Compare Money Transfer Options Easily with RemitFinder

Today there are requirements for both effective and reasonably priced international money transfers the need has never been higher. From supporting loved ones back home and education to cross-border businesses, the demand for reliable remittance services cannot be overstated. This is one of the many reasons we have partnered with RemitFinder a globally acclaimed money transfer comparison platform. This collaboration is aimed at increasing value, transparency, and convenience to our customers who use international remittance services.

Understanding Remittance

Before getting into the particulars of what this relationship, a little context on the remittance industry will be helpful. Remittances represent an enormous economic lifeline for millions across the globe. According to the World Bank, global remittance flows will reach over $750 billion annually, with a large part destined for low- and middle-income countries. In most cases, the money goes into meeting fundamental needs associated with food, shelter, education, and healthcare.

However, sending money overseas can be troublesome. Traditional banking systems are often slow and replete with hidden expenses, and there is a large variation between providers in the exchange rates. The actual cost of a transfer may not quite be easy to find. This is what platforms like RemitFinder achieve, simplicity in an obviously complex process.

Who is RemitFinder?

RemitFinder is an online platform that helps people and businesses to get the best deal on sending money abroad. In its challenge to help illuminate a naturally grey area in the world of remittances, making it a fair one, RemitFinder aggregates data from money transfer services so that users can compare rates, fees, and transfer times across different providers. By doing this, users can make easy, quick and good decisions on which to take, ensuring maximum value in every transaction.

Visit RemitFinder

The Origins and Growth of RemitFinder

RemitFinder was founded on the increasing demand for more openness and ease of use in money transfer services. As the world’s economy continues to integrate, the need for effective cross-border transactions has risen exponentially. Traditional financial institutions, however, have usually been behind in delivering cheap and accessible solutions to their clients. Comprehending this void, the RemitFinder founders set out to design a platform that would shift power into the hands of consumers.

Within a very short period, RemitFinder has expanded its customer base across the globe. Some of the pillars on which this platform stands are transparency, accuracy, and customer-centricity. Trust earned by RemitFinder was an outcome of providing users data in real time and detailed comparisons, making it an impeccable resource for sending money across borders.

What Does RemitFinder Do?

At its core, RemitFinder is a money transfer comparison tool. However, with the services stretching way beyond the comparing of simple rates, it has composed a suite of features designed to enhance the remittance experience:

- Real-Time Comparisons: RemitFinder provides up-to-the-minute data on exchange rates and fees from a wide range of providers. This ensures that users always have access to the most current information when making decisions about their transfers.

- User Reviews and Ratings: RemitFinder integrates reviews and ratings from other customers to help users find the best service. Feedback from peers is very important in reviewing the credibility and quality of the different providers.

- Educational Resources: Realizing that not everyone knows the ins and outs of international money transfers, RemitFinder provides a host of educational resources. From guides on how to send money abroad to tips for getting the best possible exchange rates and an explanation of common industry terms, this platform offers it all.

- Security and Privacy: RemitFinder treats the security and privacy of its users very seriously. Advanced encryption technologies are employed to protect user data and make sure that all transactions are carried out safely.

Why Remitfinder Is a Game-Changer

The global remittance industry is enormous, full of providers offering all types of services. This can be overwhelming to the everyday consumer. RemitFinder empowers them by putting everything in one place. It offers fully transparent and independent comparisons, guiding users past those unseen pitfalls of hidden fees and bad exchange rates to find them the best possible deal.

Furthermore, the transparency of RemitFinder extends to money transfer providers. Theirs is a platform that partners with firms that have really proved their value on reliability and customer service. This, therefore, instills trust that any services users find in Remitfinder have been vetted on quality and integrity.

The Impact of Remittances on Global Economies

To really appreciate the work delivered by RemitFinder, you have to put into perspective just how much remittances contribute to global economies. Generally, remittances are an income lifeline for many developing countries; for some, they even make up a double-digit percentage of their GDP. These funds finance real needs like food, shelter, education, and healthcare.

Remittances also has a very critical role to play in reducing poverty and advancing economic development. By providing families with the resources they need to improve their living standards, remittances can make a significant difference in having communities out of poverty and contributing toward long-term economic growth. Such as high costs, however, drastically reduce the quantum of money reaching those who need it the most. This is why platforms such as RemitFinder are important for maximizing the value of remittances through the reduction of costs and enhancement of transparency.

Why We Partnered with RemitFinder

The decision to partner with RemitFinder was based on the common goal of customer satisfaction and empowerment. We are very conscious of the fact that our customers depend on us to provide them services that are not just reliable but offer the best possible value. Thus, through RemitFinder’s comparison tools integrated into our platform, we were able to increase our value proposition for our customers in their remittance experience.

This partnership demonstrates our broader vision of making financial services more accessible and inclusive for cross-border money transfers. In this sense, we can help our customers make an informed decision, save them money, and guarantee that funds sent reach destinations quickly and safely by offering them access to powerful tools from Remitfinder.

How Our Partnership Improves User Experience

This means users will be able to integrate comparison tools available on RemitFinder into our platform and compare exchange rates, transfer fees, and times between providers without needing to leave our website or app. Very easy, self-explanatory, and it enables a user to get the best deal in just a few clicks.

This collaboration will further help us to provide personalized recommendations in view of each customer’s needs. For example, if the customer normally sends money to a particular country, we use RemitFinder data to recommend the best and most cost-saving transfer options available for that destination. Personalization like this will ensure that our customers are always getting the best possible deal, tailored to their unique situation.

Speak with an Expert

The Benefits to Our Customers

Our partnership with RemitFinder benefits our customers in numerous ways. Some of the most important ones include:

- Cost Savings: We allow our customers to make real-time comparisons between the exchange rates and different kinds of fees which are imposed while transfers are being done. This will save a considerable amount, particularly for those transferring money abroad frequently.

- Transparency: One of the biggest headaches for the remittance industry. There are sometimes hidden charges and rip-off exchange rates that can eat up into an amount of money that gets into the pocket of the recipient. RemitFinder addresses this with clear, upfront information on the real cost of each transfer.

- Convenience: With RemitFinder’s tools, the customer is able to compare transfer options and send money without toggling between a lot of websites or back and forth between apps.

- Security: We at Our Platform and RemitFinder maintain the highest order of security features. Our customers are assured that their personal and financial information is safe and that their money transfers are secure.

- Empowered Decision-Making: Arguably, customers and potential clients are in a better position to compare different value transfer options and therefore empowered to make decisions whose consequences are most appropriate for their goals. Whether they care most about speed, cost, or reliability, RemitFinder presents them with the data they need to make an informed choice of best.

An Inside Peek into How RemitFinder Works

The value of RemitFinder to the partnership, let’s look at how the platform operates. As soon as you input information concerning the transfer amount, currency, and where you are transferring, RemitFinder then does a scan of their database of money transfer providers. It then gives back results in the form of options, either sorted by cost, speed, or even customer reviews.

What each provider offers is broken down into their constituting parts, specifying the exchange rate, the fees. This degree of detail allows comparisons of not only the total cost but also specific factors that are most important to the user.

Besides the comparison features, RemitFinder has a lot to offer in regard to educative resources on the subject of remittance, including how the exchange rates work and aspects to be on the lookout for in a money transfer service, among others. With this knowledge, users can make smarter financial decisions.

The Importance of Transparency in the Remittance Industry

One reason behind the selection of RemitFinder was their high level of respect for transparency. Few providers in the same space can claim transparency, with hidden charges and non-market-competitive exchange rates. This often leads to a loss of hundreds and sometimes thousands of pounds for customers who are sending big sums or have frequent transfers.

RemitFinder deals with this issue by offering up upfront information about the cost of every transfer. Through the detailed breakdown of the fees and exchange rates, RemitFinder ensures users know exactly what they are paying for and can make informed decisions. This helps in establishing a level of transparency with the customers and gaining their trust in the service chosen.

Visit RemitFinder

The Role of Technology in Modern Remittances

In recent years, the remittance industry changes have been tremendous from technological innovation. Digitalization offers speedier, more affordable, and convenient money transfer, hence replacing traditional methods of transfer, such as through banks or by cash pickups.

As our tagline goes, RemitFinder is leading this revolution in tech. In a nutshell, the solution RemitFinder provides transparency and ease of a transaction that once was unimaginable. It places at the user’s fingertips the ability to get informed in real time from any part of the world, compare services at the click of a button, and send money home at a click.

The fact that it is shifting toward digital remittances therefore assumes a special importance from the perspective of financial inclusion. Most people in developing countries lack access to traditional banking services. Digital platforms like RemitFinder fill this gap by providing low-cost and much more accessible financial services to those who need them the most.

Customer-Centric Innovation: How We and RemitFinder Are Shaping the Future

At the very core of our relationship with RemitFinder is innovation. Innovation at both our companies involves constant work on improvement in services offered, driven solely by the desire to serve customers better. This customer-centric approach to innovation is reflected in the features and tools, which make it easy to remit and add value through the process.

As the global remittance market continues to evolve, so shall we. We will continue to improve our services, continue to build up more partner-providers, and continue to integrate new technologies. Our vision is to meet and exceed customer expectations by providing them with the best remittance experience.

Global Money Transfers, Financial Inclusion, and the Challenge

Equal access to suitable and affordable financial services remains a challenge in a majority of the world’s regions. According to the World Bank, approximately 1.7 billion people globally remain unbanked, meaning they do not have access to basic financial services such as bank accounts, credit, or insurance. This makes it difficult to save or invest, or even access credit, hence leading to cycles of poverty.

Remittances are playing a larger role in major financial inclusions across developing countries. In most cases, remittances are some key channel of earning revenue for families to address basic needs or else to invest them in the future. Quite significant, though, is that a high proportion of these funds are taken away by the heavy costs of sending money across the same borders.

This is where the concept of platforms such as RemitFinder comes into play. By helping to find the cheapest way to transfer funds, RemitFinder ensures a greater amount of that money goes to the intended recipients. An increase in inflow and outflow of funds increases economic development through more local economies benefiting from such funds.

The Future of International Money Transfer

With increasing globalization, migration, and technological progress, the prospects of international money transfer look set to surge in the next few years. However, new challenges and opportunities come along with this growth: the need for more transparency, security, and customer-centric solutions as the industry grows further.

This strategic step and partnership with RemitFinder will keep us at the forefront of this changing industry. Together, we are ensuring that our customers receive the best possible remittance services now and in the future. Be it real-time comparisons, higher levels of security on transactions, or new features and tools, our focus remains zeroed in on the needs of our customers in a world always in change.

How to Get Started with RemitFinder

If you are new to using RemitFinder, it’s easy to get started. Log in to your account, click on the international money transfer tab, and fill in your transfer details. A list of options will then be shown, detailing the cost, speed, and reliability for each provider.

Once you have zeroed in on the best option for your needs, you can perform a transfer right in our app. The process is smooth and completely secure; by using real-time tracking, you can stay posted on everything. Our customer support is always available to help with any queries or support that you may want.

Customer Testimonials: Real Stories, Real Savings

Probably one of the best ways to understand the impact of our partnership with RemitFinder is to listen directly from the customers. Let me share with you a couple of stories of individuals who have benefited from using RemitFinder on our platform:

- “I used to send money to Mexico using local companies at grocery stores. And then I came across RemitFinder. Right away, I was able to get the best rates and low fees. For someone who needs to support their family back home, every dollar counts. I recommend RemitFinder to help maximize your money’s worth.”

Jose Garcia

San Diego, USA

- “Accurate rates and up to date information on various providers is why I always use RemitFinder when sending money home to my family in India. Everything is conveniently compared in one place, and many deals and promotions help me save even more. Thanks for helping me save money every time I send.”

Pawan Agarwal

Berlin, Germany

- “I love RemitFinder’s options to send money to the Philippines – a wide range of choices helps me choose the best option depending on when I need to send. I also find the daily rate alert useful as it helps time money transfers better. Very happy with this service that impacts the bottom line directly!”

Maria Santos

Brisbane, Australia

These testimonials are just a few examples of how RemitFinder is making a real difference in people’s lives. By offering a simple, transparent, and cost-effective solution for international money transfers, we are helping our customers achieve their financial goals.

Visit RemitFinder

Looking Ahead: A Larger Partnership with RemitFinder

The future is promising as we look forward to furtherance of our partnership with RemitFinder. There are many areas that, in our view, represent great opportunities for growth and innovation:

- More Choices of Transfer Services: RemitFinder will continue to integrate more and more money transfer providers into their platform, giving more choices to customers. This will enable to serve a myriad of needs and offer much more customized solutions.

- New Features: We are working on new tools and features to help enhance the user experience. These could include personalized rate alerts, further details on transfer tracking, and advanced analytics that will help the user optimize their transfers.

- Global Outreach: We believe that our services should be within the reach of all, and since our customer base has been fast-growing, we remain dedicated to making them available to more and more people globally. This will be achieved by further developing our platform to accommodate more languages and multiple currencies, in addition to collaborating with local partners to have better service delivery in particular regions.

- Sustainability and Corporate Social Responsibility: We remain focused on ensuring that the relationship with RemitFinder stays aligned with our broader commitment to sustainability and corporate social responsibility. This includes seeking ways to reduce our potential negative impact on the environment, addressing the source of the problem, and supporting programs aimed at enhancing financial inclusion and economic development in low-income communities.

How Cambridge Currencies Works with RemitFinder: A Step-by-Step Guide

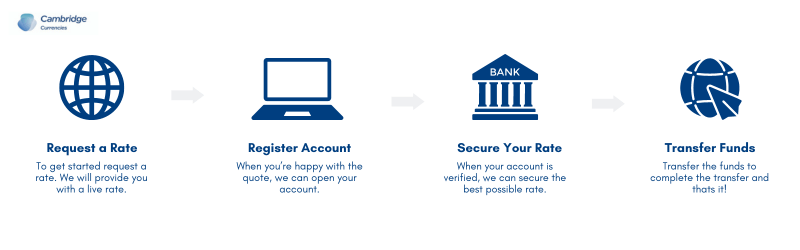

When you chooses Cambridge Currencies via RemitFinder, you have access to a convenient, very clear, cost-efficient process to execute any of your international money transfers. Here’s how it works from start to finish:

- Step 1: Get a Rate via RemitFinder

When you go to RemitFinder and key in details about your transfer—such as amount, currency, and destination—RemitFinder effectively searches its entire database, which it then makes available after processing, in a few moments. You will find Cambridge Currencies listed as one of the entries, where we offer competitive exchange rates, low fees, and the kind of dependable service you deserve.

- Step 2: Compare and Select Cambridge Currencies

After the search results are returned, you will see a comparison of several providers, including Cambridge Currencies. Our exchange rates, fees, transfer times, and customer ratings will be displayed to help you make an informed decision. If our offering is right for you, simply select Cambridge Currencies as your chosen provider.

- Step 3: Securely Transfer Your Funds

Once you have selected Cambridge Currencies, we will take you to our site to provide the details of your transfer. You will then fill in the details of your recipient, verify the amount, and check the total cost at the end of your transaction. Our site is very user-friendly, and for this very reason, it will make your transfer process as smooth as possible.

- Step 4: Track Your Transfer

After receipt of your transaction, you will be able to follow along with your transfer in real time from our very platform. We will keep you informed about the status of your money transfer, and you will have nothing to worry about. In case you have doubts of any kind or need any help, our customer service will help you out.

- Step 5: Funds Delivered

Finally, the amount will be deposited in your recipient’s account, both safely and quickly. Thanks to RemitFinder, you have now received one of the best deals for your complete value of money.

Conclusion: Easy, Transparent and Trusted

This is to say that our partnership with RemitFinder is set up to let you have the best capabilities when sending money abroad. By being able to compare rates, fees, and services in advance, you can have an idea of whom you will send to so you can save big. To send money to your family, to pay for a child’s education, or to send money for running an overseas business, Cambridge Currencies in association with RemitFinder is here to help make the process as easy, transparent, and trustworthy as possible.

We look forward to serving you and assisting in unlocking value in every transfer. Thank you for using Cambridge Currencies on RemitFinder!