INR Forecast Against USD

Stay updated with the latest trends, historical data, and expert insights on INR Forecast Against USD

Dollar to Rupee Forecast

The USD to INR rate is around 84.40, close to its highest levels. The Rupee has been under pressure from foreign investment outflows. The Dollar remains strong due to cautious policies from the US Federal Reserve. In the short term, the rate is expected to stay steady. There’s a chance the Rupee could strengthen slightly in the coming months.

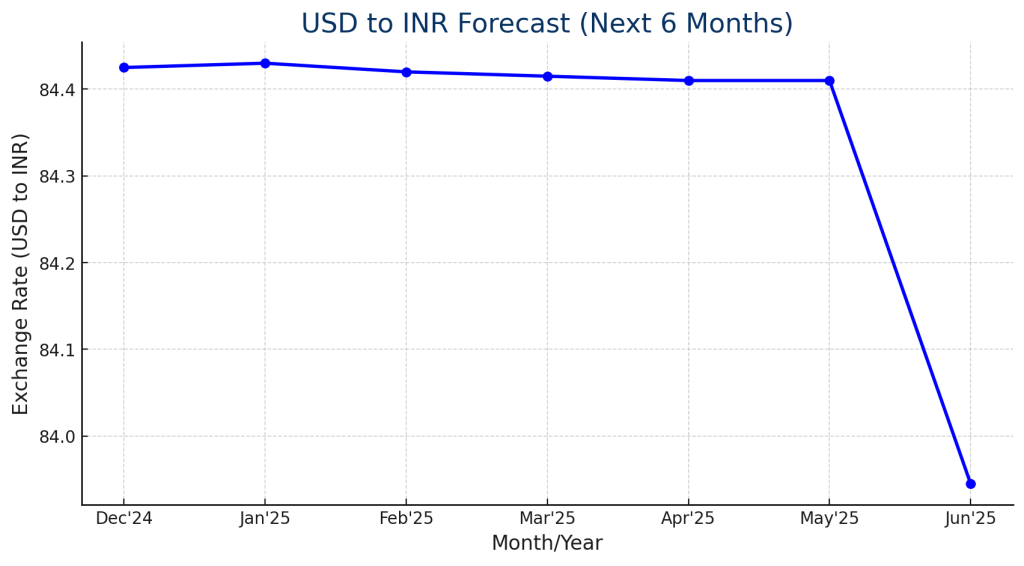

Next 6 Months INR Forecast Against USD

| Month/Year | Low Rate | High Rate | Average Rate | Change |

|---|---|---|---|---|

| Dec’24 | 84.42 | 84.43 | 84.425 | – |

| Jan’25 | 84.42 | 84.44 | 84.43 | 0% |

| Feb’25 | 84.41 | 84.43 | 84.42 | 0% |

| Mar’25 | 84.41 | 84.42 | 84.415 | -0.01% |

| Apr’25 | 84.40 | 84.42 | 84.41 | 0% |

| May’25 | 84.40 | 84.42 | 84.41 | 0% |

| Jun’25 | 83.63 | 84.26 | 83.945 | -0.56% |

Recent Federal Reserve Statements on the Dollar

The Federal Reserve has expressed a cautious outlook on the dollar. On November 7, 2024, the Federal Open Market Committee (FOMC) kept the federal funds rate at 5.25% to 5.5%, citing strong economic activity in the third quarter. This decision highlights the Fed’s careful approach amid economic uncertainties. Additionally, the Fed acknowledged stablecoins as “synthetic dollars.” They noted potential benefits but also stressed the need for proper legislation to ensure their security.

Latest Updates on India’s Banking Sector

The Reserve Bank of India (RBI) recently addressed concerns about the rupee’s exchange rate policy. It emphasized that managing the rupee’s rate hasn’t hurt export competitiveness. Although the rupee’s REER showed a 7.21% overvaluation by October, the RBI noted that export growth now relies on quality and technology rather than undervaluation. From April 2018, exports grew at an annual rate of 5.8%, outpacing the global average. Recently, the RBI intervened to support the rupee amid portfolio outflows and a stronger U.S. dollar.

Live USD to INR Chart

Monitor real-time movements in the USD to INR exchange rate with the interactive chart below:

To use our handy currency converter click here

USD to INR Prediction

As of November 21, 2024, the USD to INR exchange rate is approximately 84.40. Recent forecasts suggest a slight depreciation of the Indian rupee against the US dollar in the near term. For instance, projections indicate the rate could reach around 84.64 by early December 2024.

Historical Exchange Rates

The USD to INR exchange rate has seen significant changes over the years, influenced by economic policies and market dynamics. Below is a summary of the past year’s trends:

| Period | Highest Rate (INR) | Lowest Rate (INR) | Average Rate (INR) |

|---|---|---|---|

| Last 30 Days | 84.481 | 84.045 | 84.229 |

| Last 90 Days | 84.481 | 83.487 | 84.003 |

| Last 1 Year | 84.481 | 82.640 | – |

Understanding Cambridge Currencies

Cambridge Currencies is designed to provide businesses and individuals with competitive exchange rates for USD to INR conversions. Whether you’re sending funds for business transactions or personal needs, Cambridge Currencies offers:

- Transparent and competitive rates tailored for high-value transactions.

- Dedicated account managers to assist with your specific requirements.

- Fast and secure transfers with no hidden fees.

Our goal is to simplify your currency exchange process while ensuring you get the best possible rate. With Cambridge Currencies, you can trust that your transfers are in safe hands.

Comparing US and Indian Economic Indicators

The health of the US and Indian economies directly influences the USD/INR exchange rate. Key indicators include:

| Indicator | US | India |

|---|---|---|

| Interest Rates | 5.25% | 6.5% |

| GDP Growth | 2.1% | 7.0% |

| Inflation Rate | 3.5% | 6.8% |

| Trade Balance | Deficit | Deficit |

Economic Calendar

Stay ahead of market movements with the latest economic events affecting the USD/INR exchange rate:

Timeline of Key Events Impacting USD to INR (2024)

- June 2024: RBI maintains interest rates steady amidst inflation concerns.

- July 2024: US Federal Reserve hikes interest rates, strengthening the dollar.

- August 2024: Foreign portfolio outflows weaken the rupee.

- September 2024: Oil prices spike, increasing pressure on INR due to India’s import dependency.

- October 2024: Geopolitical tensions escalate, boosting USD as a safe-haven currency.

- November 2024: INR stabilises as foreign inflows into Indian markets improve sentiment.

Economic Policies Impacting USD to INR

- RBI Policies:

- RBI’s focus on managing inflation and stabilizing the rupee has included selective interventions in the forex market.

- Introduction of incentives for foreign direct investments during Q2 2024.

- US Federal Reserve:

- Aggressive interest rate hikes throughout 2024 strengthened the dollar, reducing demand for emerging market currencies like the INR.

- Inflation control in the US made the dollar a preferred global currency.

How to Convert USD to INR with Cambridge Currencies

- Sign up on the Cambridge Currencies website and open an account.

- Discuss your exchange needs with a dedicated account manager.

- Secure competitive rates and confirm your transaction.

- Transfer USD to Cambridge Currencies for conversion.

- Receive converted INR in the recipient’s account safely and efficiently.

Payment Methods for USD to INR Transfers: What You Need to Know

Understanding the INR Forecast Against USD is part of your journey. It’s essential to know how to efficiently transfer funds between the U.S. and India. The payment methods you choose can directly impact the speed, cost, and reliability of your transactions. Here’s a breakdown of the most common methods in the U.S. and India, along with how Cambridge Currencies simplifies the process.

Payment Options in the U.S. for Sending USD

- ACH Payments

- Why Use It? Cost-effective and reliable, ACH (Automated Clearing House) transfers are a popular option for sending funds.

- How It Works: Payments are processed in batches, settling within 1–2 business days.

- Best For: Low-cost transactions, recurring payments, and everyday transfers.

- FedWire Payments

- Why Use It? FedWire offers real-time, same-day settlement for urgent or high-value transfers.

- How It Works: Funds move directly between banks, making it a fast and secure option.

- Best For: High-value or time-sensitive transfers.

- Digital Wallets

- Why Use It? Convenient for smaller transactions, digital wallets like PayPal or Venmo work well for casual transfers.

- Downside: High fees for cross-border transfers, making them less ideal for USD to INR payments.

- Credit/Debit Cards

- Why Use It? Easy and widely accepted, but often associated with higher fees for international transfers.

Payment Options in India for Receiving INR

- UPI (Unified Payments Interface)

- Why Use It? UPI enables instant, real-time bank-to-bank transfers using just a UPI ID or mobile number.

- Best For: Everyday, low-value payments.

- NEFT (National Electronic Funds Transfer)

- Why Use It? NEFT handles medium-value transfers, processed several times a day.

- Best For: Scheduled or planned payments.

- RTGS (Real-Time Gross Settlement)

- Why Use It? For large-value transfers, RTGS offers real-time settlement with no delays.

- IMPS (Immediate Payment Service)

- Why Use It? IMPS supports 24/7 instant transfers, including weekends and holidays.

- Cash Deposits

- Why Use It? Useful for informal or emergency transfers directly into a recipient’s account.

How Cambridge Currencies Simplifies USD to INR Transfers

When transferring money with Cambridge Currencies, you can enjoy significant savings on fees and faster payments. Here’s how we make it easier:

- ACH Payments for Lower Costs

- What We Do: Use ACH transfers for everyday payments, minimizing fees and keeping your costs low.

- Why It’s Great: ACH transfers settle within 1–2 business days. They offer reliability at a fraction of the cost of traditional banks.

- FedWire Payments for Urgent Transfers

- What We Do: For large or urgent payments, FedWire ensures same-day settlement.

- Why It’s Great: It’s perfect for high-value transfers that need to move quickly.

- Transparent Fees and Competitive Exchange Rates

- Cambridge Currencies ensures you avoid hidden fees while benefiting from highly competitive USD to INR exchange rates.

- Dedicated Support

- Our experts guide you through the transfer process, ensuring a smooth and stress-free experience.

Choosing the Right Payment Method For USD to INR

- For smaller, less urgent payments, ACH is cost-effective and reliable.

- For high-value or time-sensitive payments, FedWire guarantees speed and security.

- UPI, IMPS, or RTGS ensure fast disbursement of INR within India.

Making the Most of USD to INR Transfers

With the INR Forecast Against USD predicting potential fluctuations, now is the time to streamline your transfer process. Cambridge Currencies offers an unbeatable combination of lower fees, faster payments, and competitive exchange rates.

When you’re ready to transfer funds, trust Cambridge Currencies to handle your payments efficiently. Whether you’re sending money for personal needs or business transactions, we can assist you.

USD to INR Predictions 2024 – FAQs

What will USD to INR be in 2024?

The USD to INR is currently around 84.40. It may rise slightly to 84.64 by December 2024.

Will the INR weaken further in 2024?

The rupee might weaken slightly due to strong US dollar demand, high oil prices, and geopolitical tensions. However, it depends on global conditions.

What impacts USD to INR in 2024?

Key factors include US Federal Reserve policies, foreign investment flows, oil prices, and geopolitical events.

Should I exchange USD to INR now or wait?

If the dollar strengthens further, waiting might result in a better rate for buying INR. Monitor updates closely.

What is the long-term forecast for USD to INR?

The long-term rate depends on India’s economic performance relative to the US. Steady growth in India could stabilize the rupee.

Powered by Cambridge Currencies. Simplifying currency exchanges for businesses and individuals.