How to Send Money from the UK to Bangladesh

If you’re looking to send money from the UK to Bangladesh, you’ll find there are several easy and reliable ways to do so. Whether you’re supporting family, paying for services, or handling business transactions, it’s important to know your options to make sure the process is smooth and cost-effective. Let’s break down the most common methods and what you need to know.

1. Bank Transfers

One of the most traditional ways to send money from the UK to Bangladesh is through a bank transfer. Almost all major banks offer this service. However, you might want to check the fees and exchange rates, as these can vary quite a bit from bank to bank.

- Pros: Secure and reliable.

- Cons: Can be more expensive due to higher fees and lower exchange rates.

2. Online Money Transfer Services

Online services like Wise (formerly TransferWise), Remitly, and Xoom have become popular for transferring money internationally. They offer competitive exchange rates, lower fees, and a user-friendly experience. You simply create an account, enter the recipient’s details, and transfer the money in minutes.

- Pros: Fast, low fees, and good exchange rates.

- Cons: Requires an internet connection and a bank account or debit card.

3. Money Transfer Operators (MTOs)

MTOs like Western Union and MoneyGram are also great options. You can send money online, via an app, or by visiting their physical branches. The recipient can often collect the money in cash from a local agent in Bangladesh.

- Pros: Available in many locations and ideal for cash pickups.

- Cons: Fees can be higher compared to online platforms.

4. Mobile Wallets

Mobile wallets such as bKash, Rocket, and others in Bangladesh allow recipients to receive funds directly into their mobile accounts. Services like WorldRemit offer this option, making it quick and easy for your recipient to access the money.

- Pros: Instant transfers and convenient for the recipient.

- Cons: Both sender and receiver need to use supported services.

5. Exchange Rate and Fees to Consider

When sending money from the UK to Bangladesh, exchange rates and fees can make a big difference in how much your recipient actually gets. Always compare a few options before making your transfer. Sometimes, a service with a lower fee might have a worse exchange rate, which can end up costing you more.

6. Time Frame for Transfers

- Instant or Same-day Transfers: Some services like Remitly or WorldRemit offer same-day transfers, especially if the money is being sent to a mobile wallet or for cash pickup.

- Bank Transfers: These can take 1-5 business days depending on the bank and service used.

Conclusion

Sending money from the UK to Bangladesh is easier than ever, with plenty of fast, secure, and affordable options. Whether you prefer using banks, online services, or mobile wallets, there’s a solution that fits your needs. Always compare fees, exchange rates, and transfer times to get the best deal for your situation.

By following these simple tips, you can ensure your money gets to your recipient safely and at the best value.

Key Considerations When Sending Money

1. Exchange Rates

Exchange rates can vary significantly between providers. A small difference can impact the final amount your recipient gets. Always compare rates to ensure you’re getting the best deal.

2. Fees

Be mindful of both visible and hidden fees. Some services might charge lower upfront fees but offer poor exchange rates, making the transfer more expensive overall.

3. Transfer Speed

The speed of your transfer can be a critical factor. While some services offer instant transfers, others might take several days. Choose based on your urgency.

4. Security

Always use a reputable and regulated provider to ensure your money is safe. Check if the service is regulated by financial authorities and offers protection against fraud.

5. Customer Service

Good customer service is essential, especially if any issues arise. Opt for providers with accessible and reliable customer support.

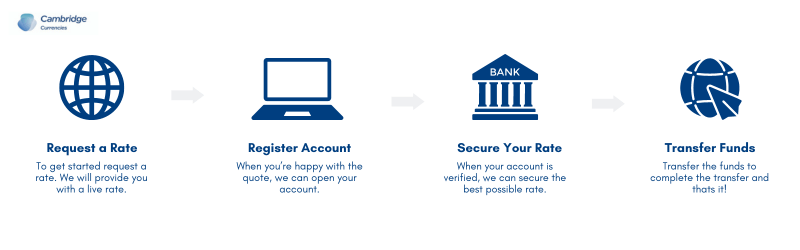

Steps to Send Money from the UK to Bangladesh

- Select a Transfer Service: Choose the best service for your needs, considering factors like fees, exchange rates, and transfer speed.

- Create an Account: If necessary, sign up and verify your identity with the chosen service.

- Provide Transfer Details: Enter the amount, recipient’s details (name, bank account, or mobile wallet number), and select the delivery method.

- Make the Payment: Complete the payment using your preferred method, such as a bank transfer, credit/debit card, or cash.

- Confirm and Track: Confirm the details and track the transfer using the service’s tracking feature.

Tips for Getting the Best Deal

- Compare Rates: Use online comparison tools to find the best exchange rates and lowest fees like RemitFinder

- Watch for Promotions: Many services offer discounts or special rates, especially for new users.

- Plan Your Transfers: If possible, avoid last-minute transfers to save on fees.

- Check Transfer Limits: Be aware of any limitations on the amount you can send in a single transaction.

- Verify Recipient Details: Double-check the recipient’s information to avoid delays or errors.

Frequently Asked Questions

Here are the top 10 questions often asked about sending money from the UK to Bangladesh:

- What is the cheapest way to send money from the UK to Bangladesh? Many compare services like Wise, XE, and Remitly for low fees and favorable exchange rates(Exiap)(finder.com).

- How long does it take to send money to Bangladesh from the UK? Transfer times vary, but services like Remitly and Western Union offer same-day or instant transfers(finder.com)(Finty).

- What are the fees involved in sending money from the UK to Bangladesh? Fees can include service fees, collection fees, and exchange rate margins. Comparing different services can help reduce costs(finder.com).

- Can I send money to Bangladesh if the recipient doesn’t have a bank account? Yes, options like cash pickup, mobile wallets (e.g., bKash), or prepaid cards can be used(Finty).

- Which transfer service offers the best exchange rate for GBP to BDT? Services like Wise, XE, and Remitly are known for offering competitive exchange rates(Exiap)(finder.com).

- Is it safe to send money to Bangladesh from the UK? Yes, as long as you use reputable services that are regulated, such as those overseen by the FCA(finder.com).

- What information do I need to send money from the UK to Bangladesh? Typically, you’ll need the recipient’s full name, bank account details (if sending to a bank), and sometimes their contact information(Finty).

- Can I use my credit card to send money to Bangladesh? Yes, but using a credit card may incur additional fees, such as cash advance fees(Finty).

- What is the fastest way to send money from the UK to Bangladesh? Services like Western Union, Remitly, and XE offer quick transfers, often within minutes(finder.com).

- Can I track my money transfer to Bangladesh? Most online services offer tracking options through their website or app(finder.com)(Finty).

Extended Questions

Q: How long does it usually take to send money to Bangladesh? A: Transfer times vary. Bank transfers may take 2-5 business days, while online services and MTOs can be instant or within a few hours.

Q: What information is needed to send money to Bangladesh? A: You typically need the recipient’s full name, bank account number or mobile wallet number, and possibly their address.

Q: Are there any transfer limits when sending money to Bangladesh? A: Yes, limits depend on the provider and payment method. Check with your chosen service for specific limits.

Q: Can I track my transfer to Bangladesh? A: Most providers offer tracking options, either through a reference number or online account.

Q: Is it safe to send money online to Bangladesh? A: Yes, as long as you use reputable and regulated services. Always ensure the service you use has proper security measures in place.