CHAPS Payments Explained: What You Need to Know

When transferring a large amount of money, CHAPS is often the go-to method. This guide explains CHAPS payments, how they work, and why they’re used. You might be an individual buying property. You might also be a business settling large invoices. In either case, understanding CHAPS is key to making secure, high-value payments efficiently.

What Is CHAPS?

CHAPS stands for Clearing House Automated Payment System. It’s a UK-based payment system designed specifically for fast, high-value transfers in sterling. Regular bank transfers may take a day or more to process. In contrast, CHAPS moves funds swiftly, typically within the same working day.

The CHAPS system has been a cornerstone of high-value payment processing in the UK since its inception in 1984. Today, it’s operated by the Bank of England, which ensures the system’s stability, reliability, and security. Businesses, banks, and individuals primarily use the service. They require large sums to be transferred efficiently. Delays are not acceptable for them.

How Do CHAPS Payments Work?

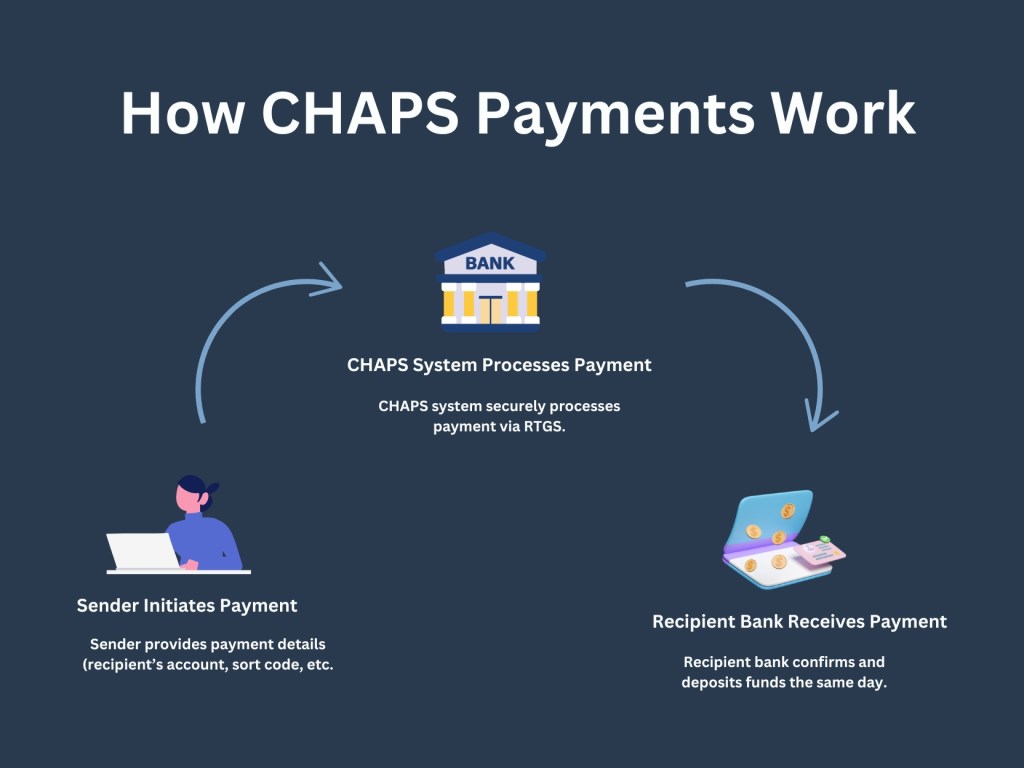

CHAPS payments are processed through banks and financial institutions, enabling seamless money transfers between accounts. Here’s a step-by-step breakdown of how they work:

- Initiating a CHAPS Payment

To use CHAPS, you’ll need to set up the payment through a participating bank. This can be done in person at a branch. You can also do it over the phone or online. This is possible if your bank offers digital CHAPS services. You’ll need to provide the following details:- Recipient’s name

- Sort code

- Account number

- Payment reference (optional, but useful for identifying the purpose of the transaction)

- Approval and Processing

Once the payment request is submitted, the bank will verify the details. They will ensure sufficient funds are available. Some banks may require additional security checks for high-value transfers, such as confirmation codes or identity verification. - Same-Day Clearance

CHAPS payments are processed immediately after approval, provided the request is made before the bank’s cut-off time. The money is sent directly to the recipient’s account and is usually available for use within hours. - Bank Communication

Behind the scenes, CHAPS operates on a system of direct communication between participating banks. The funds are settled through the Bank of England’s Real-Time Gross Settlement (RTGS) system. This system ensures that transfers are completed in real time.

Who Can Use CHAPS?

CHAPS is widely supported by UK banks and financial institutions, though not every bank is a direct participant. Instead, some banks act as intermediaries, processing CHAPS payments on behalf of their customers through a partner institution. If you’re unsure whether your bank offers CHAPS services, you can check its sort code to confirm compatibility.

CHAPS is primarily designed for high-value transactions, making it more commonly used by businesses than individuals. Anyone with a qualifying bank account can request a CHAPS payment. They must meet the requirements and pay the associated fee.

Direct Participants of CHAPS

CHAPS is supported by a network of direct participants, which include leading UK and international banks. These institutions connect directly to the CHAPS system to process payments efficiently. Below is the list of direct participants:

- Banco Santander, S.A. (London branch)

- Bank of America N.A. (London branch)

- Bank of China Limited (London branch)

- Bank of England

- Bank of New York Mellon (London branch)

- Bank of Scotland plc (part of the Lloyds Banking Group)

- Barclays International (a trading name of Barclays Bank plc, part of the Barclays Group)

- Barclays UK (a trading name of Barclays Bank UK plc, part of the Barclays Group)

- BNP Paribas SA (London branch)

- Citibank N.A. (London branch)

- ClearBank Limited

- CLS Bank International (an Edge Act Bank based in New York)

- Clydesdale (a trading name of Clydesdale Bank plc, part of the Virgin Money UK PLC Group)

- Danske Bank (a trading name of Northern Bank Limited, part of the Danske Bank Group)

- Deutsche Bank AG (London branch)

- Elavon Financial Services DAC (UK branch)

- Euroclear Bank SA/NV (Brussels Head Office)

- Handelsbanken plc (a UK subsidiary of Svenska Handelsbanken AB)

- HSBC Bank plc (part of the HSBC Group)

- HSBC UK Bank plc (part of the HSBC Group)

- ING Bank N.V. (Amsterdam Head Office)

- J.P. Morgan Chase Bank N.A. (London branch)

- LCH Limited

- Lloyds Bank plc (part of the Lloyds Banking Group)

- National Westminster Bank plc (part of the NatWest Group)

- Northern Trust Company (London branch)

- Royal Bank of Scotland plc (part of the NatWest Group)

- Santander UK plc (part of the Banco Santander Group)

- Societe Generale (Paris Head Office)

- Standard Chartered Bank plc

- State Street Bank and Trust Company (London branch)

- The Co-operative Bank plc

- TSB Bank plc

- UBS AG (London branch)

- Virgin Money (a trading name of Clydesdale Bank plc, part of the Virgin Money UK PLC Group)

If your bank is not a direct participant, it may use one of these institutions as an intermediary. This way, the bank can process CHAPS payments.

When Is CHAPS Used?

CHAPS is the payment method of choice for scenarios where speed and reliability are paramount. Here are some common use cases:

1. Property Transactions

Homebuyers and sellers frequently use CHAPS to transfer large sums during property purchases. The funds need to be cleared on the same day to complete the transaction. CHAPS provides a secure and efficient solution.

2. Large Business Payments

Businesses often rely on CHAPS for high-value transfers. They use CHAPS to settle invoices with suppliers or pay taxes. It is also used for transferring funds between accounts.

3. Legal Settlements

CHAPS is used in legal contexts. For example, it is used for paying court settlements. Immediate payment is required to meet deadlines or legal obligations.

4. Emergency Transfers

In some cases, individuals may use CHAPS for urgent personal transfers. They might consolidate funds, move large savings, or pay medical or education-related expenses.

How Long Should CHAPS Payments Take?

The primary advantage of CHAPS is its speed. Payments are processed and settled within the same working day, provided they are initiated before the bank’s cut-off time. Cut-off times vary by bank but typically range between 3 pm and 5 pm on weekdays.

The system operates Monday to Friday, generally from 6 am to 6 pm. Payments initiated after the cut-off time or on weekends and bank holidays will be processed the next working day.

Is There a Limit for CHAPS Payments?

One of the standout features of CHAPS is its flexibility in handling large amounts. There are no maximum or minimum limits for transactions, making it ideal for both modest and multi-million-pound transfers.

However, individual banks may impose their own restrictions or require additional verification for extremely high-value transfers. For example, a bank might flag a transaction over £1 million for extra security checks. It may also request further documentation to prevent fraud.

Do CHAPS Payments Cost Money?

Yes, CHAPS payments come with a fee. The cost typically ranges between £20 and £30 per transaction, though this can vary depending on your bank. Business accounts may have different fee structures, with some institutions offering reduced rates for high-volume users.

For individuals, it’s worth considering whether the urgency and amount justify the cost. If the transfer isn’t time-sensitive, alternative methods like Bacs or Faster Payments may be more cost-effective.

CHAPS vs. Other Payment Systems: What’s the Difference?

When deciding on the best payment method, it’s helpful to understand how CHAPS compares to other UK payment systems. These systems include Bacs and Faster Payments.

CHAPS vs. Bacs

- Processing Time: Bacs payments take up to three working days to clear, while CHAPS completes transactions on the same day.

- Use Case: Bacs is ideal for regular, recurring payments such as salaries or direct debits. CHAPS is better suited for urgent, high-value transfers.

- Cost: Bacs is significantly cheaper, often costing pennies per transaction, whereas CHAPS incurs a fee of £20-£30.

CHAPS vs. Faster Payments

- Speed: Both systems offer near-instant processing. Faster Payments has a transaction limit, which is currently set at £1 million for most banks. In contrast, CHAPS has no such restriction.

- Cost: Faster Payments is typically free or low-cost, making it a better choice for transfers under £1 million.

Advantages of Using CHAPS

There are several benefits to choosing CHAPS for your payment needs:

- Speed

Same-day processing ensures that funds are available without delay. - High Value

With no transaction limits, CHAPS accommodates even the largest transfers. - Security

Operated by the Bank of England, the system is highly secure and trusted for sensitive transactions. - Reliability

CHAPS guarantees same-day clearing and settlement of funds. This offers peace of mind for both senders and recipients.

Potential Drawbacks of CHAPS

While CHAPS is a powerful tool for high-value transfers, it may not be the right fit for every situation. Consider the following downsides:

- Cost

The fees for CHAPS transactions can be prohibitive for smaller transfers or individuals. - Limited Availability

CHAPS operates only on working days, making it unsuitable for weekend or holiday payments. - Cut-Off Times

Payments must be initiated before the bank’s deadline to be processed the same day.

How to Initiate a CHAPS Payment: Step-by-Step Guide

If you’re ready to make a CHAPS payment, follow these steps:

- Check Eligibility

Confirm that your bank supports CHAPS payments. Ensure you have sufficient funds to cover the amount and the fee. - Gather Information

Collect the recipient’s bank details, including their account number, sort code, and name. - Choose a Method

Decide whether to initiate the payment online. You can also do it in person or over the phone. This depends on your bank’s options. - Complete Security Checks

Be prepared to verify your identity and confirm the payment through any required security measures. - Submit Before the Deadline

Ensure that you initiate the payment before your bank’s cut-off time for same-day processing.

The Future of CHAPS Payments

As the financial landscape evolves, CHAPS continues to adapt to new technologies and customer needs. Recent upgrades to the Real-Time Gross Settlement (RTGS) system have improved CHAPS’s efficiency and resilience. These enhancements ensure it remains a critical component of the UK’s payment infrastructure.

Looking ahead, further innovations—such as integration with digital currencies or expanded operating hours—could make CHAPS even more accessible and versatile.

Conclusion

CHAPS is a vital payment system for those who need to transfer large sums quickly and securely. Whether you’re buying property, settling business accounts, or handling legal obligations, CHAPS offers unparalleled speed, reliability, and flexibility. However, its associated costs and operating constraints mean it’s best suited for high-value, time-sensitive transactions. By understanding how CHAPS works, you can make informed decisions. Knowing when to use it ensures your payments are processed smoothly.