Can you pay euros from Germany to a uk bank account?

Navigating the world of currency exchange can be a daunting task. Especially when you’re dealing with transactions between different countries, like paying euros from Germany into a UK bank account.

Understanding the process and its implications is crucial. It can impact your business operations, profitability, and even your studies if you’re an economics student.

This article aims to shed light on this complex topic. We’ll delve into the factors affecting currency exchange rates, the mechanics of international payments, and practical advice for managing currency risk.

Whether you’re an international business owner or an economics student, this comprehensive guide is designed to help you. It will provide you with the knowledge you need to make informed decisions about your international transactions or studies.

So, can you pay euros from Germany into a UK bank account? Let’s find out.

Stay with us as we explore this topic in depth, providing you with valuable insights and practical tips along the way.

Understanding Currency Exchange Rates and Their Impact on Your Business

Currency exchange rates are pivotal in shaping international financial transactions. They determine how much one currency is worth in terms of another. This can fluctuate based on a range of factors, causing the financial landscape to shift.

For businesses engaged in international trade, these fluctuations can impact costs and profits. If the euro strengthens against the pound, your euro receipts can yield more in pounds, boosting revenue. Conversely, a weaker euro means receiving less for the same amount.

Several factors influence currency values, making them volatile. This includes interest rates, inflation, political stability, and economic growth data. Each can sway investor confidence and thus affect exchange rates.

Understanding these dynamics is key for businesses to plan and budget effectively. It helps in managing costs and predicting future exchange scenarios. With knowledge of currency trends, you can also better time transactions for favorable rates.

Consider the following to grasp exchange rate impacts:

- Interest Rates: Higher rates can attract foreign investment, boosting currency value.

- Inflation: Lower inflation can strengthen currency by maintaining purchasing power.

- Political Stability: Stability can enhance investor confidence, supporting currency strength.

- Economic Performance: Positive data (e.g., employment, GDP) can increase currency demand.

- Market Speculation: Traders’ sentiments influence short-term currency movements.

By keeping these factors in mind, businesses can devise strategies to mitigate risks associated with currency fluctuations.

The Process of Transferring Euros to a UK Bank Account

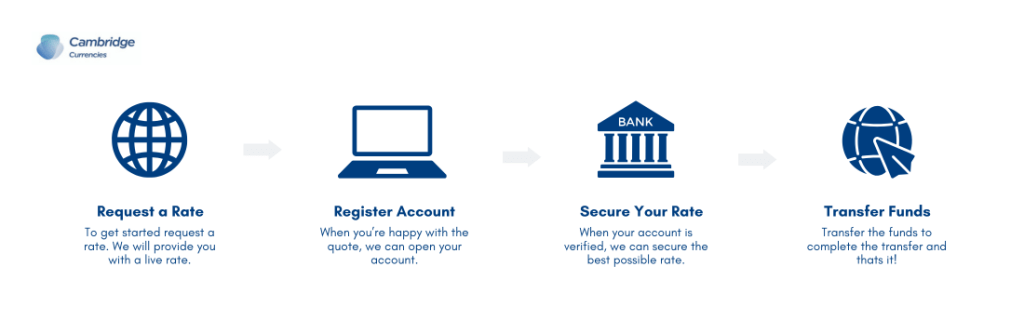

Transferring euros to a UK bank account involves several steps that ensure a smooth and secure transaction. Understanding this process can help you avoid common pitfalls and unexpected costs.

Firstly, ensure your UK bank account can receive foreign currencies like euros. Some banks automatically convert foreign currencies into pounds upon receipt. Contacting your bank for clarity can prevent misunderstanding.

Once confirmed, initiate the transfer through your bank or an international payment provider. Each option comes with its fees, processing times, and exchange rates. Comparing these can be beneficial.

Consider the exchange rate at the time of the transaction. Rates fluctuate, impacting the final amount deposited. Timing can play a significant role in maximizing returns.

Finally, after confirming the transfer, monitor the transaction process. This ensures funds are credited correctly and any discrepancies are addressed promptly.

Can I Pay Euros into My Bank Account Directly?

Some UK bank accounts allow direct deposits in euros. These accounts can either hold euros or convert them to pounds immediately. This depends on the type of account and bank policies.

It is crucial to verify with your bank if it supports direct euro deposits without conversion. This clarity helps you manage your funds effectively.

Banks that support direct deposits of euros may offer multi-currency accounts, which can be advantageous for businesses dealing with frequent international transactions.

Methods of Transferring Euros to a UK Bank Account

Several methods are available for transferring euros to a UK bank account. Each method has its unique benefits and drawbacks, which should be considered carefully.

One common method is through traditional bank transfers. These are secure but can include higher fees and slower processing times.

Alternatively, online platforms provide quicker, often cheaper services. These platforms usually offer competitive exchange rates.

Another option is using a currency broker. These brokers can offer personalized service and better rates, especially for larger sums.

When choosing a transfer method, consider the following:

- Cost: Evaluate fees and potential hidden charges.

- Speed: Consider how quickly the funds need to arrive.

- Exchange Rates: Assess the offered rates and their competitiveness.

- Convenience: Think about ease of use and access to support.

By analyzing these factors, you can select the best method for transferring euros efficiently and cost-effectively.

Factors Influencing the Euro to Pound Exchange Rate

The euro to pound exchange rate is a dynamic metric affected by numerous global factors. Understanding these influences can help mitigate risks in international transactions.

Market sentiment plays a crucial role in determining exchange rates. Investors’ perceptions about the European and UK economies can cause rate fluctuations.

The following elements often impact the EUR/GBP exchange rate:

- Interest rates: Different rates can attract investors, affecting currency demand.

- Trade balances: Surpluses or deficits can influence currency strength.

- Inflation rates: Higher inflation usually weakens a currency’s value.

- Economic data: GDP, employment, and consumer spending reports sway investor confidence.

- Political stability: A secure political climate strengthens currency trust.

It’s essential for business owners and students to monitor these factors. Noticing trends allows for more strategic financial decisions. Furthermore, engaging with financial advisers or economists can offer insights into interpreting complex data trends.

The Role of Central Banks and Monetary Policy

Central banks significantly impact currency values through their monetary policies. Decisions on interest rates and money supply are pivotal.

For instance, if the European Central Bank raises interest rates, the euro might strengthen as investors seek higher returns. Similarly, the Bank of England’s policy decisions affect the pound’s value.

Thus, understanding central bank actions provides crucial insights into currency movements and prepares businesses and students for potential economic shifts.

Economic Indicators and Their Effects

Economic indicators are powerful tools for predicting currency movements. GDP growth, inflation, and employment rates are closely watched.

Rising GDP indicates a healthy economy, often leading to a stronger currency. Conversely, high inflation might weaken a currency as it reduces purchasing power.

Monitoring these indicators helps businesses plan their financial strategies. Students studying these trends can gain valuable insights into economic dynamics.

Political Events and Their Impact on Currency Values

Political events can have immediate and profound effects on exchange rates. Stability enhances trust, while uncertainty can lead to volatility.

Events such as Brexit had significant impacts on the euro and pound relationship. Sudden shifts in political climate can alter exchange rates swiftly.

Being aware of political changes worldwide helps in anticipating and mitigating risks. Both business owners and students benefit from understanding the link between politics and currency stability.

Fees and Charges: What to Expect When Converting Euros to Pounds

Transferring euros to a UK bank account involves understanding associated fees and charges. Ignorance of these costs can lead to unexpected expenses.

It’s essential to recognize that exchange rates offered by banks often come with hidden margins. Hence, knowing the mid-market rate is crucial.

When converting euros to pounds, expect the following potential fees:

- Exchange rate margin: The difference between market and offered rates.

- Transfer fees: Flat fees per transaction, varying by bank.

- Recipient fees: Charged by the receiving bank for processing.

Comparing fees across providers is important for minimizing conversion costs. Online platforms or currency brokers may offer better rates than traditional banks. Additionally, inquire about any promotional offers that can reduce fees.

Understanding these charges helps in planning your financial transactions better. Recognizing the potential impact on your bottom line aids in making strategic choices. Thus, informed decisions reduce financial strain and boost operational efficiency.

Multi-Currency Accounts and Their Benefits for International Business

Multi-currency accounts offer a solution for businesses dealing with multiple currencies. These accounts help streamline international transactions. They provide flexibility, allowing you to hold, pay, and receive funds in various currencies.

The primary advantage is reducing the need to convert currencies frequently. This minimizes conversion fees and associated risks. Moreover, businesses can better manage cash flow by aligning income and expenses in the same currency.

Key benefits of multi-currency accounts include:

- Reduced currency conversion fees

- Improved cash flow management

- Simplified international transactions

- Convenience in dealing with suppliers or customers in different countries

Additionally, multi-currency accounts simplify accounting for international business operations. They facilitate clearer financial statements by minimizing foreign exchange impacts. As businesses expand globally, such accounts prove essential.

Thus, integrating multi-currency accounts into your financial strategy enhances operational efficiency. It also positions your business to better navigate the global market. As a result, you’ll gain a competitive edge in international trade.

How to Open a Multi-Currency Account

Opening a multi-currency account involves a straightforward process. Begin by researching banks and financial institutions that offer this service. Compare their fees, services, and customer reviews to make an informed decision.

Once you’ve chosen a provider, prepare the necessary documentation. Typically, you’ll need business registration details, proof of identity, and any required financial statements. These documents verify your legitimacy and financial standing.

Next, contact the selected institution to initiate the account-opening process. Many providers allow online applications, streamlining the process for convenience. Ensure you understand the terms and conditions of the account to avoid any surprises later.

After your application is approved, you’ll have access to your multi-currency account. It will then facilitate smooth and efficient international transactions, bringing tangible benefits to your global operations.

Managing Currency Risk: Tools and Strategies for Businesses

Currency risk can impact your profitability significantly. Unplanned fluctuations in exchange rates can erode margins. Managing this risk is crucial for any business operating internationally.

Employing diverse strategies can mitigate these risks effectively. One such strategy is using financial instruments like forward contracts and options. These tools lock in exchange rates, providing predictability.

Additionally, businesses can leverage technological solutions. Currency exchange platforms offer real-time monitoring and analysis tools. They help track market movements and make informed decisions.

Key strategies for managing currency risk include:

- Utilizing forward contracts and options

- Implementing robust currency monitoring systems

- Establishing a risk management framework

- Diversifying currency exposure

Staying informed about global economic events also aids in managing currency risk. By understanding macroeconomic trends, businesses can better anticipate potential impacts. Through strategic planning, businesses can safeguard their operations from currency volatility.

Hedging with Forward Contracts and Options

Forward contracts and options serve as vital tools for hedging currency risk. A forward contract allows you to agree on a fixed exchange rate for a future date. This method ensures certainty in cash flows and aids in budgeting.

Options provide more flexibility than forwards. They give the right, but not the obligation, to exchange currency at a set rate. This flexibility allows businesses to benefit from favorable rate movements.

Choosing between forwards and options depends on your risk appetite and business needs. Both tools can protect against adverse currency fluctuations. They ensure you can focus on core business activities without the distraction of currency volatility.

Monitoring Exchange Rates and Timing Your Transactions

Constantly monitoring exchange rates helps in timing transactions strategically. Market conditions can change rapidly, affecting the timing of currency exchanges. Being vigilant allows businesses to capitalize on favorable rate movements.

Utilizing technological solutions like currency exchange apps offers real-time rate updates. These tools provide insights that aid in making informed decisions. Businesses can identify optimal times to transact, maximizing financial benefits.

Successful monitoring also involves understanding market trends and geopolitical events. These factors influence rate movements and can offer additional insight. By staying proactive, businesses can make transactions at the most advantageous times, enhancing overall efficiency.

Conclusion: Making Informed Decisions for Currency Exchange

Navigating the currency exchange landscape requires diligence. International businesses must grasp the nuances of exchange rates. Such understanding aids in making informed financial decisions.

Comprehending how global events influence rates is crucial. This knowledge enables businesses to mitigate risks effectively. By adopting strategic tools, you can safeguard profitability against market volatility.

Stay proactive in monitoring the financial environment. Regular updates on economic shifts empower you to adapt swiftly. This approach ensures that your business thrives amidst currency fluctuations.

Practical Tips for International Business Owners

For business owners, successful currency exchange involves strategy and foresight. Utilizing the right techniques can reduce exchange-related risks significantly. Practical steps can make a substantial difference.

Consider these essential tips:

- Engage with a reputable currency broker for competitive rates.

- Incorporate hedging instruments to lock in favorable rates.

- Stay informed on global economic trends and forecasts.

- Adopt a multi-currency account to simplify transactions.

These strategies can streamline your financial operations and protect against unpredictable market changes.

Final Thoughts for Economics Students

Economics students must understand the intricacies of currency exchange. This knowledge is pivotal for future careers in finance or international trade. A thorough grasp aids in conceptualizing broader economic scenarios.

Currency exchange is shaped by multifaceted factors. Students should explore how political events, central banking, and market sentiment influence rates. This holistic view enhances analytical skills and market comprehension.

Continuous learning is crucial in this ever-evolving field. By engaging with real-world examples, students can bridge theory with practice. This approach prepares you for the dynamic challenges of global economics.