In this guide, we’ll explore everything you need to know about currency exchange. We will cover the factors that influence exchange rates. You will learn ways to get the best rates and how to avoid common pitfalls. Whether you’re an individual who wants to save on personal transfers, this article has you covered. It also benefits a business that aims to minimize costs.

Understanding how currency echange works is essential for everyone. This applies from international travelers to businesses conducting cross-border transactions. Currency exchange affects every international payment you make. This includes sending money to family overseas, paying international school fees, or investing in global markets.

Things We Will Cover

- What is Currency Exchange and How Does It Work?

- Why Currency Exchange Matters for Individuals and Businesses

- Key Factors That Affect Currency Exchange Rates

- How to Get the Best Currency Echange Rate

- Currency Exchange Services: Pros and Cons of Each

- Tips for Safe and Efficient Currency Exchange

- Frequently Asked Questions about Currency Exchange

1. What is Currency Exchange and How Does It Work?

Currency exchange is the process of converting one currency into another. It’s a simple concept, but it’s driven by complex factors that cause exchange rates to fluctuate constantly. When you visit a bank, you’ll see the exchange rate. Online currency exchange platforms also show the rate for converting your money to another currency. This rate is influenced by the global forex market, where currencies are traded.

For example, you may want to convert Indian Rupees (INR) to the Pound Sterling (GBP). The currency exchange rate determines how much GBP you receive for each INR. These rates are updated in real-time, reflecting changes in the global currency market.

2. Why Currency Echange Matters for Individuals and Businesses

Currency exchange isn’t just relevant for travelers; it impacts a wide range of transactions and financial decisions. Here’s how it affects individuals and businesses alike:

For Individuals

- Travel Expenses: When traveling abroad, you’ll need local currency. Currency exchange rates directly affect how much local currency you get for your money.

- International Payments: If you’re paying for services, such as tuition fees for international schools, currency exchange rates play a role. They determine how much you end up paying. The same applies to overseas subscriptions.

- Sending Money Home: Many people work abroad and send money back home to support family. Exchange rates influence the amount received in the home currency.

For Businesses

- Import and Export Costs: Businesses that import goods pay suppliers in foreign currencies, so exchange rates impact their expenses. Similarly, exchange rates affect revenue from exports.

- Investment Returns: Companies investing in foreign assets or stocks need to be mindful of exchange rates. Currency fluctuations can influence profits.

- Risk Management: Currency exchange volatility can be risky for businesses. Many companies use hedging strategies to protect against unfavorable rate movements.

Currency echange, as some might mistakenly spell it, is an integral part of financial management for both individuals and businesses. Understanding it can help reduce costs and maximize the value of your money.

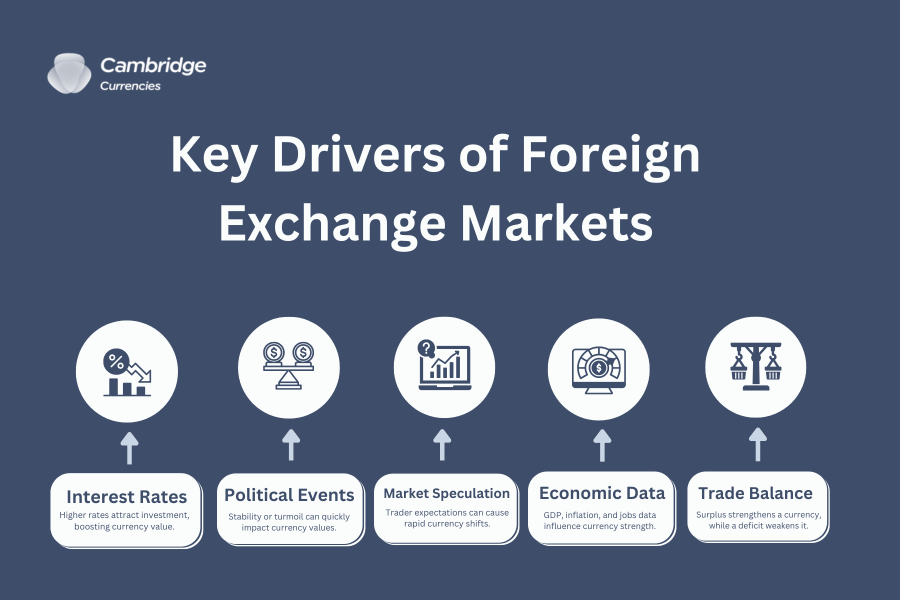

3. Key Factors That Affect Currency Exchange Rates

Currency exchange rates fluctuate due to various factors. Knowing these can help you time your exchanges more effectively. Here are the main drivers of currency exchange rates:

1. Interest Rates

Countries with higher interest rates often see their currencies appreciate because they attract more foreign investment. Central banks set interest rates to influence the value of their currencies. The Federal Reserve does this in the US, and the European Central Bank does this in Europe.

2. Economic Indicators

Economic strength plays a significant role in determining a currency’s value. Key indicators include GDP growth, employment rates, and inflation levels. A strong economy usually strengthens the currency, as it’s considered stable and attractive to investors.

3. Political Stability

Currencies from politically stable countries are usually more attractive. Political uncertainty or turmoil (e.g., elections, policy changes) can weaken a currency, as investors see it as riskier.

4. Supply and Demand

The forex market is driven by supply and demand. When demand for a currency is high (e.g., during economic growth or investment booms), its value rises. Conversely, oversupply can lead to depreciation.

5. Global Events

Events like pandemics, natural disasters, and wars have a massive impact on currency values. For example, the COVID-19 pandemic affected exchange rates globally as economies slowed down and central banks adjusted policies.

Understanding these factors can help you predict and time your currency echange transactions more effectively.

4. How to Get the Best Currency Echange Rate

Getting the best exchange rate is crucial for saving money. Here are some strategies to help you maximize your currency exchange:

1. Compare Providers

Exchange rates vary across banks, online platforms, and currency bureaus. Use comparison sites to find providers offering the best rates for the amount and currency pair you need. RemitFinder is especially good for comparing and getting the best deals.

2. Avoid Airport Exchange Counters

Exchange bureaus at airports are convenient but usually offer poor rates due to high overhead costs. Plan ahead and exchange your currency online or at a trusted provider before traveling.

3. Use Online Currency Exchange Platforms

Online platforms like Wise, Revolut, and Cambridge Currencies offer better rates than traditional banks. Their rates are often close to the mid-market rate, which is the “true” exchange rate without markups. These platforms also have lower fees, making them a cost-effective option.

4. Consider Timing

Exchange rates fluctuate throughout the day. By monitoring the market and setting alerts, you can time your transactions to get the best rate. Some platforms allow you to set a target rate and will notify you once the rate hits that level.

5. Lock in Rates for Future Payments

If you need to make regular international payments, such as tuition fees, consider using forward contracts. You can also use rate locks to secure a favorable exchange rate for the future. This hedges against potential rate fluctuations.

5. Currency Exchange Services: Pros and Cons of Each

There are several methods for exchanging currency, each with its advantages and disadvantages. Here’s a look at the options:

1. Banks

- Pros: Reliable, secure, convenient if you already have an account.

- Cons: High fees, less competitive rates, additional charges for international transfers.

2. Online Currency Exchange Platforms

- Pros: Low fees, better exchange rates, user-friendly, faster transactions.

- Cons: Requires internet access and sometimes account setup.

3. Currency Exchange Bureaus

- Pros: Widely available in cities and airports, immediate cash in hand.

- Cons: High fees, often the least competitive rates.

4. Dedicated Forex Brokers

- Pros: Best for large transactions and businesses; often provide tailored support.

- Cons: Not ideal for small transactions; can have complex processes.

5. ATMs Abroad

- Pros: Convenient, generally better rates than exchange bureaus.

- Cons: Foreign transaction fees, poor rates from some banks.

Each method has its use cases, and choosing the right one depends on factors like transaction size, frequency, and convenience.

6. Tips for Safe and Efficient Currency Exchange

To get the best experience from your currency exchange, keep these tips in mind:

1. Look for Transparency

Choose providers that clearly show their fees and rates. Avoid services with hidden charges or unclear pricing structures.

2. Use Secure Platforms

Security is crucial, especially for online exchanges. Make sure the platform uses encryption and complies with regulatory standards.

3. Avoid Dynamic Currency Conversion (DCC)

When using a credit or debit card abroad, some vendors offer to convert the transaction to your home currency. This “convenience” usually comes with a high markup. Always opt to pay in the local currency.

4. Track Exchange Rates Regularly

Use apps or rate alerts to monitor fluctuations and know the best times to exchange your money. Many platforms, like Wise or Revolut, offer real-time rate tracking.

5. Plan Ahead

Avoid last-minute exchanges to bypass poor rates and high fees. If you know you’ll need currency in advance, use forward contracts or rate locks to protect yourself from volatility.

7. Frequently Asked Questions about Currency Exchange

What is the difference between currency exchange and forex exchange?

Currency exchange usually refers to converting money for personal or business transactions. Forex exchange, or forex trading, is a form of investment. Individuals or companies trade currencies to make a profit from rate fluctuations.

What’s the best way to get a good currency echange rate?

The best way is to compare rates across multiple providers. Use online platforms with competitive rates. Avoid last-minute exchanges at airports. Timing your transaction during favorable market conditions also helps.

Are there hidden fees in currency exchange?

Some providers, especially banks, may include hidden fees or mark up their exchange rates. Always look for transparent providers that display all fees upfront.

Is online currency exchange safe?

Yes, if you use regulated, reputable providers. Look for services that use encryption and comply with financial regulations.

How much money can I exchange without declaring it?

The amount you can exchange without declaring it depends on your country’s regulations. In India, for instance, there are limits on how much currency individuals can send abroad without specific approvals.

Do I need a bank account for currency exchange?

Not necessarily. Many currency exchange bureaus and online platforms don’t require a bank account. However, banks often handle transferring larger sums internationally.

Currency exchange may seem complex. However, with the right approach and knowledge, you can make informed decisions. This helps maximize the value of your money. You should understand the basics of currency exchange when transferring funds internationally. It is also important when paying overseas fees or preparing for a trip abroad. Using reliable services will help you save money and avoid unnecessary fees. You can manage currency exchange efficiently by choosing trusted providers like Cambridge Currencies. Using competitive platforms also helps to keep more of your hard-earned money.

Do You Need To Make A Currency Transfer?

Cambridge Currencies will guide you through the process of making international currency payments. They provide genuine end-to-end customer support. Click Here to Get a Quote Now!