send money to south africa

In an increasingly globalized world, the need to send money across borders is more common than ever. Whether you’re supporting family, conducting business, or paying for services, sending money to South Africa can be a necessity.

However, navigating the world of international money transfers can be daunting. With a myriad of services, fees, and regulations to consider, it’s easy to feel overwhelmed.

This comprehensive guide aims to simplify the process. We’ll explore the various methods available, from traditional bank transfers to innovative online services. We’ll also delve into the specifics of sending money from the UK to South Africa, highlighting the most cost-effective options.

Understand the basics of money transfers. Compare different services. Be aware of potential hidden fees. This way, you can ensure your money reaches its destination safely and efficiently.

Whether you’re a seasoned sender or a first-time remitter, this guide will be helpful. It equips you with the knowledge you need to send money to South Africa with confidence.

Why Send Money to South Africa?

Sending money to South Africa serves several important purposes. Individuals and businesses alike find themselves needing to transfer funds across borders.

Many people send money to support their loved ones in South Africa. Families rely on these remittances to cover living expenses, educational costs, and emergencies.

For those with family in South Africa, financial assistance can be vital. Providing regular support helps ensure their welfare and stability.

Besides personal reasons, business transactions also drive money transfers to South Africa. International trade and investments are crucial for economic growth.

Businesses operating with South African partners often require efficient payment solutions. Whether it’s paying suppliers or settling accounts, reliable methods for transferring funds are essential.

In summary, people and companies send money to South Africa for various reasons. It ranges from personal support to complex business dealings. Understanding these motivations helps tailor your approach to transfer needs.

Understanding the Basics of Money Transfers

Navigating the world of money transfers can seem complex. However, understanding the basics can simplify the process significantly.

Traditional bank transfers are a common method for sending money internationally. They are secure but often come with higher fees and slower processing times.

Online services offer an attractive alternative. They provide competitive rates and faster transactions. This efficiency appeals to many users looking for quicker transfers.

Exchange rates play a critical role in cross-border transfers. They determine how much money the recipient ultimately receives. These rates can fluctuate, impacting the final amount received in South Africa.

Transfer fees are another key factor to consider. Both banks and online platforms charge fees for their services. It’s important to compare these costs to determine the most cost-effective option.

Understanding these elements helps in making informed decisions. Choosing the right service depends on your specific needs and priorities for sending money to South Africa.

Choosing the Right Money Transfer Service

Selecting the best money transfer service requires careful consideration. With numerous options available, it’s essential to weigh the pros and cons of each.

Start by comparing different services. Look at aspects like fees, transfer speed, and customer service. Not all providers offer the same benefits.

Online transfer services often stand out for their convenience. They allow you to send money from the comfort of your home. This ease of use is a major advantage for many users.

Furthermore, online services can offer lower fees. They bypass some of the overhead costs associated with traditional banks. This makes them an appealing choice for budget-conscious individuals.

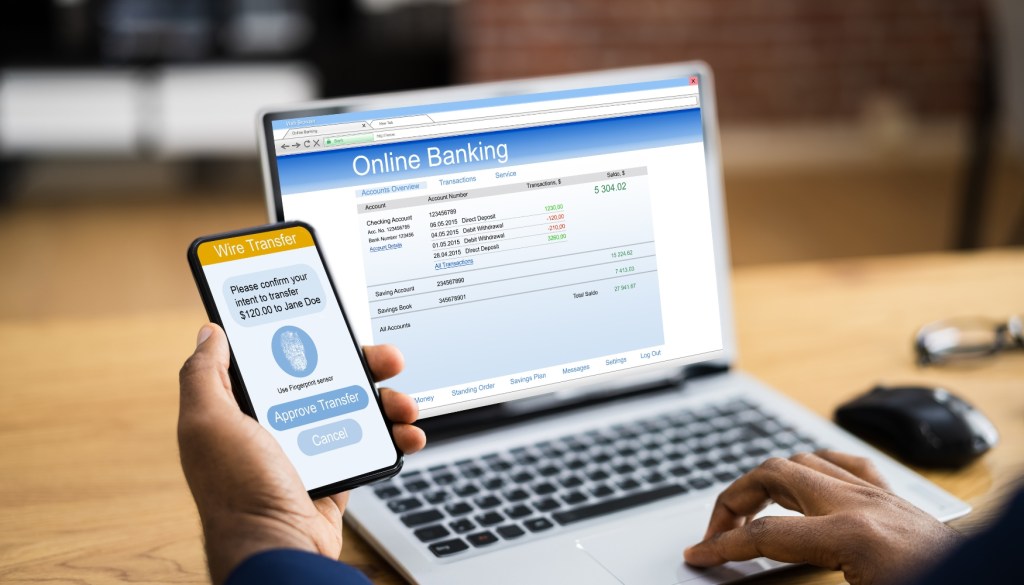

Security is a primary concern when sending money internationally. Ensure the service you choose is reputable and secure. Look for companies that comply with regulations and have strong customer reviews.

Consider the security measures implemented by the provider. Features like encryption, two-factor authentication, and identity verification are crucial. These protect your personal and financial information.

Here’s a quick checklist to help you select the right service:

- Compare fees and exchange rates.

- Check transfer speed and options for urgent transfers.

- Look for robust security features.

- Read customer reviews and ratings.

- Ensure the provider is regulated by authorities.

By following this checklist, you can make a well-informed decision. The right service will provide a balance of cost, speed, and security. With careful evaluation, sending money to South Africa can be a smooth and secure process.

How to Send Money to South Africa from the UK

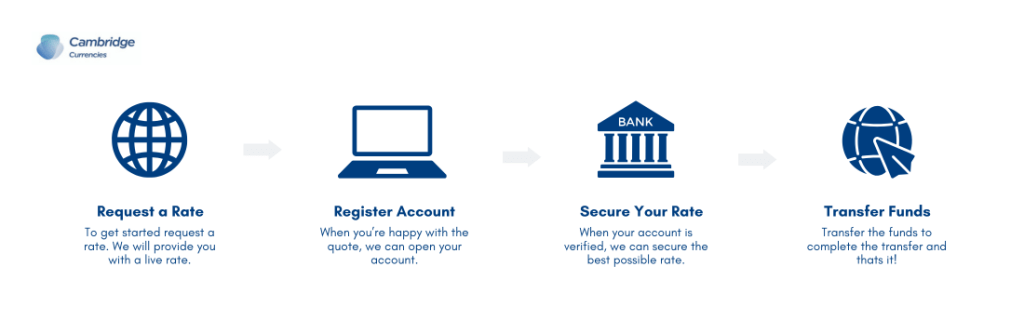

Transferring money from the UK to South Africa can seem daunting. However, understanding the steps involved makes the process straightforward.

First, decide on a money transfer service that suits your needs. Compare different providers based on fees, speed, and exchange rates. This ensures you get the best deal.

Once you’ve selected a service, create an account. Most platforms have a simple registration process. You’ll typically need to provide identification and proof of residence.

Next, link your UK bank account or debit card to the transfer service. This step is crucial for transferring funds securely. Ensure you have accurate details to avoid delays or errors.

The Financial Conduct Authority (FCA) regulates money transfer services in the UK. Check that the provider complies with these regulations. This ensures your funds are handled safely and legally.

Opting for cheaper transfer methods can save you money. Consider online transfer services that offer competitive rates compared to banks. These providers often reduce transfer fees, making them a cost-effective choice.

By following these steps, sending money to South Africa from the UK becomes less complex. Ensuring compliance with FCA regulations adds an extra layer of security. With careful planning, you can transfer funds efficiently and economically.

Avoiding Hidden Fees and Ensuring the Best Rates

Understanding all potential fees is key to a cost-effective money transfer. Some fees are hidden and can inflate the cost without notice.

Hidden fees often come in the form of exchange rate markups. Transfer services might promote low transfer fees while disguising costs in unfavorable exchange rates.

When comparing services, pay attention to both flat fees and percentage-based fees. A flat fee remains the same regardless of the amount sent, while percentage fees vary with the transfer amount.

List of fees to watch for:

- Exchange rate markups

- Service charges

- Receiving fees

- Processing fees

Securing a favorable exchange rate is crucial. Many providers allow you to lock in a rate at the moment of transfer initiation. This tactic can shield you from fluctuating currency markets.

Always review the provider’s terms to ensure transparency. Opt for services that offer full visibility into fees and rates upfront. This transparency helps you make informed decisions, ensuring your funds reach South Africa without unexpected costs.

Speed and Convenience: Sending Money Quickly

Time is often of the essence when sending money to South Africa. Whether for business needs or urgent family support, speed can be vital.

Fast transfers ensure that the recipient has quick access to funds. This reduces stress and helps manage unexpected expenses effectively.

Mobile apps simplify and accelerate the money transfer process. They allow users to send money from almost anywhere with just a few taps. Their user-friendly interfaces and real-time updates enhance the entire experience.

Several services offer same-day transfer options for those in a hurry. These services may come with higher fees, but they are invaluable when time is a priority.

Opting for a reliable provider ensures that funds are delivered swiftly and securely. It’s always wise to confirm the transfer time frames upfront to avoid any surprises.

Cash Pickup and Other Receiving Options in South Africa

When sending money to South Africa, choosing the right receiving method is crucial. Options range from traditional bank accounts to more modern solutions like mobile wallets.

Bank account transfers are a straightforward method. Funds go directly to the recipient’s account, which is secure and convenient. However, this option may not suit those without a bank account.

For those who prefer cash, cash pickup locations are widely available. Recipients can collect their money from designated agents, a handy option for unbanked individuals.

Mobile wallets offer a flexible alternative. They allow funds to be transferred and used via a smartphone, expanding financial inclusion. Recipients can pay bills or make purchases without needing cash.

Each option comes with its own set of benefits and considerations. When selecting, think about the recipient’s needs and their access to technology and banking facilities.

Keeping Track: Receipts, Records, and Notifications

Tracking transfers is vital for both senders and recipients. Knowing where your money is in the process provides peace of mind.

Receiving timely notifications keeps you informed of transfer status changes. Most services offer alerts via text or email, which helps monitor the progress.

Retaining detailed records of all transactions is good practice. These documents can resolve disputes or issues and provide proof of your financial activities. Always save receipts for future reference.

Conclusion: Making an Informed Choice

Sending money to South Africa involves several factors. Key points include understanding transfer methods, comparing fees, and choosing reliable services.

It’s crucial to review all available options and select the best fit for your needs. Consider speed, convenience, and security when deciding.

Finally, ensure a smooth transfer by confirming all details before sending. Stay informed about any changes in regulations or fees, and keep records handy for reference. Making an informed decision leads to successful and stress-free transactions.

FAQs About Sending Money to South Africa

When transferring funds to South Africa, common questions arise. Many wonder about the best service to choose and how to ensure secure transactions.

For further assistance, there are numerous resources online. Many money transfer services offer detailed FAQ sections and customer support to guide you.

Here are some frequently asked questions:

1. How long does it take to transfer money to South Africa?

Transfers to South Africa typically take 1 to 3 business days, depending on the service provider and payment method. Some services offer express options for same-day transfers, but these may come with higher fees.

For more details on transfer speeds and options, visit our Transfer Speeds and Options section.

2. What are the costs associated with money transfers?

The cost of transferring money varies by provider but typically includes:

- Transfer fees: Fixed charges or a percentage of the transfer amount.

- Exchange rate margins: The difference between the market rate and the rate offered by the provider.

- Intermediary bank fees: Charged by banks involved in the transaction.

To compare costs and learn how to avoid hidden fees, check out our Fees and Charges section.

3. Are there limits on the amount I can send?

Yes, most providers have limits on the amount you can send. These limits vary based on:

- The provider’s policies

- The payment method used

- Local regulations in South Africa

If you need to send larger amounts, some providers offer higher limits. Alternatively, they allow you to split the transfer into smaller amounts. For specific details, see our Transfer Limits section.

Understanding these answers can help make the process smoother and more predictable.