Send Rand (ZAR) to Pounds (GBP): Best Methods and Tips

Sending money from South African Rand (ZAR) to British Pounds (GBP) can be challenging, especially with fluctuating exchange rates and varying transfer fees. Whether you’re supporting family, paying for services, or making business transactions, choosing the right method can save you money and time. This guide covers the best ways to send ZAR to GBP, offering live exchange rates, tips, and hassle-free transfer solutions.

Live Exchange Rate: ZAR to GBP

Stay updated with real-time exchange rates to ensure you transfer money at the most favorable time. Use our live exchange rate widget to track fluctuations and make informed decisions.

Why Exchange Rates Matter

Exchange rates determine how much GBP your recipient receives. Rates fluctuate due to economic factors like inflation, interest rates, and geopolitical stability. A small rate change can significantly impact your transfer amount, making it crucial to monitor rates before sending money.

Best Methods to Send Rand to Pounds

1. Bank Transfers

Traditional bank transfers are a secure way to send money internationally. However, they often come with higher fees and less competitive exchange rates.

Pros:

- High security

- Direct deposit to bank accounts

Cons:

- High transfer fees

- Less favorable exchange rates

- Longer processing times (2-5 business days)

2. Online Money Transfer Services

Platforms like Wise (formerly TransferWise), PayPal, and Remitly offer competitive exchange rates and lower fees compared to banks.

Pros:

- Better exchange rates

- Lower fees

- Faster transfers (same-day or 1-2 days)

Cons:

- Requires internet access

- Some services have transfer limits

3. Money Transfer Operators (MTOs)

Companies like Western Union and MoneyGram provide convenient cash pickups and bank deposits with a wide agent network.

Pros:

- Accessible worldwide

- Multiple payout options

Cons:

- Higher fees compared to online services

- Less favorable exchange rates

4. Forex Brokers

Forex brokers specialize in large transfers and often provide better rates.

Pros:

- Best rates for large amounts

- Personalized service

Cons:

- Minimum transfer amounts apply

- Requires additional setup

Tips for Sending Rand to Pounds

1. Monitor Exchange Rates

Use the live exchange rate widget to check when rates are in your favor.

2. Compare Fees

Different providers have varying fee structures. Always check the total cost, including hidden fees.

3. Choose the Right Transfer Speed

If urgent, opt for online services or MTOs instead of traditional bank transfers.

4. Look for Promotions

Some transfer services offer promotional rates for first-time users.

Frequently Asked Questions

How long does a ZAR to GBP transfer take?

- Bank transfers: 2-5 business days

- Online services: A few hours to 2 days

- MTOs: Instant to 24 hours

What’s the best way to send large amounts of Rand to Pounds?

Forex brokers and online transfer services offer the best rates and lowest fees for large transactions.

Are there hidden fees when transferring money?

Some services charge additional fees for currency conversion or processing. Always check the provider’s fee structure before transferring.

Can I send money without a bank account?

Yes, services like Western Union and MoneyGram allow cash pickups without a bank account.

What documents are required for a transfer?

You’ll typically need an ID (passport or national ID card) and recipient details. Some providers may require proof of address.

Should I transfer money during market volatility?

Exchange rates fluctuate during economic uncertainty. Avoid transferring money during high volatility for better rates.

Why Choose Cambridge Currencies?

Cambridge Currencies offers better exchange rates and lower fees compared to banks and traditional money transfer services. Here’s why:

- Lower Overheads: We pass savings to you by operating with reduced costs.

- Specialization: Focused exclusively on currency exchange for better deals.

- Direct Market Access: Access to wholesale rates without the typical bank markup.

- Transparent Fees: No hidden charges—what you see is what you pay.

Cost Comparison: Cambridge Currencies vs. Banks

| Provider | Exchange Rate | Amount Received (for £10,000) |

|---|---|---|

| Cambridge Currencies | 1.70 | £17,000 |

| Bank A | 1.63 | £16,300 |

| Bank B | 1.64 | £16,400 |

| Bank C | 1.65 | £16,500 |

Save up to £700 compared to banks!

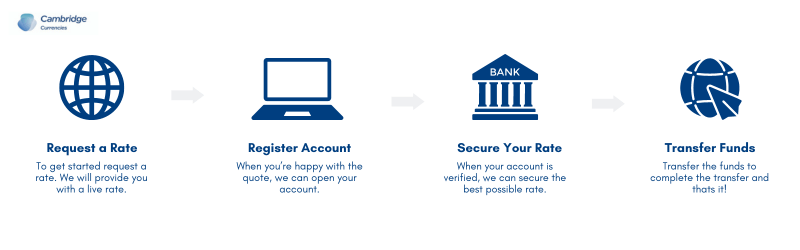

How to Send Money with Cambridge Currencies

Step 1: Request a Quote

Get a live exchange rate quote with no hidden fees.

Step 2: Register an Account

The process is simple and takes just a few minutes.

Step 3: Secure Your Rate

Lock in your quoted exchange rate to avoid market fluctuations.

Step 4: Transfer Funds

Send the amount securely with Cambridge Currencies’ expert support.

Security & User Experience

- Regulatory Compliance: Fully licensed for secure transactions.

- Data Protection: Advanced encryption ensures safety.

- User-Friendly Interface: Easy transfers via web or mobile.

- Dedicated Account Managers: Get expert guidance for large transactions.

Additional Features

- Multi-Currency Support: Handle over 40 currencies for international needs.

- 24/7 Transfers: Make transactions anytime, anywhere.

- Rate Alerts: Get notified when your desired exchange rate is available.

Final Thoughts

Sending Rand to Pounds is simple when you choose the right provider. By comparing exchange rates, fees, and transfer speeds, you can ensure a smooth and cost-effective transaction. Whether using a bank, online service, MTO, or forex broker, staying informed will help you save money.

For the best rates, low fees, and secure transactions, Cambridge Currencies is your go-to solution. Get a quote today and start saving on your currency exchange!