For Riya and Amit, enrolling their daughter Aarohi in an international school wasn’t just about education. It was an investment in her future. He wanted her to experience a global curriculum, high-quality facilities, and holistic development. He explored different Cambridge international schools in Delhi, Mumbai, and Bengaluru. They realised that international education comes with significant costs.

Enter Cambridge Currencies, a platform dedicated to simplifying foreign currency transfers. Cambridge Currencies offered Riya and Amit competitive rates. They provided flexible payment options and dedicated support. This was a practical solution to manage Aarohi’s school fees with ease and efficiency. This guide follows their journey, demonstrating how Cambridge Currencies helped them optimize every aspect of paying international school fees.

In This Guide We Will Cover

- The Growing Demand for International Schooling in India

- Financial Challenges of Paying International School Fees

- Why Cambridge Currencies is the Ideal Partner for International Fees

- A Step-by-Step Guide to Using Cambridge Currencies

- Real-Life Benefits of Using Cambridge Currencies for Fee Payments

- Cambridge Currencies vs. Traditional Payment Methods

- Tips for Saving on International School Fees

- Frequently Asked Questions (FAQs)

1. The Growing Demand for International Schooling in India

India has seen a surge in demand for international education in recent years. Schools providing globally recognized curricula are increasingly sought after by Indian parents. These include the Cambridge Assessment International Education (CAIE) and International Baccalaureate (IB). These parents value the emphasis on critical thinking, creative learning, and exposure to global perspectives.

Families are willing to invest in institutions like Cambridge International School Srinivaspuri or Cambridge School Indirapuram. They believe these schools can prepare their children for international opportunities. However, international education comes at a premium, with fees significantly higher than traditional Indian schools, that’s why Cambridge Currencies focuses on international school fee’s.

Some common queries among parents include:

- What is the average fee structure at Cambridge schools?

- Are there additional fees for exams and extracurricular activities?

- How can we save on foreign exchange when paying fees?

This is where Cambridge Currencies steps in. They offer a transparent, cost-effective way to manage these fees. This approach makes the dream of an international education more accessible.

2. Financial Challenges of Paying International School Fees

Enrolling Aarohi in a Cambridge school presented Riya and Amit with a set of financial challenges they hadn’t encountered before. Unlike regular Indian schools, where fees are straightforward, international schools have a complex fee structure that includes:

- Tuition Fees: This covers the core education program and is generally higher than traditional Indian school tuition.

- Development and Infrastructure Fees: These are fees used to maintain and improve school facilities.

- Examination Fees: For Cambridge curriculum schools, parents must pay additional fees for official Cambridge assessments. These costs can add up, especially in higher grades.

- Miscellaneous Fees: Costs related to extracurriculars, transportation, uniforms, and other needs.

Each fee category posed a unique financial burden. Riya and Amit knew they had to be strategic with their payments. Cambridge Currencies offered a practical way to manage these expenses through affordable foreign currency transfers.

3. Why Cambridge Currencies is the Ideal Partner for International Fees

For families like Riya and Amit’s, Cambridge Currencies provides a unique blend of features specifically designed to handle international payments. Here’s how Cambridge Currencies addresses the key concerns Indian parents face:

- Competitive Exchange Rates: Cambridge Currencies offers better rates than traditional banks. This allowed Riya and Amit to save more on each payment. Traditional banks often include hidden markups, but Cambridge Currencies provides near mid-market rates with full transparency.

- Minimal Fees: Unlike banks that charge high transfer fees and percentage-based service charges, Cambridge Currencies keeps costs low. The platform charges a flat, transparent fee for each transaction, so parents know exactly what they’re paying.

- Automated Transfers for Regular Payments: Schools often require term-wise or monthly payments. Cambridge Currencies enables parents to set up recurring payments, so they never miss a due date.

- Dedicated Account Managers: Every client is assigned an account manager. They assist with setting up payments. They help choose the best time to exchange currency. They also aid in navigating complex financial regulations. Riya and Amit found this level of personalized support invaluable.

- Hedging Options to Lock in Favorable Rates: Cambridge Currencies offers forward contracts. This allows parents to lock in a favorable exchange rate for future payments. This protects them from market fluctuations.

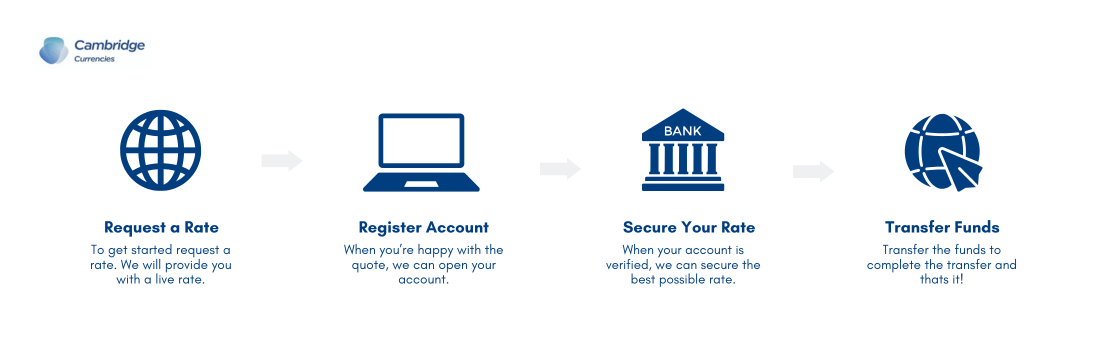

4. A Step-by-Step Guide to Using Cambridge Currencies for School Fees

Cambridge Currencies aims to make the process as smooth as possible. They have simplified the steps involved in setting up and managing school fee payments.

Step 1: Account Registration

Riya and Amit started by signing up for an account on the Cambridge Currencies website. They provided their personal information and uploaded documentation for identity verification.

Step 2: Identity Verification

In line with anti-money laundering (AML) regulations, Cambridge Currencies required Riya and Amit to verify their identity. This step involved submitting government-issued ID and proof of address. The process was completed within 24 hours.

Step 3: Setting Up Payment Schedule

Riya and Amit chose a term-based payment plan that matched Aarohi’s school’s schedule. Cambridge Currencies allowed them to specify the currency, amount, and frequency of payments, automating future transfers.

Step 4: Locking in Exchange Rates

Cambridge Currencies offers forward contracts that let users secure today’s exchange rate for future transactions. Riya and Amit decided to lock in the current rate for the next term’s payments. This decision ensures that their budget will not be affected by rate fluctuations.

Step 5: Real-Time Payment Tracking

For each payment, Cambridge Currencies sent a confirmation email. They also provided tracking details. This allowed Riya and Amit to monitor their transfers. They could plan accordingly.

5. Real-Life Benefits of Using Cambridge Currencies for Fee Payments

Using Cambridge Currencies provided Riya and Amit with several tangible benefits:

- Savings on Fees: The difference in fees between Cambridge Currencies and their bank saved them approximately 10% over a year. This saving could go towards Aarohi’s extracurricular activities or a family trip.

- Time Saved: With automated payments and quick transaction processing, Riya and Amit spent less time managing transfers. This allowed them to focus on their work and family life.

- Predictable Payments: By locking in exchange rates, they could predict exact budget needs for the term’s fees. This eliminated surprises.

- Peace of Mind: The account manager provided clear communication. Their support gave them confidence in their payment process. This helped them avoid any financial mishaps.

6. Cambridge Currencies vs. Traditional Payment Methods

Many parents in India rely on traditional banks for international transactions. However, here’s how Cambridge Currencies compares:

| Feature | Cambridge Currencies | Traditional Banks |

|---|---|---|

| Exchange Rates | Near mid-market, no markups | Marked up rates, less favorable |

| Fees | Low, transparent | High fees, often percentage-based |

| Support | Dedicated account manager | Limited, generic customer support |

| Payment Flexibility | Automated, customizable | Limited options |

| Hedging Options | Forward contracts | Generally not available |

7. Tips for Saving on International School Fees

- Plan Payments Ahead: Schedule transfers in advance and avoid last-minute transactions, which may carry higher fees.

- Use Forward Contracts: Lock in rates when the currency is favorable. This can save you from market fluctuations, especially if your child’s fees are paid in USD or GBP.

- Take Advantage of Tax Benefits: If you’re financing education through loans, you may be eligible for tax deductions. Consult a tax professional to understand how Section 80E might apply to your situation.

- Explore Multi-Currency Accounts: Holding funds in a multi-currency account can be beneficial. Accounts, such as one offered by Revolut, allow you to convert when rates are favorable. This is better than converting at the time of payment.

- Look for School-Specific Discounts: Some schools offer discounts for upfront annual payments instead of term-wise payments. Check with your child’s school for any incentives.

8. Frequently Asked Questions (FAQs)

What is the average fee for Cambridge international schools in India?

The annual tuition fees for Cambridge schools in India usually range from INR 2 lakh to INR 10 lakh. The cost depends on the location and grade level.

Can Cambridge Currencies help with fees for universities abroad?

Yes, Cambridge Currencies can be used for any foreign currency payment. This includes university fees in the UK, US, and other countries.

How do forward contracts work with Cambridge Currencies?

A forward contract allows you to lock in an exchange rate today for future payments. This can protect you from currency volatility, providing budget stability.

How does Cambridge Currencies compare to PayPal for international payments?

PayPal is convenient. However, it has higher fees and less favorable exchange rates. Cambridge Currencies specializes in cost-effective currency transfers.

What are the fees for using Cambridge Currencies?

Cambridge Currencies charges a low, transparent fee per transaction, with no hidden markups. Exact fees vary depending on the currency and amount.

How Cambridge Currencies Helps Indian Parents Manage International School Fees

For families like Riya and Amit’s, managing international school fees doesn’t have to be complicated or costly. With Cambridge Currencies, they found a reliable partner. This partner streamlined the process, saved them money, and provided support whenever they needed it. Cambridge Currencies automated transfers and offered transparent pricing. They provided competitive rates. What was once a challenging task became a simple and efficient routine.

As they plan for Aarohi’s future, Riya and Amit now have the tools and resources they need. They can navigate her international education journey with confidence. They know they’re in control of their finances every step of the way.

For anyone else looking at international education options, finding the right currency exchange partner is crucial. It can make all the difference in creating a smooth, stress-free experience.