Understanding MT103 Codes

What is an MT103?

What exactly is an MT103, and why is it important for businesses and individuals dealing with cross-border transactions? Let’s dive into the details in a simple, straightforward way.

Understanding MT103: The Basics

MT103 is a standardized format used for electronic money transfers, specifically within the SWIFT network. SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a global network. It allows banks and financial institutions to securely exchange information about financial transactions.

When you hear about an MT103, it refers to a specific type of SWIFT message used for international wire transfers. It’s a payment instruction sent from one bank to another. This ensures the smooth and secure transfer of funds across borders.

Key Features of an MT103

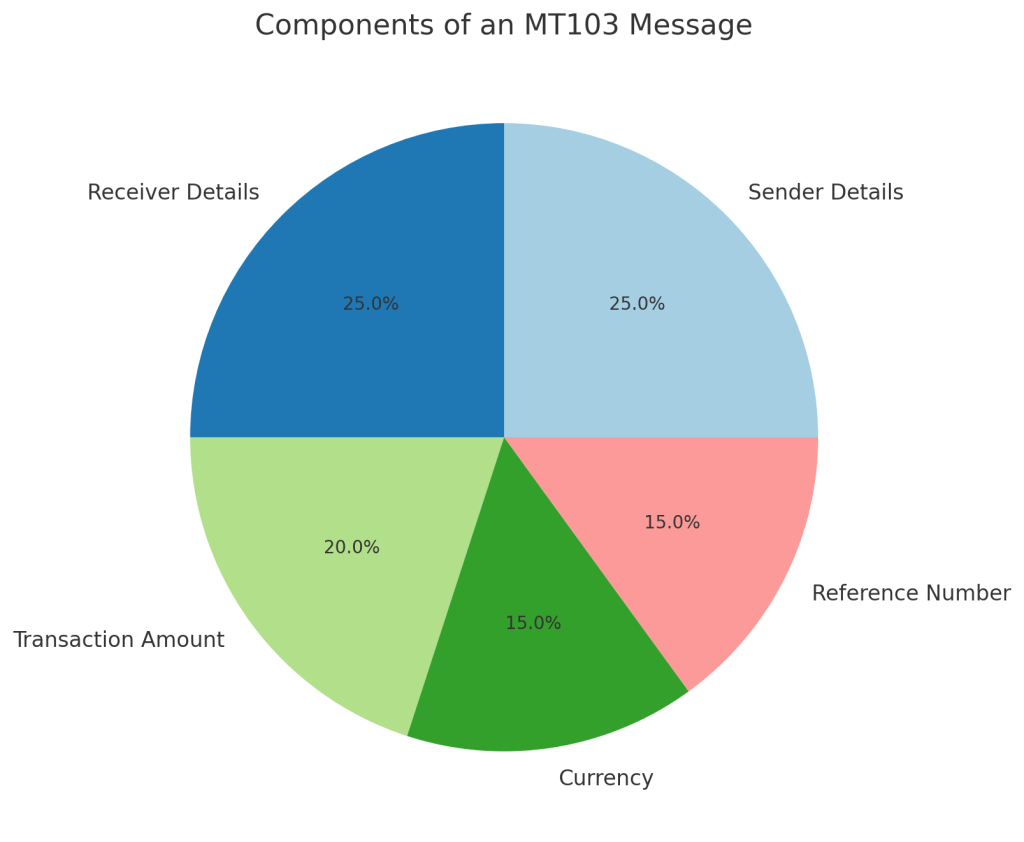

- Detailed Information: An MT103 message contains comprehensive details about the transaction. It includes the sender’s and receiver’s bank information. It includes the amount being transferred. The currency is included, and often, the purpose of the transfer. This level of detail ensures transparency and accuracy, which is critical for both parties involved.

- Standardization: MT103 is a globally recognized format, making international money transfers more straightforward. Banks around the world are familiar with the MT103 format. This familiarity reduces the chances of errors or misunderstandings that could lead to delays or complications.

- Security: The SWIFT network is renowned for its high level of security. An MT103 message is encrypted and transmitted securely, ensuring that transaction details remain confidential and protected from unauthorized access.

- Traceability: One of the most important features of an MT103 is that it provides a unique transaction reference number. This number allows both the sender and recipient to track the transaction throughout the transfer process. It ensures full traceability and accountability.

Why MT103 Matters

MT103 messages are essential for businesses and individuals involved in international trade and finance. Here’s why:

- Trust and Transparency: The detailed information provided in an MT103 builds trust between the sender and receiver. Both parties can verify the transaction details. This reduces the risk of disputes and ensures that the funds are transferred as intended.

- Efficiency: The standardized format of MT103 messages streamlines international payments, making transactions quicker and more efficient. This is particularly important for businesses that need to manage cash flow and financial transactions smoothly.

- Compliance: Banks and financial institutions must comply with various regulations to prevent money laundering and fraud. MT103 messages play a crucial role in maintaining compliance. They provide a clear, auditable record of the transaction. This record can be essential for regulatory reporting.

How to Use MT103 in Your Transactions

Whether you’re a business owner or an individual frequently dealing with international payments, understanding how to use MT103 can be highly beneficial. Here’s a step-by-step guide:

- Initiate the Transfer: Contact your bank. Provide them with the necessary details for the transfer. These details include the recipient’s bank details, the amount, and the currency.

- Verify Details: Double-check all the information to ensure accuracy. Mistakes in the recipient’s bank details or the transfer amount can lead to delays or complications.

- Request an MT103: Once the transfer is initiated, ask your bank to provide you with the MT103 message. This document includes all the transaction details, along with the unique reference number needed for tracking.

- Track the Payment: Use the reference number from the MT103 to monitor the status of the payment. You can check with your bank or use online tools provided by your bank to keep an eye on the transfer’s progress.

- Confirm Receipt: After the recipient confirms they’ve received the funds, keep the MT103 as a record of the transaction. This record can be invaluable for future reference or in case any disputes arise.

Common Questions About MT103

- Can individuals use MT103 for personal transfers?

- Yes, MT103 is not limited to businesses. Individuals can also use this format for personal international money transfers.

- How long does it take for an MT103 transfer to complete?

- The duration can vary depending on the banks involved and the countries. Typically, it takes 1-3 business days for the transfer to complete.

- Is there a cost associated with MT103 transfers?

- Yes, banks usually charge a fee for international wire transfers. The cost can vary based on the bank and the transfer amount.

- What if there’s an error in the MT103 message?

- If you notice any errors, contact your bank promptly to correct the information. Errors can cause delays or even failed transfers.

Why You Should Care About MT103

MT103 provides a standardized, secure, and efficient way to transfer money across borders. Whether you’re a business dealing with international clients or an individual sending money to family abroad. Understanding MT103 can help ensure your transactions are smooth and trouble-free.

The next time you initiate an international payment, remember to ask for an MT103. It’s your ticket to a transparent, trackable, and secure money transfer experience. Having this document at hand gives you peace of mind. It also serves as an important record for your financial transactions.

In Summary

In the world of international banking, an MT103 is more than just a message. It’s a vital tool that ensures the efficiency, security, and transparency of your cross-border transactions. By understanding its importance, you can navigate the complexities of global finance with greater confidence. Learn how to use it effectively. So, whether you’re conducting business across continents or sending personal remittances, make sure to leverage the power of an MT103. This ensures a hassle-free transaction experience.