Transferring Money Internationally Between Banks: A 2025 Guide

Transferring money between banks in different countries may seem difficult at first. However, with the right approach, you can avoid delays, extra charges, and poor exchange rates.

This 2025 guide explains how international transfers work, what to expect, and how to save money. It is written to help individuals and business owners navigate the options available in today’s global financial environment.

What Is an International Bank Transfer?

An international bank transfer moves money from one account to another in a different country. Most transfers rely on the SWIFT network, and some use SEPA if both accounts are in Europe. These networks help move funds securely and ensure they arrive at the correct destination.

You might wonder, can I transfer money from my bank to another bank internationally? Yes, almost all major banks offer this service. However, they may charge high fees and provide poor exchange rates compared to fintech alternatives.

Before sending money, you’ll need:

- A SWIFT/BIC code, which identifies the receiving bank

- An IBAN, which identifies the account (especially in Europe)

- The recipient’s full name and address

- The reason for the payment, in some cases

Investopedia explains SWIFT and IBAN codes in detail.

Additionally, you should check whether the country you’re sending to has any specific compliance or reporting requirements.

How Much Do Banks Charge for International Transfers?

Bank charges can be confusing and sometimes excessive. You may face several types of fees:

- A sending fee (charged by your bank)

- A receiving fee (charged by the recipient’s bank)

- An intermediary fee (charged by any banks in the middle)

These fees vary significantly by country and institution. For example, UK high street banks can charge over £30 just to send money overseas. Others may hide their fees in less favourable exchange rates. NerdWallet offers a breakdown of typical bank fees.

You should always ask your bank to provide the full cost, including any intermediary fees. Keep in mind that some receiving banks may also charge a fee.

How Long Do International Transfers Take?

An international bank transfer usually takes 1 to 5 business days. The exact timing depends on the currency, destination, and banks involved.

So, how long should an IBAN transfer take? If the transfer is between SEPA countries, it often arrives within 1–2 business days.

You may also ask, how long do SWIFT transfers take? These can take 2–5 business days, especially if intermediary banks are used.

If you’re wondering, why is my SWIFT transfer taking so long? — possible reasons include:

- Compliance or security checks

- Incorrect or incomplete recipient details

- Delays at intermediary banks

- National holidays or time zone issues

Bank of America outlines common causes of transfer delays.

To avoid delays, confirm all details before initiating the transfer and ask your bank for a transfer reference number.

Do You Need Both an IBAN and SWIFT Code?

For most international bank transfers, both an IBAN and a SWIFT code are needed. The IBAN ensures funds reach the correct account. The SWIFT code helps identify the recipient’s bank.

You may ask, is an IBAN enough for an international transfer? Not always. In many cases, a SWIFT code is also required to direct the funds to the correct financial institution.

Can you send money internationally without a SWIFT code? It depends on the destination and service. Some local payment networks do not require SWIFT. However, most traditional cross-border transfers will.

Online providers such as Wise and Revolut often simplify the process by handling these details in the background.

What Is the Least Expensive Way to Transfer Money Internationally?

Online transfer platforms and fintech companies typically offer the best combination of speed and low cost. So, what is the least expensive way to transfer money internationally?

Here are some cost-effective services to consider:

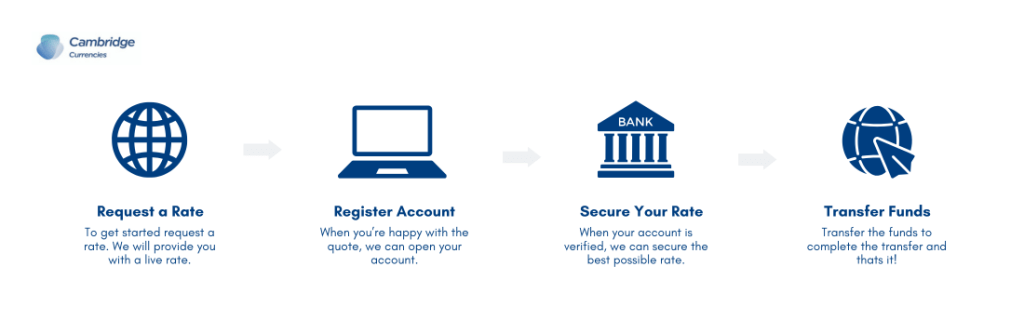

- Cambridge Currencies – A trusted currency broker offering competitive exchange rates.

- Wise: Offers mid-market exchange rates and low, transparent fees

- Revolut: Popular for personal transfers and multi-currency accounts

- WorldRemit: Useful for both bank and cash transfers

These providers usually avoid intermediary fees and offer real-time tracking. Many complete transfers within minutes to a few hours.

Comparison websites such as Monito can help you compare rates and find the cheapest provider for your route.

How Much Does SWIFT Charge Per Transfer?

The SWIFT network itself does not charge individual users. Instead, your bank pays SWIFT fees, and those costs may be passed on to you.

So, how much does SWIFT charge per transfer? Most banks add a processing fee of £10 to £50, depending on the number of intermediaries.

If several banks are involved, each may charge a fee. These charges are sometimes not visible until after the transfer is complete.

To reduce the risk of surprise fees, ask your bank if they use intermediary banks or if they can offer a flat-fee option.

How to Pay Someone in Another Country

You have several methods to pay someone in another country:

- Bank Wire Transfer – Secure and traceable but expensive.

- Online Transfer Services – Fast and often more affordable.

- Money Transfer Operators – Like Western Union or MoneyGram, useful for cash pickups.

- Foreign Exchange Specialists – Helpful for larger amounts or business transfers.

So, how to pay someone in another country? Match the service to your priorities — speed, cost, destination, or payout method.

International businesses may benefit from dedicated business transfer platforms with bulk transfer and reporting tools.

Can I Cancel an International Bank Transfer?

Many users wonder, can I cancel an international bank transfer? The answer depends on the provider and the stage of the transfer.

- If the money hasn’t yet been processed, your bank may allow cancellation.

- Once processed through SWIFT or another network, cancellation becomes more difficult and may involve fees.

- Some providers, like Wise or Revolut, allow same-day cancellations if the money hasn’t left their system.

Always double-check the recipient details before you send money to avoid the need for cancellation.

What Happens If I Use the Wrong IBAN or SWIFT Code?

Mistakes happen. If you send money using incorrect details, the transfer might:

- Be rejected and returned (minus fees)

- Be delayed significantly

- Be credited to the wrong person (if the account exists)

Contact your bank or provider immediately if you suspect an error. Some banks have a trace or recall process for such cases.

Can I Track an International Bank Transfer?

Yes, most banks and providers offer tracking. You can usually:

- Request a tracking number or reference code

- Ask for a SWIFT message copy (MT103) for bank-to-bank transfers

- Monitor the transfer status within online apps (e.g., Wise, Revolut)

Tracking helps you stay informed and allows the recipient to know when funds will arrive.

Tips for Cheaper and Safer Transfers

To make international transfers cheaper and more secure:

- Compare rates and fees across multiple providers

- Transfer larger amounts when possible to reduce per-unit cost

- Use forward contracts or limit orders for better exchange rates

- Double-check recipient details to avoid rejections

- Ask about tracking options for better visibility

If sending large sums (£10,000+), consider using a currency broker like Cambridge Currencies for better rates, personal service, and reduced fees

Be aware of online scams. Only use trusted, regulated platforms and never send money to unfamiliar contacts.

What Affects the Cost of International Transfers?

Many factors influence the total cost of sending money overseas:

- The amount being transferred

- The destination country

- The currency involved

- The type of transfer service (bank vs online platform)

- The speed of the transfer (express or standard)

Understanding these variables can help you choose the most efficient and affordable route.

Are There Limits on International Bank Transfers?

People often ask, are there limits on international bank transfers? The answer depends on the institution and country. Some banks have daily or monthly transfer limits, especially for personal accounts. Business accounts usually offer higher limits.

Online providers also have limits, although these may increase if you verify your identity or provide additional documentation.

If you’re transferring a large sum, speak with your provider in advance to ensure the process runs smoothly.

Do You Pay Tax on International Transfers?

Generally, you do not pay tax simply for transferring money. However, do you pay tax on international transfers depends on the origin, destination, and purpose.

For example:

- Gifts or inheritances above a certain threshold may be taxed.

- Large transfers might require reporting under anti-money laundering rules.

- In some countries, transfers may trigger capital gains tax if related to asset sales.

Always consult a tax adviser if you are unsure.

How Do I Make an International Transfer Between Banks?

Many people ask, how do I make an international transfer between banks? The process can be simple if you follow a few clear steps:

- Log in to your online banking account or visit your bank in person.

- Select international payments or wire transfers from the menu.

- Enter the recipient’s name, IBAN, and SWIFT/BIC code.

- Choose the amount and currency you want to send.

- Review the fees and exchange rate offered.

- Confirm the transfer and save the reference number.

Some banks also allow you to schedule transfers in advance or set recurring international payments. If you’re sending a large amount, you might need to call your bank to increase your transfer limits.

It’s important to double-check all the recipient details before confirming the payment. Errors can cause delays or lost funds.

What Are Intermediary Banks and Why Do They Matter?

If you’re transferring money through a traditional bank, it may pass through intermediary banks. These are third-party institutions that help complete international transfers between two banks that don’t have a direct relationship.

Intermediary banks:

- Can slow down the transfer

- Often charge additional handling fees

- May affect exchange rates if they process conversions

Ask your bank whether an intermediary will be involved and what extra charges may apply.

Can I Use a Currency Broker Instead of a Bank?

Yes, and in many cases, it’s a better choice. Currency brokers specialise in international money transfers, particularly for large sums. They:

- Offer competitive exchange rates

- Provide tailored support and market insights

- Often waive fees for high-value transfers

This makes them ideal for:

- Paying for overseas property

- Funding international investments

- Repatriating income

Unlike retail banks, brokers focus on international clients and know how to handle complex transfers efficiently.

How Can Businesses Transfer Money Internationally?

Businesses with international operations face unique challenges. If you’re a business owner, it’s worth asking, how can businesses transfer money internationally in a cost-effective way?

Business accounts with traditional banks offer international payments, but you may get better value through:

- Business FX platforms (e.g., Wise Business)

- Currency brokers with B2B services

- Multi-currency accounts and batch payments

Also consider:

- Bulk payment solutions

- Integration with accounting software

- Access to real-time FX quotes

Professional support can reduce both cost and administrative time.

Conclusion

Transferring money internationally between banks requires careful planning. By understanding how the system works and comparing your options, you can reduce costs and avoid unnecessary delays.

Use online tools to compare providers, make sure your recipient details are accurate, and consider fintech alternatives to save time and money.

Whether you’re a business sending payments abroad or an individual supporting family overseas, this guide should help you transfer funds confidently in 2025.