Money Exchange Comparison – How to Get the Best Rates

When dealing with international money transfers or currency exchanges, knowing where to get the best rates can save you a lot of money. Comparing services, fees, transfer speeds, and exchange rates is key, whether you’re buying property abroad, selling assets, or managing business payments.

What is Money Comparison and How Do You Do It?

Money comparison means evaluating different currency exchange or money transfer services to find the best rates and lowest fees. This involves looking at:

- Exchange rates: The rate at which one currency is converted to another.

- Fees: Some providers charge flat fees, while others add a margin to the exchange rate.

- Transfer speed: How quickly the money reaches its destination.

By comparing all these aspects, you can ensure you’re not overpaying, especially when transferring large amounts.

Money Exchange Comparison for Businesses

For businesses, getting the best rates on international payments is crucial to managing expenses. Here’s a breakdown of factors to consider when comparing services:

- Fees: Some providers offer lower fees for higher transfer amounts. Make sure to check the thresholds.

- Transfer Speed: Some providers may offer same-day transfers, while others could take a few days.

- Exchange Rates: Even a small difference in exchange rates can have a big impact when transferring large sums.

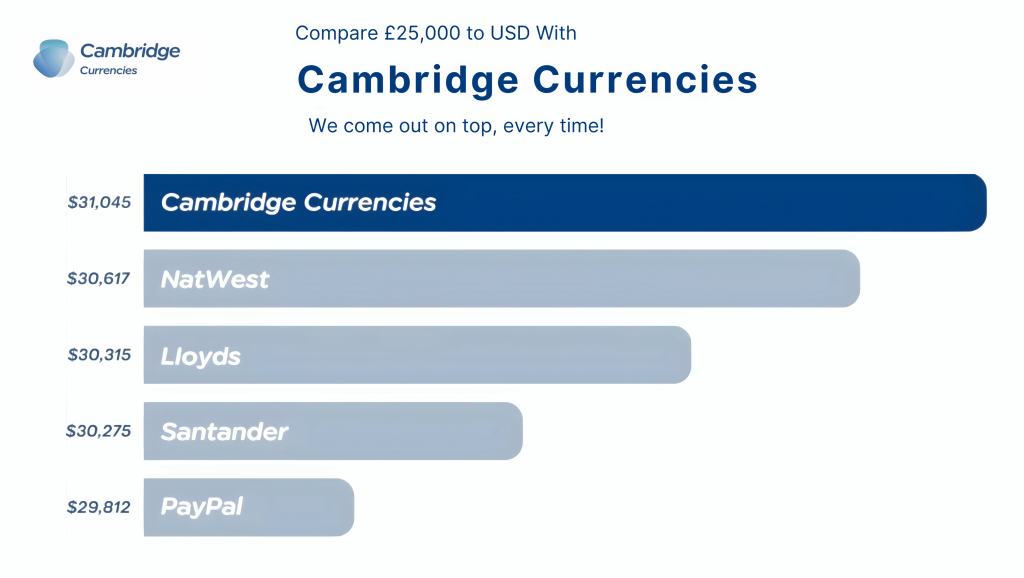

Here’s a comparison of Cambridge Currencies against other major providers:

| Provider | Fees | Exchange Rates | Transfer Speed | Best For |

|---|---|---|---|---|

| Cambridge Currencies | £0 for large transfers | Best-in-class rates | Same day for large transfers | Business and property transfers |

| Wise | 0.35% to 1% | Competitive rates | 1–2 business days | Small to medium personal transfers |

| OFX | £7 for small transfers, £0 for large transfers | Good rates | 1–2 business days | High volume personal transfers |

| Western Union | Variable fees | Poor rates for large sums | Instant to 2 days | Small, fast personal transfers |

| PayPal | 5% + currency margin | High margins on exchange rates | Instant for PayPal-to-PayPal | Small personal transfers |

This table shows that Cambridge Currencies provides the best overall solution for businesses looking for competitive rates and low fees for large transfers.

Money Exchange Comparison for Buying Property

If you’re buying property abroad, even a small difference in exchange rates can significantly impact the total cost. Comparing providers is essential to find the best service for you.

Key Considerations:

- Exchange Rate: Look for a provider that offers live, competitive rates.

- Fees: Avoid hidden fees or high flat charges, especially for large transfers.

- Transfer Speed: Timeliness can be key when purchasing property, so opt for a service that offers quick transfers.

Money Exchange Comparison for Selling Property

Selling property abroad often involves repatriating large sums of money, making it even more important to get the best rates.

- Exchange Rates: Opt for a service with transparent rates and low margins.

- Service Fees: Many providers waive fees for large transfers, so this should be a top priority.

- Security: Ensure that the provider is regulated and offers full transparency.

Compare Money Transfer Rates for Businesses

Businesses transferring money internationally should focus on minimizing costs. Comparing fees and rates can make a significant difference to your bottom line.

Here are some top tips:

- Check hidden fees: Some providers hide costs in poor exchange rates or additional service fees.

- Volume discounts: Some companies offer better rates for large, frequent transfers.

Best Exchange Rates in 2024

When it comes to predicting exchange rates for the year ahead, always opt for a service that offers consistent, reliable rates. Cambridge Currencies is particularly suited for large international transfers, and here’s why:

- Competitive exchange rates with no hidden fees.

- Fast transfers that match or beat competitors.

- Personalized service designed to meet the needs of expats, property buyers, and businesses.

Please select a valid form.

Related Articles

- Remitfinder – Real-Time Money Transfer Comparison

- How to Transfer Large Sums Internationally: A Guide for Businesses

- Understanding Exchange Rate Margins for Expats

By comparing services based on fees, transfer speeds, and exchange rates, you can ensure you’re making the most of your money. Whether you’re buying or selling property, managing business payments, or transferring large sums, Cambridge Currencies offers competitive solutions that are tough to beat.