Send Money to America from the UK: A Simple Guide

If you’re looking to send money to America from the UK, you’re not alone. Transferring funds overseas can be simple, whether for personal needs, property purchases, or business ventures. In this blog, we’ll guide you through the process, highlight cost-effective options, and share tips to make your transfer smooth and secure.

We’ll also delve into the costs involved. Understanding fees and exchange rates is crucial to getting the best deal.

Finally, we’ll provide practical advice. This includes how to avoid scams and ensure a smooth transfer process.

This guide will help you with international money transfers, whether you’re supporting family, paying for services, or settling bills.

Send Money to America from the UK

Easily Send Money to America from the UK just get a free quote.

Understanding the Basics of International Money Transfers

Sending money internationally involves several key elements. It’s important to understand these to navigate the process smoothly.

Firstly, you need to consider exchange rates. These rates affect how much the recipient will actually receive.

Next, transfer fees come into play. Different services have varying costs for sending money overseas.

Additionally, the method of transfer affects speed and cost. Options include bank transfers, online services, and money transfer agencies.

Consider security and compliance. Always use trusted, regulated services to protect your funds.

Here’s a quick checklist for transferring money internationally:

- Check current exchange rates.

- Compare transfer fees.

- Choose a transfer method.

- Ensure the service is secure and compliant.

Understanding these basics can save you both time and money. Being informed helps avoid common pitfalls.

Why Send Money to America from the UK?

People transfer money overseas for various reasons. Supporting family and friends is a common motivation.

Payments for services, businesses, or investments also drive transfers. Understanding your purpose helps in selecting the right method.

Choosing the correct service can offer more than convenience. It can ensure your hard-earned cash gets to its destination quickly.

Currency Exchange Rates Explained

Currency exchange rates are central to international transfers. They determine how much money the recipient will get.

Rates fluctuate due to economic factors. These include inflation, interest rates, and market stability.

Staying aware of rate trends can be beneficial. Timing your transfer might save money if rates are favorable.

To make the most of your money, compare exchange rates from different services. Small differences can impact the total received.

Transfer Fees and Hidden Costs

Transfer fees can significantly affect your transaction. Banks and services often charge fees for sending money.

Fees can be flat-rate or percentage-based. Always check both to understand the total cost.

Some services might have hidden costs. Look for terms like “exchange rate margin” that can add to the expense.

To avoid surprises, read the fine print. Understanding the full cost upfront prevents unexpected charges.

Comparing options can help identify the most cost-effective choice. Many platforms now offer fee calculators for transparency.

Send Money to America from the UK

Easily Send Money to America from the UK just get a free quote.

Choosing the Right Money Transfer Method

Selecting the proper method for sending money is crucial. Factors like cost, speed, and convenience play a major role.

Banks offer traditional transfer services. However, they might be slower and incur higher fees compared to digital methods.

Online services and mobile apps offer competitive rates and speed. These modern solutions are increasingly popular for their ease of use.

Each method has unique advantages and considerations. Here’s a breakdown to help you decide:

- Bank Transfers: Reliable but can be costly and slow.

- Online Services: Competitive rates, fast, and user-friendly.

- Mobile Apps: Convenient for on-the-go transfers.

- Transfer Agencies: Offer cash pickups, useful where bank access is limited.

Evaluating these options based on your needs ensures effective international transactions.

Bank Transfers and the SWIFT Network

Banks leverage the SWIFT network for international transactions. This network securely connects thousands of financial institutions globally.

Bank transfers are generally secure and reliable. However, they may take several business days to process.

Banks charge fees for their services, sometimes with additional exchange rate margins. It’s wise to check these costs before proceeding.

Online Money Transfer Services

Online services have transformed global money transfers. Companies like Cambridge Currencies l provide fast, affordable options.

These services allow transfers directly from your bank account or credit card. They’re popular for their competitive exchange rates and transparency.

Using online platforms is simple. Set up an account, enter recipient details, and transfer the funds.

Mobile Apps for Quick Transfers

Mobile apps bring the convenience of quick transfers to your fingertips. Apps like Revolut and PayPal offer swift services anywhere with internet access.

These apps often provide competitive rates and lower fees. Some even allow transfers without a traditional bank account.

Security is a top priority for mobile transfer apps. Most use encryption and other technologies to keep your data safe.

Money Transfer Agencies and Cash Pickup

Transfer agencies facilitate cash pickups, making them ideal for recipients without bank accounts. Companies like Western Union and MoneyGram dominate this sector.

They provide extensive global networks, reaching areas other services may not. This makes them highly accessible for many users.

However, fees can be higher for cash pickups. Comparing costs ahead of time ensures you get the best deal. Agencies also offer the benefit of transactions in person, if desired.

How to Send Money to America for Free or at Low Cost

Sending money internationally doesn’t have to break the bank. Several methods can help you minimize fees and maximize value.

Online services often provide competitive rates. They might waive fees for first-time users or offer promotions. Look for these opportunities to save money.

Bank transfers can sometimes be free. Certain banks offer free international transfers for premium account holders. It’s worth checking your bank’s offerings.

Additionally, using fx comparison sites will give you access to the whole market and you may want to check rates with other providers, you can do this here.

Key strategies to save on transfers:

- Promotions: Use first time offers from online platforms.

- Bank Offers: Check your bank for free transfer conditions.

- Peer-to-Peer Platforms: Explore currency swaps with minimal fees.

- Multi-Currency Accounts: Avoid conversion fees by holding currency in advance.

Combining these approaches can reduce the expense of cross-border transactions significantly.

Comparing Costs and Speed of Services

Different services vary not only in price but also in delivery speed. Fast transfers can incur higher fees, while economy transfers might take longer.

When speed is a priority, mobile apps and online services can offer near-instant transfers. However, the trade-off is often a higher fee.

It’s essential to compare the exchange rates, fees, and delivery times of each service. Doing so ensures you make an informed decision without surprises.

Send Money to America from the UK

Easily Send Money to America from the UK just get a free quote.

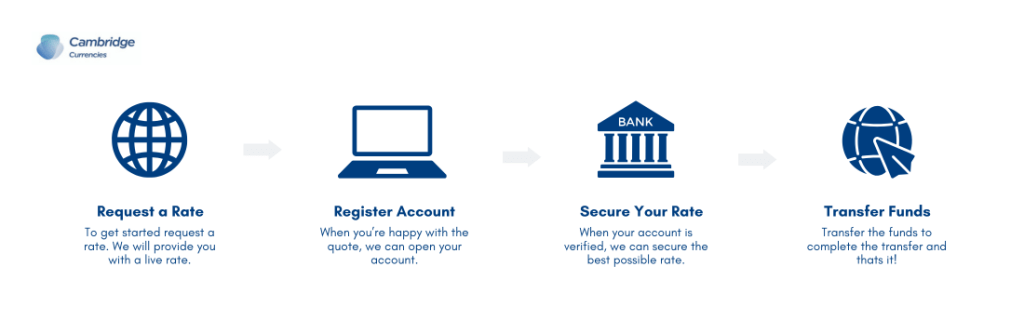

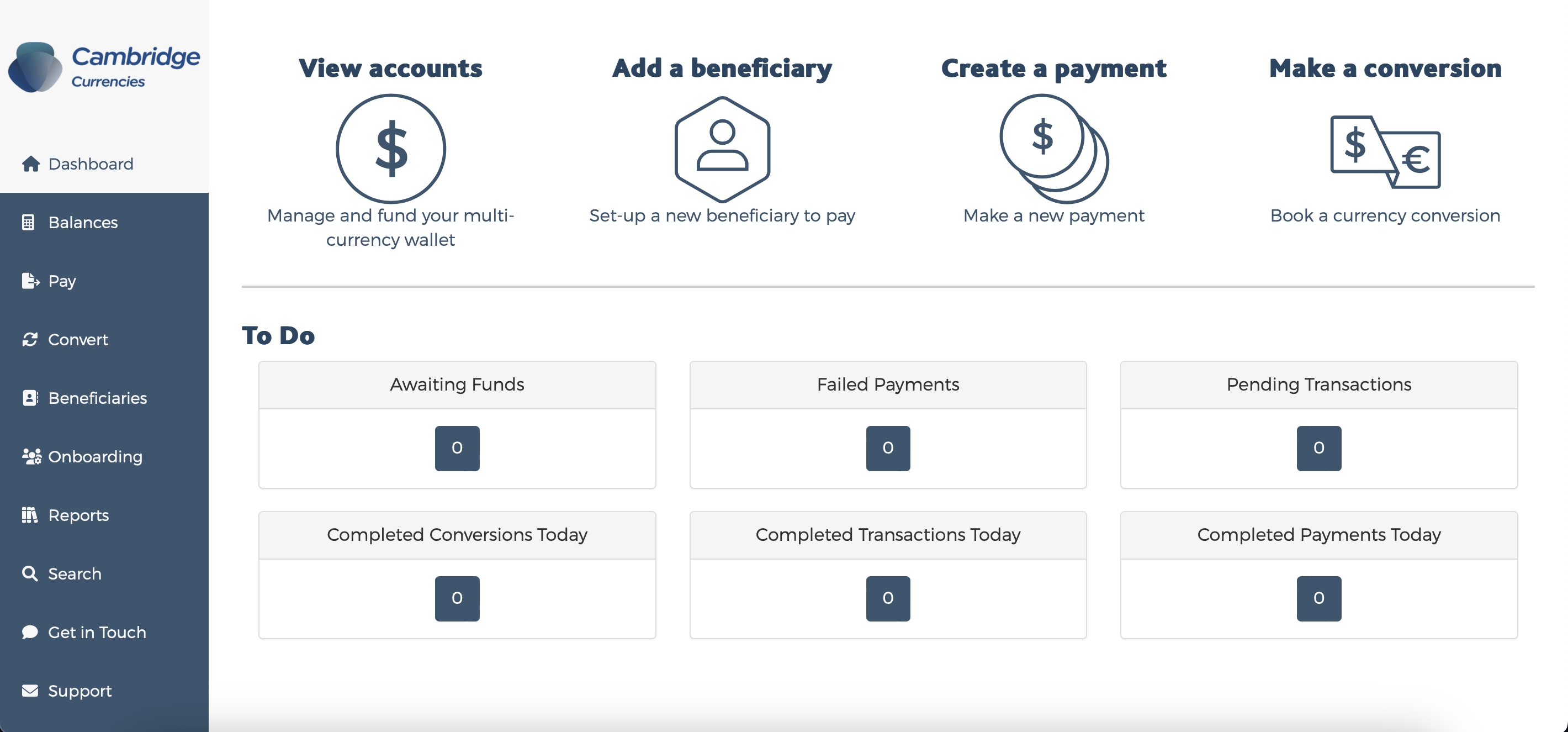

Step-by-Step Guide to Transferring Money with Cambridge Currencies

Making an international transfer doesn’t have to be complicated. Follow this simple guide for a smooth process:

- Choose Your Service

Decide on the best transfer option with Cambridge Currencies. Consider costs, speed, and convenience. - Set Up Your Account

Register with us and complete the verification process. This is quick and straightforward. - Provide Recipient Details

Enter the recipient’s information carefully. Double-check for accuracy to avoid delays. - Confirm and Transfer

Review the transfer details, confirm the amount, and send. Keep a record of the transaction for reference.

Quick Checklist:

- Select Your Transfer Option: Compare rates and services.

- Create an Account: Register and verify your details.

- Enter Recipient Info: Ensure accuracy.

- Review and Send: Save transaction details.

Tips for Reducing Transfer Costs

Minimizing transfer costs is a common goal. Several practical tips can help achieve this objective.

Firstly, plan transfers ahead of time. This avoids rush fees often charged for expedited services.

Secondly, monitor currency exchange rates. Transferring when rates are favorable can save money over time.

Lastly, consider building up funds before transferring. Sending larger amounts less frequently can reduce the fees you pay.

By adopting these strategies, you can reduce the overall costs associated with international money transfers effectively. This proactive approach helps in keeping more money in your pocket.

Security and Compliance in Money Transfers

Security is crucial when sending money internationally. Ensuring safe transfers protects your finances and personal data.

Many transfer services employ encryption to safeguard transactions. This process encodes your details, preventing unauthorized access. Always choose platforms that prioritize robust security measures.

Compliance with regulations also matters. Legitimate services follow laws aimed at protecting consumers. Verifying a service’s compliance can provide peace of mind.

It’s wise to monitor your transfers. Notifications from your service can alert you to suspicious activity. Prompt action can mitigate potential threats.

Avoiding Scams and Fraudulent Services

The risk of fraud exists but can be minimized with caution. Scammers often target those unfamiliar with digital transfers. Stay informed to avoid falling prey.

Research the transfer service before use. Read reviews and ensure that they have a solid reputation. A few minutes of research can save significant amounts of money.

Avoid sharing personal details with unverified sources. Scammers often impersonate legit services. If unsure, directly contact the service provider using official contact details.

Stay wary of offers that seem too good to be true. High returns or low fees may hide scams. It’s best to rely on well-established providers.

Regulatory Aspects and Anti-Money Laundering

Regulations play a key role in international money transfers. They aim to prevent money laundering and protect consumers from fraud.

Financial institutions must comply with KYC (Know Your Customer) protocols. This involves verifying the identity of their customers. While it might seem confusing why it just means your funds are secure.

AML (Anti-Money Laundering) regulations are crucial too. These regulations help detect and report suspicious activities. They are vital in preventing illegal transactions.

Understanding these regulations can enhance the security of your transfers. It emphasizes the importance of using compliant services, ensuring your money is in safe hands. Checking a service’s compliance status can prevent potential issues.

Send Money to America from the UK

Easily Send Money to America from the UK just get a free quote.

Additional Considerations for Sending Money to America

When sending money to America, there are several factors to consider to ensure a smooth transaction. First, understand the service provider’s terms regarding transfer limits and fees. This knowledge can help in planning your transfers effectively.

Every transfer service has different rules and limitations. Familiarize yourself with these to avoid unexpected delays or additional costs. Moreover, some services may require extra documentation for larger sums.

Secondly, consider the time it takes for the money to reach America. Transfer times can vary widely depending on the method and service used. It’s advisable to plan ahead, especially if timing is crucial.

Here’s a short checklist for sending money to America:

- Review transfer fees and exchange rates.

- Check transfer limits and necessary documentation.

- Compare transfer times between providers.

- Ensure the recipient’s details are correct.

- Monitor the transfer process until completion.

Impact of Transfer Limits

Transfer limits can affect how you send money abroad. These limits vary between services and can impact larger transactions. Knowing your provider’s limits helps you plan transfers better.

Transferring smaller amounts can avoid hitting these limits. However, some services might allow limit increases. It’s wise to inquire if you need to transfer larger sums.

Understanding these limitations ensures compliance with regulations. Exceeding limits could halt transfers or require additional verification. Always verify with your provider to prevent issues.

Tax Implications and Reporting Large Transfers

Sending large amounts to America may attract tax scrutiny. Different jurisdictions have varying tax implications. Knowing these rules can help you avoid unexpected tax liabilities.

It’s important to report significant transfers accurately. Doing so ensures compliance with both UK and US regulations. Keeping records of all transactions can simplify reporting and auditing.

Consult a tax advisor if unsure about implications. They can offer guidance tailored to your situation, ensuring you meet all legal obligations. This advice can save both time and potential penalties.

Tracking Your Money Transfer

Keeping track of your transfer is essential for peace of mind. Most services offer real-time tracking features. These updates ensure you know your money’s status at every step.

Notifications and alerts can inform you when the transfer is complete. This confirmation is crucial, especially for significant amounts. It reassures both the sender and recipient.

If any issues arise, contact customer support promptly. Having all transaction details handy can assist the support team. This step ensures quick resolution of any queries or problems.

Conclusion and Final Tips

Sending money to America from the UK involves careful planning and informed decisions. Choose a service that aligns with your needs while considering costs and speed. Stay vigilant for any changes in regulations that might affect your transfer.

It’s crucial to prioritize security when transferring money internationally. Always verify your chosen service. A cautious approach ensures a secure and efficient transfer process.

Choosing the Best Service for Your Needs

Selecting the ideal money transfer service depends on various factors. Analyze costs, transfer times, and customer support. Opt for a service with competitive rates and a solid reputation.

Consider the recipient’s convenience as well. Services with flexible options, such as bank deposit or cash pickup, can be more beneficial. Your choice should align with both your needs and those of the recipient.

Staying Informed and Planning Ahead

Keeping updated on financial trends can enhance your transfer’s efficiency. Exchange rates fluctuate; staying informed lets you transfer when rates are favorable. This knowledge can lead to significant savings over time.

Plan your transfers in advance to avoid last-minute hiccups. This approach leaves room to resolve unexpected issues. Moreover, advance planning helps in choosing the most cost-effective options available.