Top Methods for Transferring Money to Germany

Sending money to Germany doesn’t have to be complicated. Whether you’re helping family, paying for services, or handling business needs, there are plenty of easy and reliable options. This blog covers the top methods for transferring money to Germany, so you can find the one that suits your needs best. Let’s get started!

This guide is for anyone sending money to Germany—expats, students, businesses, or those helping loved ones. We’ll delve into the nuances of international money transfers, helping you navigate the process with ease.

We’ll also provide tips on how to get the best exchange rates and minimize fees. This way, you can ensure that more of your money reaches its destination.

So, if you’re looking to transfer money from England to Germany, or from any other country, stay tuned. This guide will help you make smart choices when sending money to Germany. Let’s get started.

Send Money to Germany From UK

Looking to Send Money to Germany From UK?

Understanding International Money Transfers

Understanding international money transfers is crucial for anyone wanting to send money to Germany. It involves moving funds from one country to another, often involving currency exchange.

The key to a successful transfer lies in selecting the right method. Several options are available, each with its own advantages.

The process usually starts with choosing between traditional banks, online transfer services, and mobile apps. Each of these methods offers different features and costs, impacting your overall experience and expenses.

Currency exchange rates significantly affect the final amount received. Understanding how these rates work can help you make better decisions. High fees and poor rates can eat into your funds, making it essential to be informed.

Here’s a quick guide to what you should consider:

- Transfer speed: How fast the money will reach Germany.

- Fees: The cost of the transfer process.

- Exchange rates: Rates at which your currency is converted.

- Security: Measures in place to protect your money.

Researching different services can help you find the best match for your needs. Comparing their features is crucial to avoid unnecessary costs and delays. Staying informed helps ensure your money reaches its destination efficiently and safely.

Traditional Bank Transfers and Their Fees

Traditional bank transfers involve using banks to send money internationally. This method is reliable but often costly. Banks typically charge high fees for international transfers.

The transfer process can be slow, especially when compared to online services. This delay can range from a couple of days to a week.

Banks use the SWIFT network for these transactions. It’s a secure method but can incur additional hidden costs. Always check the bank’s fees and compare them with other options. Look for potential hidden charges linked to exchange rates.

Online Money Transfer Services

Online money transfer services are popular for their speed and efficiency. These platforms offer lower fees compared to traditional banks. Companies like Wise, PayPal, and Revolut are well-regarded in this arena.

Using these platforms allows you to send money with ease, often from the comfort of your home. Transactions are typically processed faster, arriving in a day or even within hours.

Exchange rates on these platforms are often more favorable. Online services often offer real-time tracking and customer support, adding to their appeal. Exploring various services can help you find the most cost-effective solution.

Mobile Apps for Money Transfers

Mobile apps offer a convenient way to send money to Germany. Many online transfer services have companion apps, making transfers accessible on the go.

These apps bring all the features of online platforms to your smartphone. With a few taps, you can initiate transfers, monitor their progress, and manage your account.

Security is a priority, with most apps employing encryption and biometrics. Mobile apps often offer competitive exchange rates and lower fees than banks. As mobile technology advances, these apps are becoming more user-friendly and secure, providing a seamless transfer experience.

How to Transfer Money from England to Germany

Sending money from England to Germany can be straightforward and economical. A variety of options cater to different needs, offering varied costs and speeds.

Firstly, consider your priorities: speed, low fees, or exchange rates. Each method serves different preferences. Knowing what matters most to you will guide your choice.

Here is a simple guide to help you transfer money effectively:

- Select a provider: Choose between banks, online services, or mobile apps.

- Compare costs: Check fees and exchange rates to get the best deal.

- Verify details: Ensure recipient information and amounts are accurate.

- Select payment method: Choose how you’ll pay: bank transfer, card, or cash.

Send Money to Germany From UK

Looking to Send Money to Germany From UK?

Keeping track of the process is important. Most services offer tracking features that let you monitor the status of your transfer. This transparency gives peace of mind, knowing when your funds arrive.

Each method has its pros and cons, so research thoroughly. Compare options to find a service that fits your needs, making transfers to Germany easy.

Step-by-Step Guide for Online Platforms

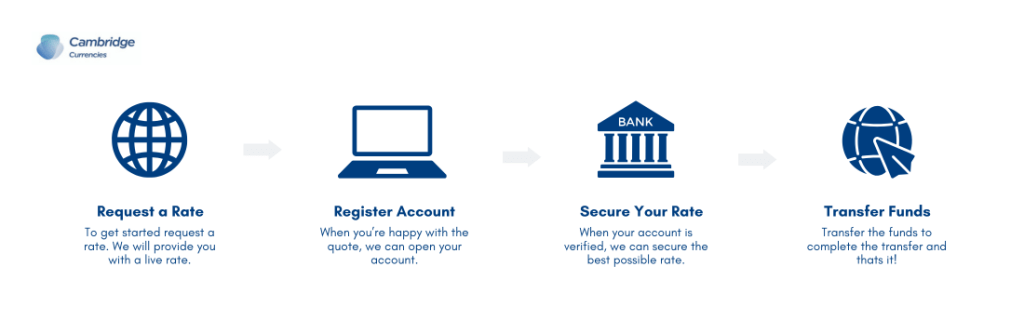

Using online platforms for money transfers can be quick and convenient. To get started, follow these straightforward steps:

Start by creating an account with your chosen money transfer service. Look for services with strong reviews and low fees. You will need to provide personal details and a form of identification. Once your account is set up, you can start a transfer.

Next, enter the recipient’s information carefully. You’ll need to provide details such as their name and bank account number. Always double-check this information to ensure there are no errors. Enter the amount you wish to send.

Select your payment method from options such as bank transfer, debit card, or credit card. Be aware that each option may carry different fees.

Finally, confirm the transaction. Review all the details, including the fees and exchange rate. Once satisfied, proceed to make the transfer. You’ll typically receive a notification, and you can track your transaction until completion.

Comparing Exchange Rates and Fees

Making informed decisions on exchange rates and fees can save you money. Rates and fees can vary greatly, impacting how much your recipient gets.

Begin by checking the exchange rate offered by your selected transfer service. Small differences can add up, affecting the overall cost of your transaction. Many services provide competitive rates, but it’s essential to compare them with other providers.

Equally important are the fees charged per transfer. These fees can include flat fees or percentages of the total amount. Some services offer lower fees for larger transfers or specific payment methods.

To help streamline your choice, consider the following factors:

- Rate margins: Understand how close the rate is to the real market rate.

- Service fees: Check if there are any fixed costs for processing the transfer.

- Hidden costs: Look for any additional fees not immediately apparent.

Choose low fees and good exchange rates to send the most money to Germany. By keeping these factors in mind, you will maintain more control over the cost-effectiveness of your transfers.

Sending Large Sums of Money to Germany

Transferring large sums to Germany comes with its own set of challenges and considerations. One primary concern is ensuring you get a favorable exchange rate. Even a small difference in rates can significantly impact the amount received.

When dealing with substantial amounts, the transfer process and fees can differ. Some services offer better rates or lower fees for large transactions. Comparing these benefits is crucial before starting a transfer.

It’s also important to consider the security of your transfer. Selecting a reputable service with robust security measures is essential. This ensures your money reaches the recipient safely and securely, without unexpected issues. Always ensure the service complies with international financial regulations.

The Role of Foreign Exchange Brokers

Foreign exchange brokers play a vital role in transferring money internationally, especially for large sums. They offer personalized services, focusing on securing the best rates and managing risk. By using a broker, you can benefit from market expertise and guidance.

These brokers provide tailored solutions that standard banks might not offer. Their ability to negotiate on your behalf means you could receive a more favorable rate than with typical providers. This can be crucial when converting sizable amounts.

Finally, brokers can offer additional services like forward contracts and spot transfers. Forward contracts allow you to lock in a rate, protecting against market fluctuations. Understanding and utilizing these services can save money and provide peace of mind.

Understanding Transfer Limits

Every money transfer service imposes limits on the amounts you can send. These limits can vary depending on the provider, the method used, and even the recipient country. Knowing these restrictions helps you plan your transfers effectively.

Limits can be a deciding factor when choosing a service. Some providers cater specifically to large transfers, offering higher maximum limits. Others might impose lower ceilings, particularly if they focus on smaller, quick transfers.

Additionally, limits might differ based on whether the transaction is one-off or recurring. Understanding how these affect your transfer can help prevent delays and ensure your transaction is processed smoothly. Always confirm the exact limits with your provider before proceeding.

Send Money to Germany From UK

Looking to Send Money to Germany From UK?

Emergency Cash Transfer Options to Germany

In urgent situations, speed becomes a priority when sending money to Germany. Several services specialize in rapid transfers, delivering funds within minutes. These options are invaluable when recipients face immediate financial needs.

Western Union and MoneyGram are popular choices for emergency cash transfers. They offer extensive networks, allowing you to send money quickly to thousands of locations. These companies prioritize speed, often at the cost of higher fees.

It’s crucial to weigh the balance between speed and cost when selecting a service for emergency transfers. While some options might charge more, they guarantee swift delivery. Always verify the service’s reliability and security to ensure your funds reach the destination safely. Check customer reviews and feedback for peace of mind before proceeding.

The Impact of Brexit on Money Transfers to Germany

Brexit has introduced uncertainties in financial relations between the UK and EU countries, including Germany. Currency movement has been one of the primary concerns for those transferring money. Fluctuations in the value of the British pound can significantly affect the total amount received in euros.

Additionally, regulatory changes may influence fees and processing times for money transfers. As the UK and EU continue to navigate their post-Brexit relationship, financial regulations could change. Such changes may impact the ease and cost of sending money from England to Germany.

Despite these challenges, many money transfer services have adapted to the new landscape. They aim to minimize disruption by updating their processes and fee structures. It’s advisable to stay informed about the latest developments. Keeping abreast of changes can help you make well-informed decisions when transferring money in the post-Brexit era.

Tips for Getting the Best Exchange Rates

Securing the best exchange rate can make a significant difference in the amount received in Germany. Timing is key when it comes to currency fluctuations. Monitoring the exchange rate trends can help you send money when rates are favorable.

Comparison tools are valuable in this process. These tools provide an overview of the current rates offered by various services. They can quickly show you where the best rates are available, saving time and potentially lowering costs.

Another effective method is to set up rate alerts with transfer services. These alerts notify you when the exchange rate reaches your desired level. Stay alert to get the best rates and ensure your recipient gets the most value.

Avoiding Hidden Fees and Ensuring Safe Transactions

Hidden fees can significantly increase the cost of transferring money to Germany. Many services advertise low fees but may include additional charges that aren’t immediately obvious. These fees can be tied to exchange rates, so always check the total cost before proceeding.

Transparency is crucial when selecting a money transfer service. Carefully read the terms and conditions, paying special attention to any potential fees. Some services offer fee calculators on their websites, allowing users to estimate costs beforehand.

Ensuring the safety of your transactions is equally important. Choose a provider with a strong reputation for security.

Look for transfer services that offer encryption and fraud protection. Reading reviews and feedback from other users can also provide insights into the reliability and security of the service.

Focusing on both cost-effectiveness and security will lead to a more satisfying transfer experience.

The Future of Money Transfers to Germany: Crypto Currency and Blockchain

The future of transferring money to Germany looks increasingly digital. Crypto currency and blockchain technology promise to transform the landscape. These innovations offer potential for reduced fees and enhanced transaction speed.

Crypto currency allows for peer-to-peer transfers without the need for traditional banks. This can eliminate some of the costs associated with international transfers. Moreover, crypto currencies like Bitcoin and Ethereum are becoming more mainstream.

Blockchain technology further enhances security and transparency. It provides a decentralized ledger system that ensures accurate recording of transactions. As these technologies advance, they may offer more robust solutions for sending money across borders. The landscape of international money transfers is evolving swiftly with the promise of these digital advances.

Conclusion: Choosing the Right Method for Your Needs

Deciding how to transfer money to Germany depends on various factors. Your choice should consider costs, speed, and convenience. Each option offers unique benefits tailored to different needs.

Traditional bank transfers are reliable but may incur higher fees and slower processing times. They are ideal for those who value security and established systems. In contrast, online platforms often deliver faster transfers and competitive rates.

Mobile apps offer the flexibility to send money on the go. They are generally user-friendly and accessible. However, ensure the app you choose has robust security measures in place.

It’s crucial to evaluate each method based on your specific requirements. Whether sending a gift or a large business sum, knowing your priorities helps you decide. Staying informed about emerging technologies can also help you benefit from potential savings and efficiencies in the future.