MT103:Tracking International Transfers

The MT103 code is one tool that plays a crucial role in tracking your transfers. If you face unexpected delays, you can ask your bank for one of these codes. If serious issues arise, you can also rely on your bank for assistance. You can rest assured knowing you can ask your bank for one of these codes. It will help you trace your funds.

What Is MT103?

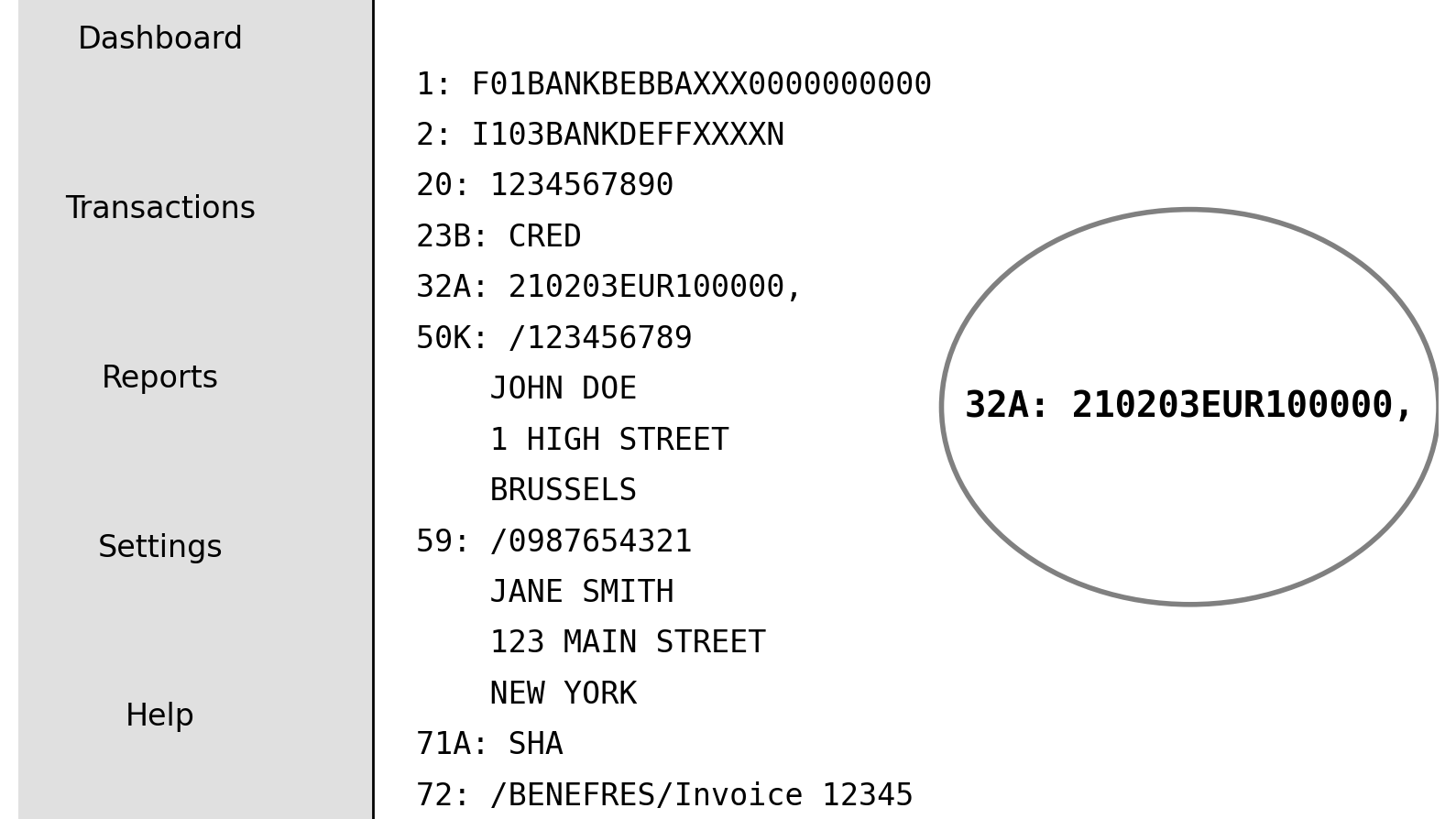

MT103 is a type of SWIFT message used for making international payments. SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global network. Banks and financial institutions use this network to securely exchange financial information. An MT103 message uses a standardized format to transmit payment details. It ensures clarity and accuracy between the sending and receiving banks.

Why They Matter

MT103 is essential because it provides a paper trail for international transactions. This document acts as a receipt. It proves that the transaction occurred and details the specifics, whether you are sending or receiving money. It includes information like:

- Sender’s details: Name, address, and account number.

- Receiver’s details: Name, address, and account number.

- Amount transferred: The exact sum sent.

- Currency: The type of currency used in the transfer.

- Transaction reference number: A unique identifier for tracking.

- Date of the transaction: When the transfer was initiated.

- Correspondent banks involved: Any intermediary banks used in the process.

How to Use to Track a Payment

Tracking an international transfer with MT103 is relatively straightforward if you know what to look for. Here’s a step-by-step guide:

- Obtain the MT103 document: After you initiate an international transfer, request the MT103 document from your bank. Some banks automatically provide it, while others may require you to ask.

- Identify the transaction reference number: This unique number is key to tracking the payment. It acts as the payment’s fingerprint, allowing all involved parties to trace the transfer through the SWIFT network.

- Contact the receiving bank: If there’s a delay in the transfer, give the receiving bank the MT103 document. Make sure to include the reference number. They can use this to track the funds.

- Follow up with correspondent banks: Sometimes, delays occur due to intermediary banks. The MT103 document will list any correspondent banks involved. This makes it easier to identify where the funds might be held up.

- Confirm the transfer completion: Once the funds reach the recipient, both banks can confirm the successful transfer. The MT103 document ensures all details are accurate, avoiding any disputes.

Common Issues and How to Resolve Them

Despite the robust nature of the SWIFT network, issues can still arise with international transfers. Here’s how the MT103 can help resolve some common problems:

- Delay in Transfer: If your payment is taking longer than expected, the MT103 reference number can assist banks. It helps trace the payment and identify any bottlenecks.

- Incorrect Amount: If the wrong amount is transferred, the MT103 document provides proof. It shows what was intended versus what was received. This allows for a swift resolution. Currency Conversion Errors: The document also shows the currency used. This can help resolve any issues related to conversion rates. It can also address misunderstandings.

- Disputes: If a dispute arises between the sender and receiver, the MT103 provides a clear record of the transaction. This helps to resolve the issue fairly.

Tips for Ensuring Smooth International Transfers

To avoid potential headaches with international transfers, here are a few tips:

- Double-check Details: Before initiating a transfer, make sure all recipient details are accurate. A small mistake can lead to delays or misrouted funds.

- Understand Correspondent Banks: Know that some transfers may involve intermediary banks. Be aware of potential delays due to these banks, especially if the transfer is time-sensitive.

- Keep Communication Open: Stay in contact with both your bank and the recipient’s bank throughout the transfer process. Open communication can prevent or quickly resolve issues.

- Request the MT103 Early: Don’t wait until there’s a problem to ask for the MT103 document. Having it from the start will save you time and stress if something goes wrong.

The Future of banking codes and International Payments

The MT103 message format has been a cornerstone of international transfers for years, but the financial world is constantly evolving. Advances in technology and the rise of real-time payments are changing how we send money across borders. However, the need for transparency, accuracy, and security will ensure that tools like the MT103 remain relevant.

While new technologies may streamline processes, the MT103 provides a level of trust and accountability that’s hard to replace. For businesses and individuals alike, mastering the use of this document is key to ensuring successful international transactions.

Final Thoughts

Understanding the MT103 document can save you time. Knowing how to use it can also save you money and stress when dealing with international transfers. Whether you’re sending or receiving funds, this guide provides the knowledge you need to track and manage your payments effectively. Remember, preparation is key. Having the document in hand is crucial. Knowing how to use it will make your international transactions smoother and more secure.