Send Money to Australia from the UK

When sending funds internationally, choosing the right method can save both time and money. If you need to transfer money from the UK to Australia, consider key factors such as exchange rates, transfer fees, and processing times.

In this guide, we’ll explore how to transfer money from the UK to Australia, covering everything from transferring money internationally to selecting the best UK to AUS money transfer services.

What is the Best Way to Transfer Money from the UK to Australia?

Online Money Transfer Services

Online money transfer services offer a cost-effective way to send funds internationally. They typically provide better exchange rates and lower fees compared to traditional banks. Transfers are processed quickly, often within 24 hours, making them a convenient option for those looking for both speed and value.

What is the easiest way to send money to someone in Australia?

Digital Wallets and Online Transfers

Digital wallets and online transfer services provide a quick and simple way to send money to someone in Australia. These platforms allow transfers using just an email or phone number, eliminating the need for bank details. Transactions are typically fast, with some transfers being completed within minutes.

Understanding the Basics of Australian Money Transfers

When it comes to transferring money internationally, understanding the key factors involved can help you save time and reduce costs. Whether you’re looking to transfer money to Australia from the UK or need a bank transfer from the UK to Australia, knowing the available options is crucial.

There are several methods for moving money from the UK to Australia, including traditional bank transfers, online money transfer services, and specialized remittance providers. The best way to send money to Australia depends on factors such as fees, exchange rates, and transfer speed.

If you’re wondering how can I send money to Australia, it’s important to compare providers and choose a secure, low-cost option. Whether you need to send funds to Australia for personal or business reasons, selecting the right service will ensure a smooth transaction.

Here’s what you should consider:

- Exchange Rates: How they influence the transferred amount.

- Transfer Fees: Understanding fixed charges and percentage-based fees.

- Transfer Method: Traditional banks, online services, or peer-to-peer.

Being aware of these elements will help you make informed decisions. It ensures that you choose a transfer method that suits your needs.

Currency Exchange Rates Explained

Understanding currency exchange rates is essential when you transfer money from the UK to Australia or any other country. Exchange rates fluctuate due to economic factors such as inflation, interest rates, and political stability. If you’re moving money from the UK to Australia, it’s crucial to monitor exchange rates to get the best deal.

How to Send Money to an Australian Bank Account from the UK

To send money to an Australian bank account from the UK, you typically need:

- The recipient’s BSB code and account number (Australia does not use IBAN).

- A trusted money transfer provider with competitive exchange rates and low fees.

- Awareness of potential transfer limits and processing times.

Choosing the Right Transfer Method

Choosing the right method to transfer money from the UK to Australia is vital. Each method comes with its own advantages and challenges. Your decision should factor in cost, speed, and reliability.

Traditional banks have long been a go-to option for many. However, their fees and exchange rates can be less competitive. Conversely, online transfer services offer more convenience and often better rates.

Dedicated money transfer companies tailor their services for international transfers. They often provide tools and features to make transfers easy and quick. Peer-to-peer services and cryptocurrencies present modern, flexible alternatives.

Consider these options:

- Traditional Banks: Reliability but higher costs.

- Online Services: Cost-effective with better exchange rates.

- Money Transfer Companies: Dedicated, with advanced features.

Each method caters to different needs and preferences, making it essential to evaluate them carefully. Understanding these options ensures you choose a method aligned with your priorities.

Traditional Banks vs. Online Transfer Services

Traditional banks have been the backbone of money transfers for decades. They offer a sense of reliability and security many people trust. However, transferring funds through banks can be costly.

Bank transfers typically include high fees and less favorable exchange rates. This makes them less appealing for regular transfers to Australia. On the other hand, bank networks provide extensive coverage worldwide.

Online transfer services are increasingly becoming the preferred choice for many. They offer competitive rates and low fees compared to banks. Furthermore, the convenience of online platforms adds to their appeal.

These services are often faster, executing transfers in hours rather than days. This speed, coupled with ease of use, makes online services attractive for personal and business transfers.

Dedicated Money Transfer Companies

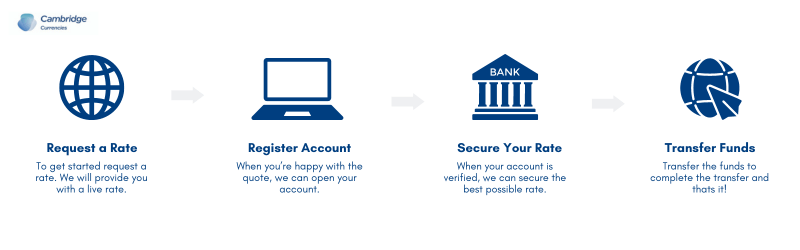

Dedicated money transfer companies serve as specialists in international transactions. Companies like Cambridge Currencies focus solely on enhancing the transfer process. Their expertise allows for better rates and reduced fees.

These companies offer specialised services such as hedging tools and rate alerts. Tools like these help customers manage market volatility and optimize transfers. Additionally, many provide 24/7 customer support to assist users.

How to Transfer Money to an Australian Bank Account

To transfer money from the UK to Australia, whether for personal, business, or investment purposes, it’s important to find a reliable and cost-effective method. Here’s a detailed guide on moving money from the UK to Australia while ensuring a smooth and secure transaction.

1. Select the Best Transfer Method

There are several options available for transferring money from the UK to Australia:

- Bank transfer from the UK to Australia: This is a traditional and secure option, but it may come with high fees and slower processing times.

- Online money transfer services: Providers like Wise and Cambridge Currencies offer competitive exchange rates and faster transfers, with Cambridge Currencies offering market leading rates on transfers above £5,000.

- International wire transfers: Many banks offer wire transfers, though costs may be higher than alternative services.

- Cash transfer services: If the recipient needs cash quickly, services like Western Union and MoneyGram can be useful.

2. Compare Exchange Rates and Fees

Different providers charge different fees for transferring money from the UK to Australia. Some services offer better exchange rates, while others include hidden costs in the conversion. Always check the real-time rate before proceeding.

3. Set Up Your Transfer

To send money to Australia, you’ll need to provide:

- The recipient’s full name and Australian bank account details.

- The amount you wish to transfer funds from your UK account.

- The purpose of the transaction (some platforms require this).

4. Confirm and Process the Transfer

Once you’ve entered the details, double-check everything before finalizing. Some services allow instant transactions, while others take 1–5 business days for the funds to reach the recipient’s Australian bank account.

5. Track Your Transaction

Most platforms offer tracking options so you can monitor the progress of your bank transfer from the UK to Australia. This ensures peace of mind and confirms when the funds have arrived.

By choosing the right provider and following these steps, you can easily and securely send money to Australia while minimising costs and maximizing efficiency.

Additional Considerations

When transferring money, several additional considerations come into play. Keeping these factors in mind ensures a smooth transfer experience.

Taxes and legalities can influence international transfers. It’s crucial to understand how these might impact your specific transaction.

Moreover, market conditions can affect how much you actually transfer. Being mindful of these aspects helps protect your financial interests.

Tax Implications and Legal Framework

Transferring money internationally may have tax implications. Knowing the tax regulations of both the UK and Australia is crucial. Consult a tax advisor for detailed guidance.

The legal framework governing international transfers can be intricate. Each country has its own rules, and compliance is mandatory.

Staying informed ensures you meet all legal requirements. Ignorance could lead to fines or delays, so due diligence pays off.

The Impact of Market Volatility and Political Events

Market volatility can cause fluctuations in exchange rates. This can significantly impact the amount received by the beneficiary. Planning ahead mitigates potential losses.

Political events often create uncertainty in financial markets. Such events can lead to sudden changes in currency values. Staying updated helps make timely transfer decisions.

A proactive approach to monitoring the market can benefit your transactions. Using alerts and market analysis tools offers an advantage.

Customer Service and Support

Quality customer service is vital in the money transfer process. Efficient support resolves issues quickly, providing peace of mind.

Look for services with a reputation for excellent customer support. It’s an indicator of overall service quality and reliability.

Reliable support teams offer assistance in multiple languages, catering to international clients. This accessibility is especially valuable during emergencies.

Conclusion and Next Steps

Successfully transferring money from the UK to Australia involves careful planning. Understanding the different options and their nuances is key. This knowledge empowers you to make sound financial choices.

As you move forward, continue to assess your needs. Each transaction may present unique challenges or opportunities. Adaptability ensures your strategies remain effective over time.

Explore available resources and stay informed. Regularly reviewing updates from transfer services and financial news can keep you ahead of the curve.

Staying Informed and Choosing Wisely

The world of money transfers is dynamic. Staying informed about market trends and changes can save you money. It also ensures you remain compliant with legal requirements.

Choose your transfer methods carefully. Consider not only costs but also speed and security. A well-rounded approach will support your financial goals.

Monitor updates from transfer service providers. Many offer valuable insights through newsletters and alerts. Being proactive allows for smarter decisions.

Leveraging Fintech Innovations for Better Transfers

Fintech is revolutionizing how we transfer money. Embracing these innovations can enhance your experience. New technologies offer improved speed, lower costs, and increased convenience.

Exploring emerging fintech solutions can yield unexpected benefits. These may include enhanced security features and user-friendly interfaces. They can make the transfer process less daunting.

Continuously engage with the fintech community. Networking with other fintech entrepreneurs can provide insights and inspiration. This engagement keeps you at the forefront of industry advancements.