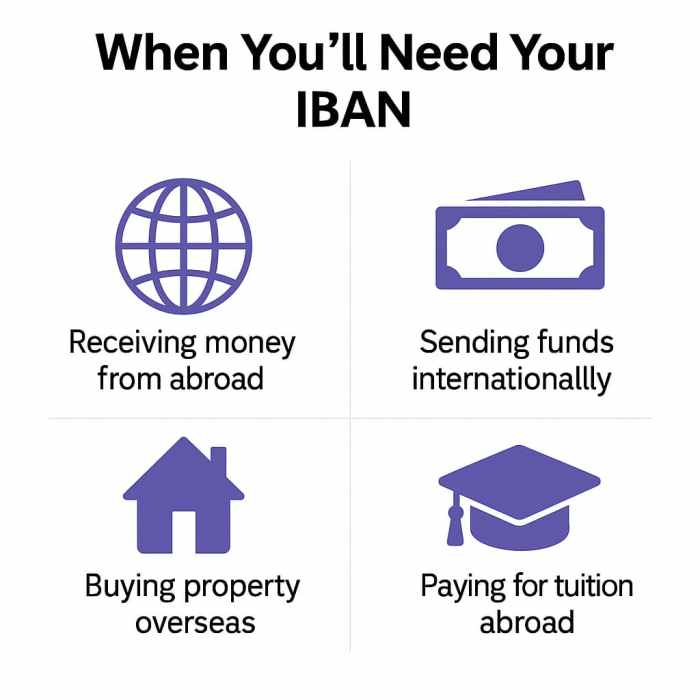

You’ll need your NatWest IBAN when:

- Receiving money from abroad (e.g. salary, rent, payments)

- Sending money to other countries

- Setting up international direct debits or standing orders

- Paying for overseas services, tuition, or property

Without it, your transaction may be delayed, rejected, or even lost.

How the NatWest IBAN Is Structured

Let’s break down this sample IBAN: GB29 NWBK 6016 1331 9268 19

| Component | Meaning |

|---|---|

| GB | Country code (United Kingdom) |

| 29 | Check digits |

| NWBK | Bank identifier (NatWest) |

| 601613 | Sort code |

| 31926819 | Account number |

Fees and Charges to Know About

International payments often come with:

- Transfer fees (check NatWest and the sender’s bank)

- Exchange rate margins (can vary)

- Incoming fees (some banks charge to receive international funds)

Make sure you understand the total cost before sending or receiving money.

Security Measures by NatWest

NatWest protects your IBAN and payments with:

- Two-factor authentication

- Data encryption

- Fraud detection tools

Always double-check account details before sending. If something looks off, contact NatWest before proceeding.

Quick Tips for Using Your IBAN

- Double-check the IBAN before sending or receiving funds

- Use NatWest’s app or calculator for accuracy

- Be clear on fees and timelines

- Save or share your IBAN securely—not over public Wi-Fi or shared devices

Common IBAN Questions

Is my IBAN the same as my account number?

No. Your IBAN contains your account number, plus extra info (country code, bank code, etc.).

Can I generate my IBAN online?

Yes. Use NatWest’s IBAN calculator with your sort code and account number.

What’s the NatWest SWIFT code?

It’s NWBKGB2L – this works alongside your IBAN for global payments.

Final Thoughts

Your NatWest IBAN isn’t something you’ll need every day—but when it comes to international payments, it’s essential. With the right tools and a quick double-check, you can send and receive money from anywhere with confidence.