Sending Money from the UK to the Philippines: A Complete Guide

Sending money from the UK to the Philippines is a common financial transaction for overseas Filipino workers (OFWs), expatriates, and individuals supporting friends or family. Whether you are making a one-time transfer or sending money regularly, understanding the best methods, exchange rates, fees, and timeframes can help you save money and ensure smooth transactions.

This guide covers everything you need to know about sending money from the UK to the Philippines, including the best transfer services, fees, speed, and tips to get the best deal.

Best Ways to Send Money from the UK to the Philippines

Several options exist for transferring money from the UK to the Philippines, each with its pros and cons. Here are the most popular methods:

1. Online Money Transfer Services

Online money transfer services are the fastest and most convenient way to send money internationally. Popular platforms include:

- Cambridge Currencies – Offers different speed options with competitive fees.

- Wise (formerly TransferWise) – Known for its transparent fees and real exchange rates.

- WorldRemit – Provides various payout options, including bank deposits and cash pickups.

- Western Union – Allows online, app, and in-person transactions.

- MoneyGram – Similar to Western Union, with worldwide agent locations.

2. Bank Transfers

Many UK banks allow international transfers to Philippine bank accounts, such as BDO, BPI, and Metrobank. While reliable, bank transfers tend to be slower and have higher fees.

3. PayPal

If both the sender and recipient have PayPal accounts, this can be an option. However, PayPal’s currency conversion fees tend to be higher than other services.

4. Cryptocurrency Transfers

Some users prefer sending money through cryptocurrencies like Bitcoin, which can be converted into pesos via local crypto exchanges such as Coins.ph. This method offers lower fees but may require technical knowledge.

5. Cash Pickup Services

For recipients without a bank account, cash pickup services like Western Union, MoneyGram, and Remitly allow recipients to collect money from agent locations or remittance centers in the Philippines.

Comparison of Money Transfer Services

To choose the best service, consider these factors:

| Service | Speed | Fees | Exchange Rate | Best For |

|---|---|---|---|---|

| Wise | 1-2 days | Low | Mid-market | Bank transfers |

| Cambridge Currencies | Instant-1 day | Varies | Competitive | Fast cash pickup |

| WorldRemit | Minutes-1 day | Low | Good | Bank & cash pickup |

| Western Union | Minutes-2 days | High | Markup applies | In-person transactions |

| PayPal | Instant | High | Poor | PayPal account transfers |

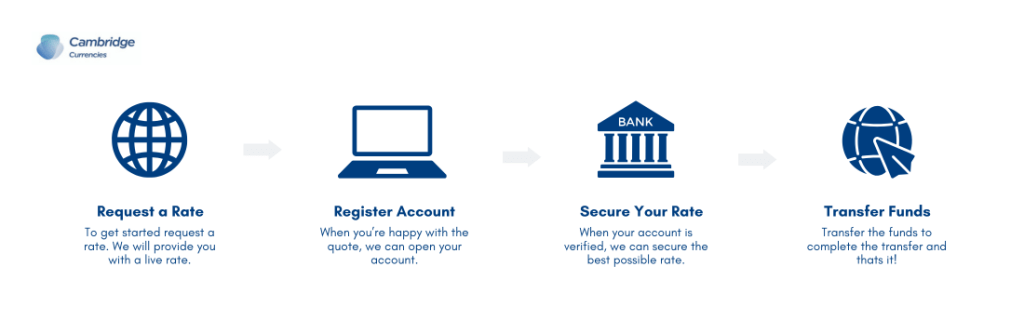

How to Send Money from the UK to the Philippines

The process of sending money is simple and generally follows these steps:

- Create an Account – Sign up with the transfer provider and verify your identity.

- Enter Transfer Details – Provide the recipient’s name, bank account, or cash pickup location.

- Select Payment Method – Use a bank account, debit card, or credit card to fund the transfer.

- Confirm and Send – Review transaction details and complete the transfer.

Fees and Exchange Rates

Understanding Fees

Transfer fees vary based on:

- The transfer amount

- Payment method (bank transfer, card, cash)

- Speed of transfer

For example, bank transfers generally have fixed fees, while card payments may include a percentage-based fee.

Exchange Rate Markups

Many providers add a markup to the exchange rate, reducing the actual amount the recipient receives. Wise stands out by offering real exchange rates with no hidden markups.

How Long Do Transfers Take?

The speed of money transfers depends on the method:

- Bank transfers: 1-3 business days

- Cash pickups: Minutes to hours

- Online transfers: Same day to 2 days

- Cryptocurrency: A few minutes (depending on blockchain congestion)

For urgent transfers, services like Remitly and WorldRemit offer instant or same-day cash pickups.

Tips to Get the Best Deal

- Compare Transfer Fees – Use online comparison tools to check costs.

- Check Exchange Rates – Use a provider with minimal rate markups.

- Avoid Credit Card Payments – They usually have higher fees.

- Use Promotions and Discounts – Some services offer fee-free transfers for first-time users.

- Send Larger Amounts Less Frequently – Small transfers often incur higher percentage fees.

Best Banks in the Philippines for Receiving Transfers

Filipinos receiving money from the UK should use banks that support international transfers. The best options include:

- Banco de Oro (BDO)

- Bank of the Philippine Islands (BPI)

- Metrobank

- Security Bank

- RCBC

- Landbank

These banks provide SWIFT codes, making international transfers smoother.

Frequently Asked Questions (FAQs)

1. What is the cheapest way to send money from the UK to the Philippines?

The cheapest option is usually Wise, as it provides real exchange rates with low fees.

2. How much money can I send from the UK to the Philippines?

There is no official limit, but providers may have transfer limits. Large transfers might require additional verification.

3. Do I need an ID to send money?

Yes, most providers require identity verification to comply with financial regulations.

4. What is the fastest way to send money to the Philippines?

Services like Remitly and WorldRemit offer instant cash pickups.

5. Can I send money from my UK bank directly to a Philippine bank?

Yes, most UK banks allow international transfers, but they tend to have higher fees and slower processing times.

Final Thoughts

Sending money from the UK to the Philippines is easier than ever, with multiple options catering to different needs. Choosing the right provider can help you save money, avoid unnecessary fees, and ensure timely delivery. Whether you prefer online transfers, bank deposits, or cash pickups, understanding the available services and their costs will help you make the best decision.

By comparing fees, exchange rates, and transfer speeds, you can maximize the value of your remittance and support your loved ones in the Philippines more effectively.