How to Open a Bank Account in Saudi Arabia: A Complete Guide

Opening a Saudi bank account is an essential step for both residents and expats looking to manage their finances efficiently. Whether you’re searching for the best Saudi bank for expats or looking for an easy online bank account opening in Saudi Arabia, this guide will walk you through the process.

Why Open a Bank Account in Saudi Arabia?

Having a bank account in Saudi Arabia is needed for handling salaries, transactions, and daily financial needs. With various banking options, individuals can choose from traditional or online account opening methods. Many banks also offer digital solutions, making it convenient to open a bank account online without visiting a branch.

Are All Banks in Saudi Arabia Islamic?

No, not all banks in Saudi Arabia are fully Islamic. While many banks operate under Islamic banking principles, offering Sharia-compliant financial services, there are also conventional banks that provide both Islamic and non-Islamic banking options. Some of the major Islamic banks include Al Rajhi Bank and Alinma Bank, while others, such as SABB and Riyad Bank, offer both conventional and Islamic banking services.

Can a Foreigner Open a Bank Account in Saudi Arabia?

Yes, foreigners can open a bank account in Saudi Arabia, but they need to meet certain requirements. Expats must have a valid residency permit (Iqama) and a local address. Some banks may also require a letter from the employer or sponsor. Non-residents might have limited options, but certain banks offer specialized accounts for them.

How to Open a Bank Account in Saudi Arabia

Step 1: Choose the Best Saudi Bank for Expats

Selecting the best bank for expats in Saudi Arabia is a crucial decision. Some of the top banks offering expat-friendly services include:

Which bank account is best in Saudi Arabia?

- Al Rajhi Bank

- Riyad Bank

- NCB (National Commercial Bank)

- SABB (Saudi British Bank)

- Alinma Bank

Step 2: Gather the Required Documents

To open a bank account, you typically need:

- A valid Iqama (residence permit)

- Passport copy

- Employment or sponsorship details

- Proof of address

- Mobile number registered in Saudi Arabia

Step 3: Open Your Account

You can choose between a new account open process at a branch or opt for an online bank account opening in Saudi Arabia. Some banks, like Enjaz Bank, even offer Enjaz bank online account opening services, making the process seamless.

Step 4: Activate Your Account

Once the documents are submitted, your bank account will be activated. You will receive your account details, debit card, and access to online banking services.

How to Open a Multi-Currency Account in Saudi Arabia

A multi-currency account allows you to hold, send, and receive funds in different currencies, which is ideal for frequent travelers, business owners, and expats. To open a multi-currency account in Saudi Arabia, follow these steps:

- Choose a Bank or Financial Institution – Many major banks in Saudi Arabia offer multi-currency accounts, such as Riyad Bank, SABB, and Al Rajhi Bank.

- Meet Eligibility Requirements – Some banks may require a minimum balance or a specific type of residency status.

- Provide Required Documents – Generally, you’ll need your Iqama, passport, and proof of income or employment.

- Apply Online or In-Person – Some banks offer online applications, while others may require a branch visit.

- Activate and Fund Your Account – Once approved, you can deposit money and start transacting in multiple currencies.

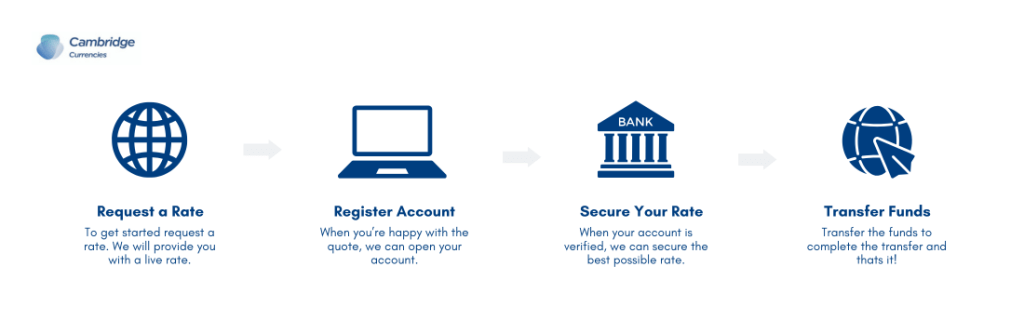

Open a Free Multi-Currency Account with Cambridge Currencies

For those looking for a seamless way to manage multiple currencies, Cambridge Currencies offers a free multi-currency account that allows users to exchange and hold various currencies without excessive fees. This is an excellent option for international business transactions and expatriates who need flexible banking solutions.

Online Bank Account Opening: A Convenient Option

Many banks now allow customers to open a bank account online through their official websites or mobile apps. The online bank account opening process typically involves:

- Filling out an application form

- Uploading necessary documents

- Verifying your identity via SMS or email

- Receiving instant access to your account

Benefits of Opening a Bank Account Online

- Faster and more convenient than traditional methods

- No need to visit a branch

- Instant access to banking services

- Secure transactions from anywhere

Conclusion

Whether you’re a resident or an expat, opening a bank account in Saudi Arabia has never been easier. With the availability of online account opening and open bank account online services, managing finances is now more convenient than ever. Choose the best Saudi bank for expats, follow the simple steps, and enjoy a hassle-free banking experience.