How to Send Money from Pakistan to the UK (2025 Guide)

Sending money from Pakistan to the UK can be quick, affordable, and hassle-free—if you choose the right method. Whether you’re helping family, paying for education, or transferring funds for business, this guide covers how to send money from Pakistan to the UK, how much you can send, and the cheapest ways to transfer without extra charges.

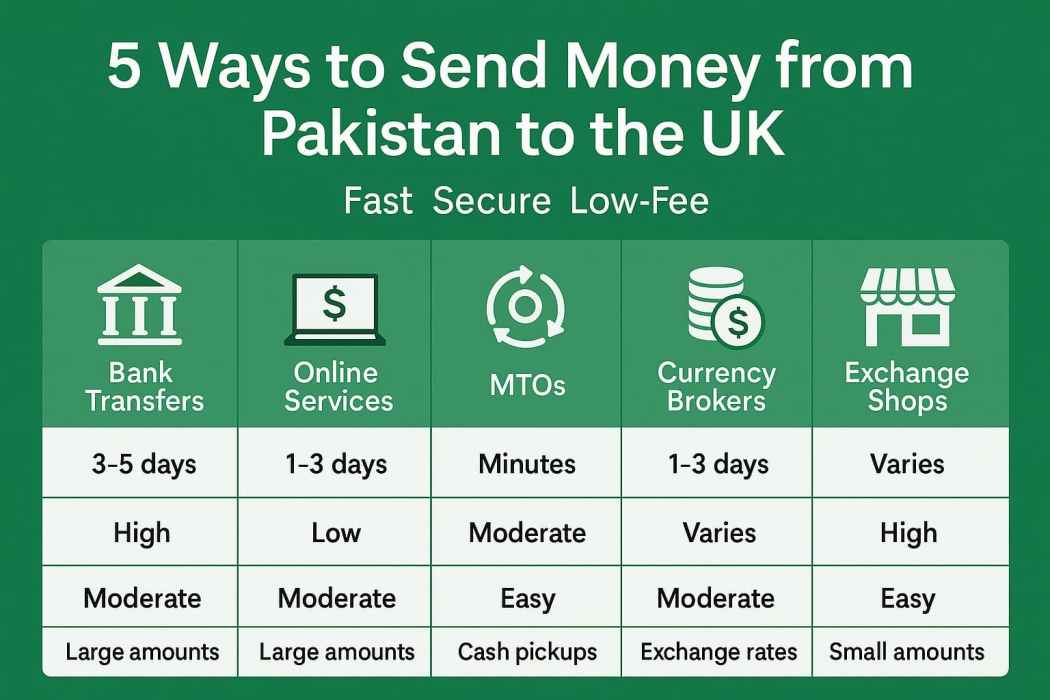

Understanding Your Options

1. Bank Transfers

Most Pakistani banks, including HBL, UBL, and MCB, offer international wire transfers to UK accounts. Secure but slower, with higher fees.

- Pros: Reliable, best for large sums.

- Cons: 3–5 business days, higher charges.

2. Online Money Transfer Services

Services like Wise, Remitly, and WorldRemit offer faster, cheaper transfers with better exchange rates.

- Pros: Fast, easy to use, low fees.

- Cons: Requires internet and registration.

3. Money Transfer Operators (MTOs)

Western Union and MoneyGram offer cash pickups or bank deposits.

- Pros: Fast, many locations.

- Cons: Fees vary, especially for cash pickups.

4. Currency Exchange Brokers

Companies like OFX, XE, and Cambridge Currencies (if abroad) offer tailored services for large transfers.

- Pros: Great rates for high-value transfers.

- Cons: More setup, not ideal for small amounts.

Best Way to Transfer Money from Pakistan to the UK

What’s the Best Way?

- Under PKR 1 million: Use Wise or Remitly for the best fees and rates.

- Over PKR 1 million: Consider currency brokers for better negotiation on rates.

- Need it fast? MTOs are quickest, but cost more.

Tip: Always compare real-time exchange rates and watch for first-time offers or fee waivers.

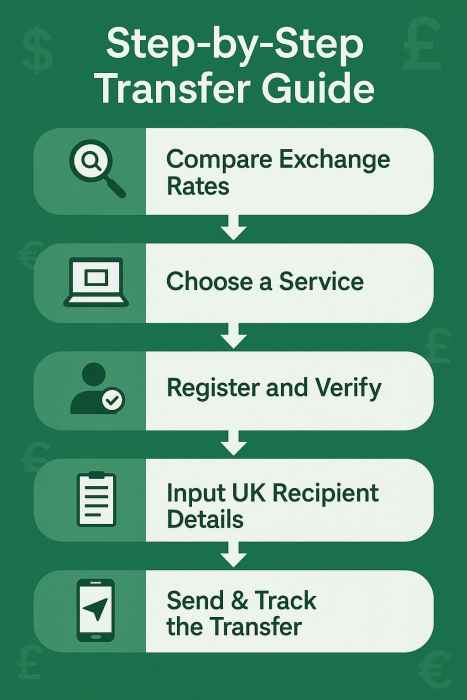

Step-by-Step: How to Send Money from Pakistan to UK

- Compare Exchange Rates – Use Wise, XE, or Google to check daily rates.

- Review Fees – Don’t get tricked by hidden costs.

- Set Up Your Account – Register with your chosen provider.

- Enter Recipient Details – Include name, account number, IBAN, and SWIFT/BIC.

- Confirm Transfer – Double-check everything.

- Notify Recipient – Let them know and share the tracking info.

Frequently Asked Questions

How much money can you transfer from Pakistan to the UK?

Daily/monthly limits vary by service. Wise allows up to PKR 5 million. Banks may allow more but require paperwork.

How to send money from Pakistan to UK bank account?

Use Wise or a bank. You’ll need the recipient’s IBAN and SWIFT/BIC code.

Can you send money from Pakistan to the UK without charges?

Some online services waive first-time fees. Always check promotions and avoid banks with bad exchange rates.

Is it legal to send money from Pakistan to the UK?

Yes, if you use approved channels. Make sure the provider complies with State Bank of Pakistan regulations.

Can I send money from Pakistan to the UK via Western Union?

Yes, Western Union offers cash pickups or deposits into UK bank accounts.

Tips for a Smooth Transfer

- Plan ahead to catch favorable exchange rates.

- Avoid last-minute transfers when rates may spike.

- Use licensed providers only.

- Double-check recipient details to prevent delays.

Final Word

Sending money from Pakistan to the UK in 2025 is easier than ever. Whether it’s a few thousand rupees or a large international payment, choose the right service, watch your fees, and make sure your transfer is safe, fast, and trackable.

Need to send money the other way—from the UK to Pakistan? Read our UK to Pakistan money transfer guide here.