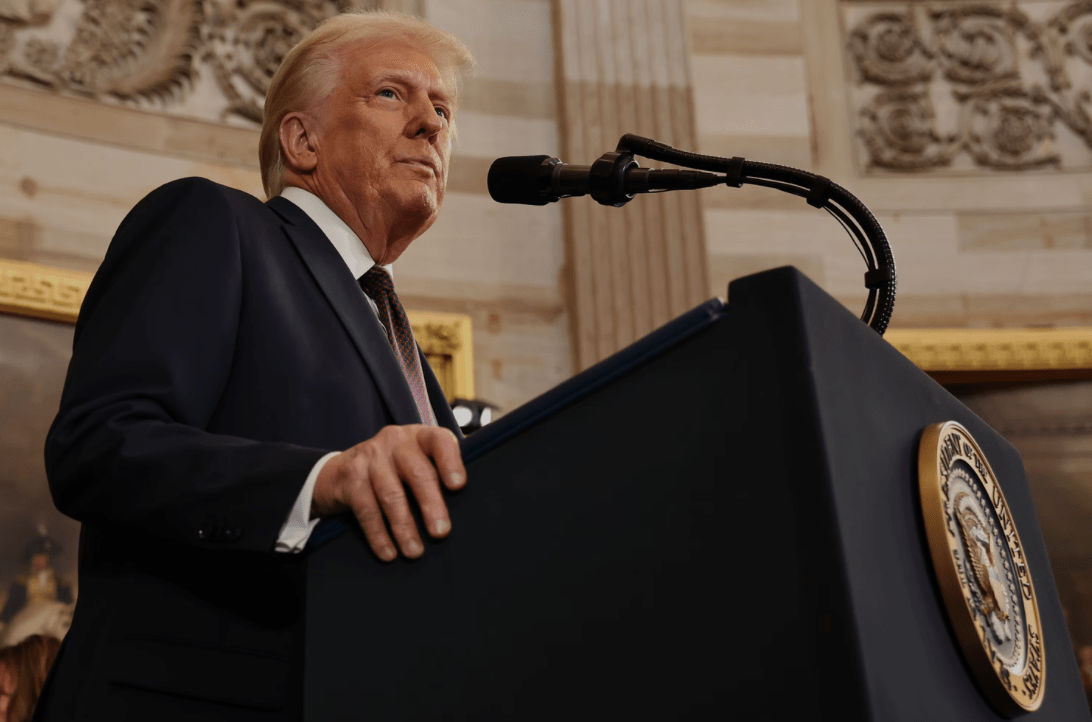

What Markets Are Watching in Trump’s Speech Today

This morning markets are reacting to softer Australian inflation data and weak German consumer confidence. President Trump’s upcoming speech could provide insights into trade and economic policy, while U.S. housing and confidence figures will shape sentiment.

Key Data Out Today

- Australia’s Monthly CPI slowed to 2.5% YoY, missing expectations (2.6%)—suggesting disinflationary pressures persist.

- Germany’s GfK Consumer Confidence came in at -24.7, below the forecast of -21, signaling persistent pessimism among consumers.

- U.S. New Home Sales (MoM) and Consumer Confidence due later today will be watched for economic strength clues.

Commodities

- Crude Oil is slightly up (Brent: $73.24, +0.16% | WTI: $69.20, +0.21%), but still faces weekly losses as supply-demand concerns weigh on prices.

- Gold is down (-0.13%) at $2,914.41, pressured by rising bond yields, while Silver remains flat at $31.77.

Currency Movements

EUR/USD (1.0498, ↓ 0.21%)

The euro weakens following weak German consumer confidence, which suggests continued economic struggles in the eurozone.

GBP/USD (1.2651, ↓ 0.16%)

Sterling slips despite BoE policymaker speeches, as inflation expectations and economic data remain in focus.

AUD/USD (0.6327, ↓ 0.38%)

The Australian dollar drops after soft CPI data, fueling speculation that the RBA may hold off on rate hikes.

NZD/USD (0.5707, ↓ 0.39%)

The Kiwi follows the Aussie lower, with weaker inflation expectations driving further declines.

USD/JPY (149.37, ↑ 0.22%)

The yen weakens as investors await Trump’s speech and monitor U.S. bond markets.

USD/CNY (7.2584, ↑ 0.09%)

The yuan remains pressured as China’s economic recovery remains fragile, leading to concerns over stimulus measures.

USD/CHF (0.8947, ↑ 0.26%)

The Swiss franc declines as risk appetite improves slightly ahead of U.S. economic data.

USD/CAD (1.4328, ↑ 0.19%)

The Canadian dollar weakens despite stable oil prices, as traders assess the outlook for Bank of Canada policy.

USD/MXN (20.47, ↑ 0.08%)

The peso remains under pressure, though still showing resilience amid broader risk trends.

USD/INR (87.05, ↓ 0.02%)

The rupee is steady, awaiting further U.S. policy signals and global risk developments.

Market Outlook

- Trump’s speech later today will be a key event for markets, with potential implications for trade and fiscal policy.

- U.S. housing data could impact sentiment on economic resilience, while Fed speakers may offer guidance on rate expectations.

- Oil prices remain a key watch, with OPEC+ dynamics influencing near-term movement.