Currency Exchange Cambridge

Currency exchange in Cambridge can feel overwhelming, especially if you’re new to it or visiting a place for the first time. Cambridge, known for its historic university and rich history, draws both tourists and students. Whether you’re traveling or living in Cambridge, it’s helpful to understand how currency exchange works. In this guide we will compare the best money exchange Cambridge and find the right option for you.

Understanding Currency Exchange

Currency exchange means swapping one currency for another. This can be for travel purposes, international business transactions, or online shopping from overseas retailers. It might seem simple, but many things can affect how much money you get after an exchange.

Exchange Rates

The exchange rate is how much one currency is worth in another. Exchange rates change due to things like inflation, interest rates, and political events. It’s important to check the current rates before making any exchange to ensure you’re getting a fair deal.

Transaction Fees

Most currency exchange places will charge a fee. This fee can be a flat rate or a percentage of the transaction amount. Always inquire about any hidden fees that might apply to avoid surprises.

Money Exchange Options in Cambridge

Cambridge has many currency exchange options, each with its pros and cons. Here’s a breakdown of some popular choices.

Banks

Banks are a reliable option for currency exchange. They offer good rates and the safety of a trusted bank. However, they may charge higher fees than other services, and not all banks exchange every type of currency.

Currency Exchange Offices

You’ll find plenty of currency exchange offices in Cambridge, especially in tourist spots. These offices focus on foreign currency and usually have better rates than banks. But it’s important to compare rates at different places to get the best deal.

Online Currency Exchange

With the rise of digital banking, online currency exchange services have become increasingly popular. These platforms give you good rates and let you exchange money right from home. But they might take longer to process transfers.

ATMs

Using an ATM is a convenient way to get local currency. Many ATMs in Cambridge allow you to withdraw money in pounds using your home country’s bank card. Be aware of foreign transaction fees and currency conversion charges that your bank might impose.

Tips for Currency Exchange in Cambridge

To get the most out of your currency exchange in Cambridge, consider the following tips:

Plan Ahead

Understanding how much money you need and the current exchange rate can help you avoid last-minute exchanges at poor rates.

Avoid Airport Exchanges

Currency exchange kiosks at airports often have higher fees and less favorable rates. If possible, exchange your money before arriving in Cambridge or in the city center.

Use a Currency Converter

A currency converter tool can help you quickly determine how much money you’ll receive after the exchange. A local business owner sent money to pay suppliers abroad.

Keep an Eye on Exchange Rates

Exchange rates change all the time. Keeping an eye on changes can help you exchange money when the rates are better.

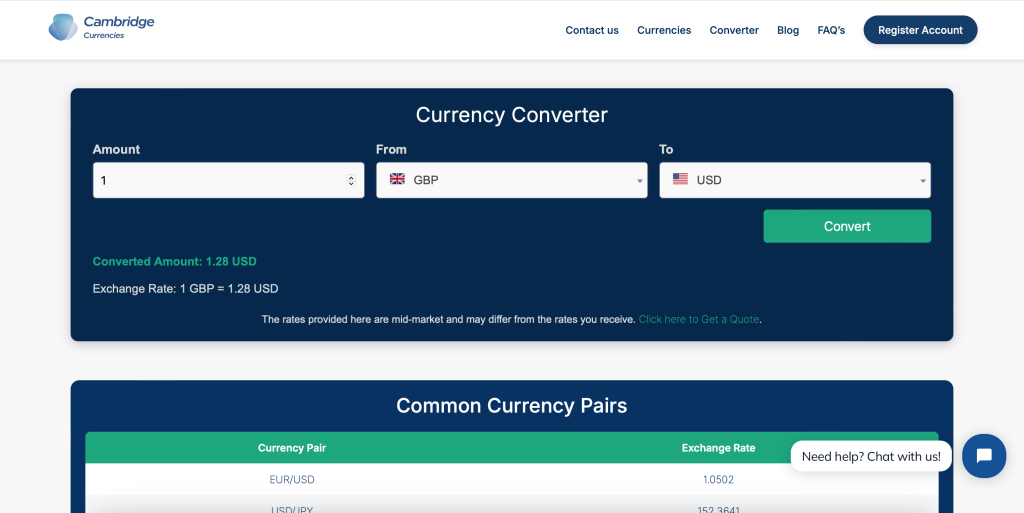

Currency Converter Tools

A currency converter helps you figure out how much one currency is worth in another. These tools are readily available online and through smartphone apps, making it easy to check rates on the go.

How to Use a Currency Converter

- Pick the currency you have and the one you want to switch to.

- Enter the amount: Type in the amount of money you wish to convert.

- Get the result: The converter will display the equivalent amount in the desired currency.

Benefits of Using a Currency Converter

- Live Rates: Most converters update instantly to give accurate exchange rates.

- User-Friendly: These tools are designed to be simple and easy to use.

- Saves Money: Comparing rates helps you pick the best service for your budget.

Large Money Transfers in Cambridge

Transferring large amounts of money needs extra care and expert handling. Handling large sums, like buying property or paying for education, needs careful planning. This is where Cambridge Currencies can make a significant difference.

Why Choose Cambridge Currencies for Large Transfers?

Cambridge Currencies focuses on making large money transfers safe and easy. They offer great rates and friendly service to take care of your transfers. Here’s why Cambridge Currencies is an ideal partner for large transfers:

- Competitive Exchange Rates: Large transfers often come with better rates than smaller transactions. Cambridge Currencies uses its know-how to get great rates for big transfers, saving you money.

- Dedicated Support: Handling large sums can be tough, but Cambridge Currencies gives you an account manager to help. You’ll get expert advice every step of the way, from market trends to timing your transfer.

- Secure Transactions: Security is paramount when dealing with large money transfers. Cambridge Currencies uses trusted systems to make sure your money stays safe.

- Custom Solutions for Unique Needs: No two transfers are the same, especially for large amounts. Cambridge Currencies lets you choose options for one-time or repeat transfers.

Tips for Large Money Transfers

To make the most of your large money transfers, keep these tips in mind:

- Plan Ahead: Timing is crucial for large transfers. Keep an eye on exchange rates and make your transfer when the rates look good.

- Avoid Hidden Fees: Ask for a clear list of all fees so there are no surprises.

- Consider Forward Contracts: Cambridge Currencies lets you lock in a good exchange rate now for future transfers. This helps shield you from market changes and keeps costs predictable.

- Know Your Limits: Check your bank’s limits to avoid delays or problems with your transfer.

Real-Life Examples of Large Transfers

Cambridge Currencies has helped many people with simple and smooth large money transfers. For example:

- Property Purchases Abroad: A couple moving from Cambridge to Canada used Cambridge Currencies and saved thousands on their property purchase.

- Business Payments: A local business owner sent money to pay suppliers abroad. Cambridge Currencies made the process easy, saving time and cutting costs.

Conclusion

Currency exchange in Cambridge doesn’t have to be a complex process. Know your options. Use the right tools. You can make smart choices to get the most value for your money.

Whether you’re a tourist or a resident, these insights can help you navigate currency exchange with confidence and ease.

Be sure to compare rates, plan ahead, and use currency converters to help with budgeting. Safe travels and happy spending in Cambridge!